Is MicroVision (MVIS) Really the Great Buy Reddit Makes It Out To Be?

MicroVision stock has gained 144 percent year-to-date. What’s the forecast for MVIS stock in 2021? Is it a good long-term investment?

April 23 2021, Published 11:05 a.m. ET

MicroVision (MVIS) stock rose 19 percent on Apr. 22, and was up in premarket trading on Apr. 23. The stock surged after it became a hot topic on Reddit’s WallStreetBets forum. What’s the forecast for MVIS stock in 2021? Is it a good long-term investment?

Founded in 1993, MicroVision develops lidar sensors for autonomous driving applications. MVIS stock has skyrocketed 5,200 percent over the last year as investors bet on the company’s laser beam scanning technology.

MVIS stock is rising

MVIS stock jumped on Apr. 22 despite there being no analyst upgrade or company-related news. Most of the rise was likely due to the Reddit forum, WallStreetBets. One of several posts about the stock indicates that MicroVision’s fair market value should be $17.1 billion, not the $2 billion that investors value it at right now. Investor sentiment in lidar technology may also be boosting the stock—lidar peer Luminar Technologies has announced it has hired executives from Tesla and Intel.

MVIS stock could continue to climb

Retail investors on WallStreetBets have several undervalued stocks this year. The most famous of these have been GameStop, AMC Entertainment, and Clover Health. A mere mention of a particular stock on the Reddit forum can send a stock soaring.

Investors seem to be speculating MVIS could rise further, as its high short interest makes it a good candidate for a GameStop-like short squeeze. The stock was up more than 7 percent on Apr. 23.

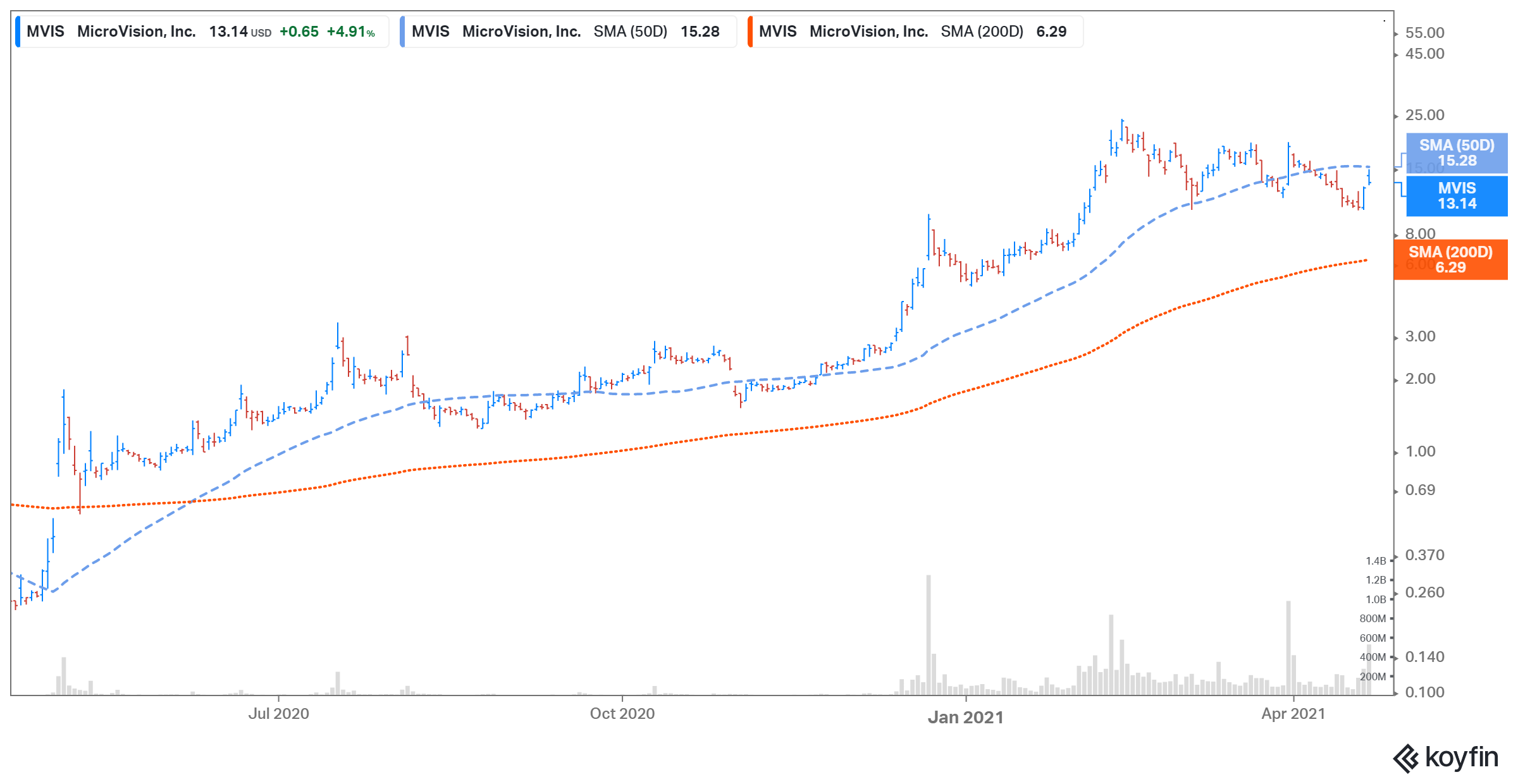

MVIS Stock Price

MVIS stock's short interest

MVIS’s short interest has surged over the last few weeks. According to Koyfin, MVIS’s short interest as a percentage of outstanding shares rose to 17.9 percent on Apr. 22 from 15.3 percent on Apr. 7 and 11.1 percent on Mar. 8.

MVIS stock price target

According to CNN Business, the one analyst tracking MVIS stock has given it 12-month price target of $0.25, which implies a 98 percent downside from its current price.

MVIS stock is a good long-term investment

MVIS stock looks like a good buy now. At almost 46 percent below its 52-week high, the stock offers investors exposure to lidar technology at a bargain. Despite Tesla CEO Elon Musk’s denouncement of the technology, many automakers developing driverless vehicles want to use lidar sensors.

The global lidar market is expected to grow to $6.71 billion in 2026 from $1.32 billion in 2018, and analysts polled by TIKR expect MicroVision’s revenue to rise 31 and 1,673 percent, respectively, in 2021 and 2022.