What’s Ahead for ITUB Stock As Redditors Target It for a Short Squeeze

ITUB is the latest stock to top of the charts in Reddit group WallStreetBets. What’s the forecast for the stock as it's targeted for a short squeeze?

June 17 2021, Published 8:15 a.m. ET

Brazilian financial service company Itau Unibanco Banco (ITUB) is the latest stock to top the charts in Reddit group WallStreetBets.

As with all most stocks targeted by the group, Reddit traders are talking about taking ITUB "to the moon.” What’s the forecast for ITUB, and is there a short squeeze ahead for the stock?

Warren Buffett looks bullish on the Brazilian fintech sector

Legendary value investor Warren Buffett and WallStreetBets don't typically make similar investment moves. However, Berkshire Hathaway recently invested in Nubank, a Brazilian digital bank, and Buffett has also invested in StoneCo, another Brazilian fintech company. Like WallStreetBets, Buffett seems bullish on the Brazilian financial service industry.

ITUB's forecast, and what Redditors have to say about the stock

According to CNN Business, analysts' median target price for ITUB is $6.83, 4.4 percent above its current price. The stock has six “buy” and seven “hold” ratings. Wall Street isn't as bearish on ITUB stock as it is on Reddit names GameStop (GME) and AMC Entertainment (AMC).

A poster on WallStreetBets has highlighted ITUB's unusual call activity and massive call buying at the strike price of $7–$8. Traders buy call options in a stock when they expect it to go up. Reddit traders are also enthusiastic about ITUB CEO Milton Maluhy Filho, the youngest CEO in the Brazilian banking sector.

Whereas WallStreetBets traders seem to think every stock will "go to the moon," investors should make sure to look at a company's business before buying into it. ITUB's looks healthy. Brazil's largest lender, the company has been making technological advancements under its new CEO.

Why ITUB stock is rising

WallStreetBets seems to be boosting ITUB. Also, in a filing, the company said it will extend $79 billion in sustainable loans by 2025—almost 45 percent of its current loan book. Going “green” is among the hottest investment themes, and ITUB seems to be capitalizing on that. Finally, the Brazilian central bank has increased its benchmark rates for a third time. Bank stocks tend to do well amid higher interest rates, which boost their net interest margins.

Is there a short squeeze in ITUB's future?

Triggering a squeeze in shorted stocks has long been part of WallStreetBets' playbook. Short-sellers have lost billions betting against Reddit names AMC and GME in 2021. According to Fintel, on Jun. 16, ITUB had a short volume ratio of 20 percent with 15 million shares shorted—its highest short volumes since Jun. 8. The volumes look high enough to trigger a short squeeze.

ITUB faces currency manipulation accusations

Brazilian exporters have filed a $3.77 billion lawsuit against several domestic and foreign banks, accusing them of rigging currency exchange rates. ITUB, among the accused banks, plans to contest the allegations.

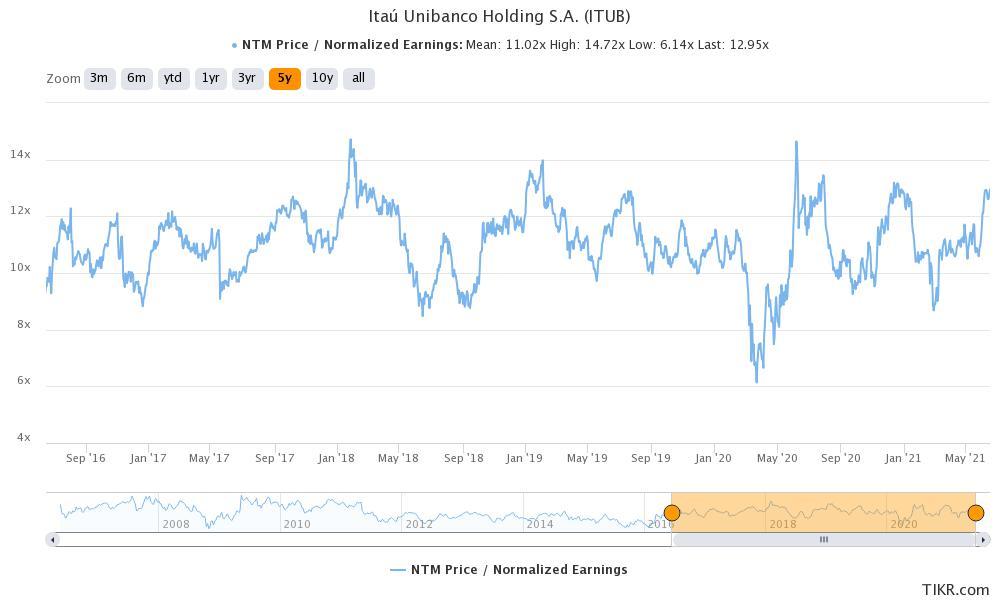

Analysts expect ITUB’s revenue to rise 1.8 percent in 2021 and 9.7 percent in 2022. The stock has a next-12-month PE multiple of 12.9x, which looks reasonable despite being higher than its past multiples. Its price-to-book value ratio of 2.79x is also higher by historical standards. Overall, considering its near-term positives, ITUB stock looks fairly priced right now.