Sundial Growers Stock Rallies Again, Still Has Poor Fundamentals

Sundial Growers stock rose by 15 percent on Feb. 24 after lying low for sometime. Many investors wonder if Sundial Growers (SNDL) is a good stock to buy.

Feb. 25 2021, Published 8:18 a.m. ET

A lot of marijuana stocks are getting outsized attention due to the Biden administration’s friendlier stance on marijuana legalization. Stocks like Tilray, Aurora Cannabis, and Canopy Growth have soared by double-digits. However, Sundial Growers (SNDL) has had other reasons to rise in addition to the usual catalyst for marijuana stocks.

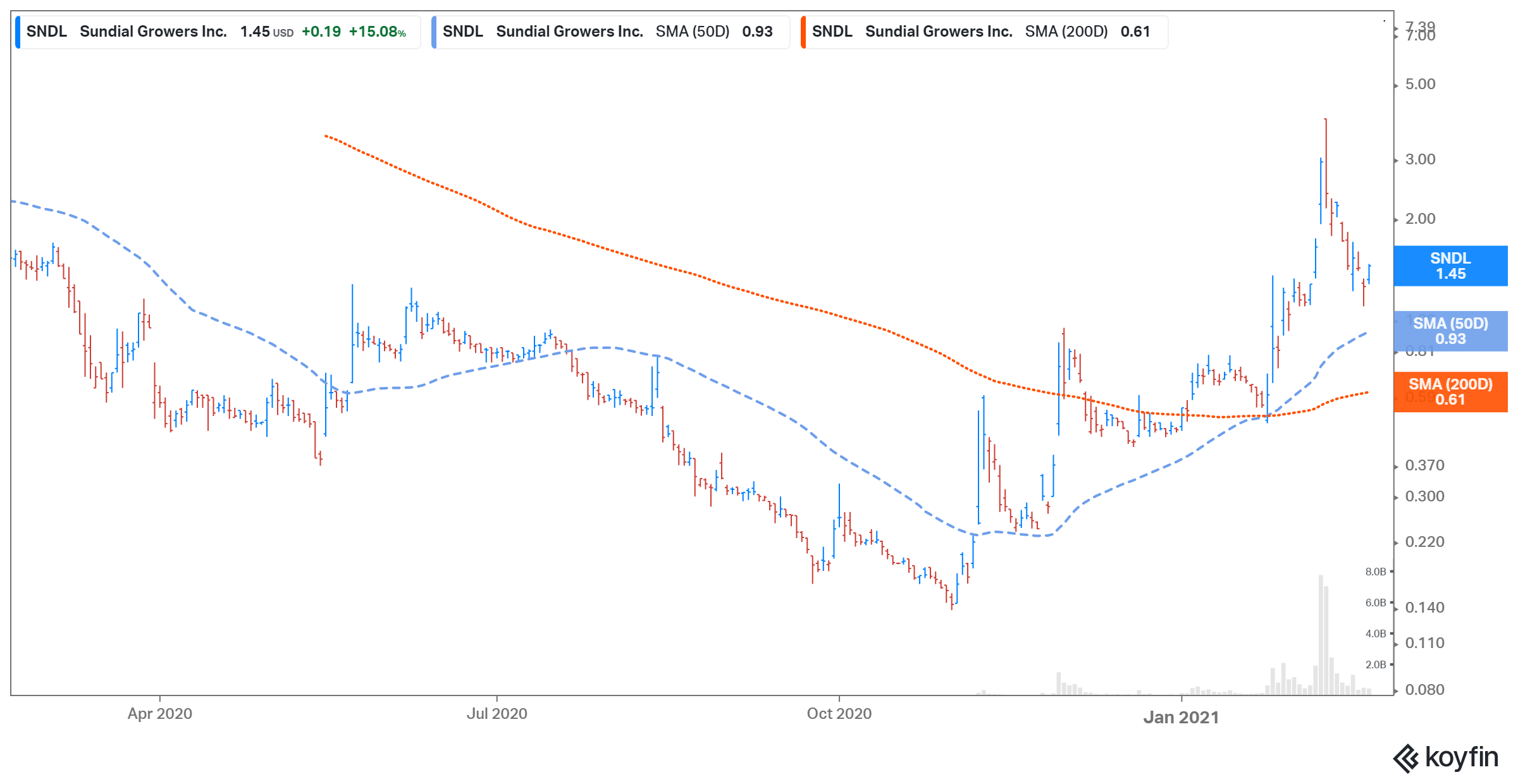

Sundial Growers stock has benefited from the WallStreetBets-driven short squeeze rally. SNDL is up 200 percent this year alone and a staggering 900 percent since November 2020. At $1.4, however, the stock is down nearly 50 percent from the 52-week high it set on Feb. 10. After lying low for a few days, the stock soared by 15 percent on Feb. 24. Why is the stock rising again? Is Sundial Growers a good stock to buy after the recent surge?

Why SNDL stock is rising again

Why is Sundial Growers stock rising again after lying low for a few days? While many people would like to pin the rise on the closing of its strategic investment in Indiva (more on that later), there doesn’t seem to be anything fundamental to the stock rally.

The surge is part of the WallStreetBets-led run once again. This seems to be the most likely reason for the stock surge since SNDL wasn't the only stock surging on Feb. 24. Other Reddit favorites including Naked Brand Group, AMC Entertainment, and Blackberry were also up by 31 percent, 18 percent, and 9 percent, respectively.

SNDL's short interest

WallStreetBets targeted penny stocks that had a high short interest since they are easier to manipulate. Being one of the cheapest stocks in the marijuana sector, Sundial Growers stock fit that bill perfectly. However, the company’s short interest has fallen significantly in the last few months. According to Forbes, the short interest was 66 percent in December 2020, which has fallen to 4.7 percent according to Koyfin. Therefore, one of the most potent catalysts for the stock rally seems to have already played out.

Sundial Indiva deal

On Feb. 23, Sundial announced that it has closed the $22 million strategic investment in Indiva, which is a Canadian producer of marijuana edibles. As part of the deal, Sundial purchased 25 million of Indiva's common shares at 44 cents per share. In exchange, Indiva received $11 million in cash and a non-revolving loan facility of $11 million. The term loan carries an interest rate of 9 percent annually and will mature on February 23, 2024. Sundial thinks that this transaction will broaden its exposure to the rapidly expanding marijuana edibles category.

Are marijuana stocks a good bet right now?

Many marijuana stocks have been on a high lately. The surge in marijuana stocks has been especially steep since Biden won the presidential election. Under the Biden administration, many people hope that marijuana will become legal at the federal level. Marijuana stocks Tilray, Hexo, Aurora Cannabis, and Canopy Growth have ballooned in the last few months.

Will the surge continue and are these stocks a good bet right now? Five states voted to legalize marijuana in some form. With this legalization comes additional pressure on neighboring states to legalize marijuana or see tax revenues shift to newly legal states. As a result, there could be a domino effect, which should benefit marijuana stocks.

SNDL stock has poor fundamentals

There's a real rush among investors to know if Sundial is a good stock. Many investors have seen the stock's meteoric rise and are sitting on the sidelines. Part of the recent rally could easily be attributed to the fear of missing out. However, the recent run has mainly been driven by a WallStreetBets-led pump after which momentum took over.

The company’s fundamentals still remain poor even after multiple cash raises. Sundial has gone debt-free but it has come at a cost of huge stock dilution. Sundial’s share count has ballooned by 1.1 billion since the end of September. The company has significant warrants outstanding, which could be potentially dilutive too. Its profitability is still at least a few years out. Sundial isn't a great stock fundamentally with a track record of poor operating performance and quality issues.