After Opendoor, Is IPOE on Cathie Wood’s Radar Before SoFi Merger?

Cathie Wood's ARK Invest has bought shares of Opendoor. Is she interested in Chamath Palihapitiya's IPOE, which is set to merge with SoFi?

April 26 2021, Published 9:51 a.m. ET

Cathie Wood’s ARK Invest has bought shares of Opendoor (OPEN)—an online home flipping platform that went public through a merger with Chamath Palihapitiya’s Social Capital Hedosophia Holdings Corp. II (IPOB). Wood also has Virgin Galactic, which went public through a merger with IPOA, as part of the ARK Space Exploration ETF (ARKX). Is she interested in IPOE stock? IPOE is set to merge with fintech company SoFi.

Wood is known for betting on high-growth disruptive companies. She has also invested in some SPACs before they have merged. For example, ARKX has Atlas Investment (ACIC) as one of the holdings. The SPAC is set to merge with Archer Aviation. Wood has also invested in Spitfire Acquisition Company (SPFR) before its merges with Velo3D.

Cathie Wood’s ARK Invest bought Opendoor shares.

Opendoor stock was in a freefall and fell sharply from its peaks. However, it recovered some of its losses after ARK Invest announced an investment in the company. Many retail investors follow Wood and buy the stocks that she buys for the ARK ETFs.

Chamath Palihapitiya

Despite a challenging near-term macro environment, OPEN stock looks like a good stock to buy for the long term. Wood also has Opendoor’s competitor Zillow in some of the ETFs.

IPOE and SoFi merger

IPOE is the third SPAC from Palihapitiya and will merge with SoFi. Like all stocks and SPACs associated with Palihapitiya, SoFi has tumbled and is currently down 43 percent from its 52-week highs.

There has been a broad-based sell-off in SPACs and growth stocks. Fintech stocks have also been under pressure. Affirm went public earlier this year in a blockbuster IPO and is also down almost 50 percent from its peak.

Will Cathie Wood buy IPOE stock before the SoFi merger?

ARK Invest has an actively managed ETF—the ARK Fintech Innovation (ARKF), which is focused on the fintech space. The ETF also has Coinbase as one of the holdings along with Opendoor. Interestingly, the ETF has invested in Lending Club and LendingTree, both of which are competitors of SoFi.

Currently, we can only speculate about whether Wood and ARK Invest will be interested in buying IPOE stock before its merger with SoFi. However, IPOE meets a lot of the requirements that Wood considers before buying a stock. It’s a high-growth fintech company that offers crypto trading on its platform. Wood is also bullish on digital wallets and genomics stocks.

IPOE stock valuation

SoFi has a pro forma market capitalization of almost $14 billion based on the current prices and an EV of $11.9 billion. The company posted revenues of $621 million in 2020 but posted a negative EBITDA of $44 million in the year. The EBITDA performance was better than the $66 million EBITDA loss that the company expected.

SoFi expects to become EBITDA positive in 2021 and expects its revenues to rise to $980 million in 2021 and $3.67 billion in 2025. The company expects its adjusted EBITDA margins to reach 32 percent by 2025, which would imply a 2025 EBITDA of $1.17 billion.

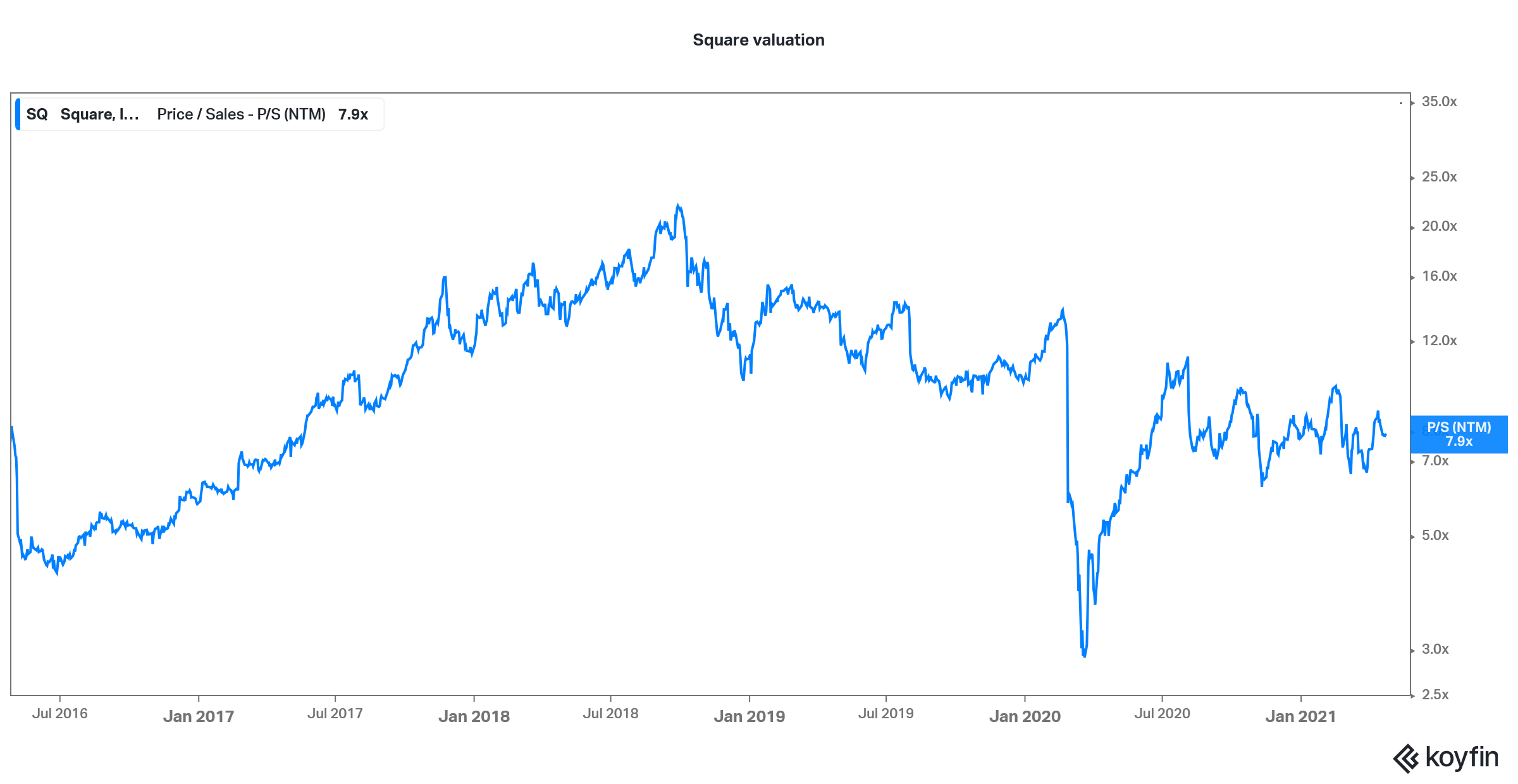

Square NTM price-to-sales multiple

SoFi versus Square

This would mean a 2021 and 2025 price-to-sales multiple of 14.3x and 3.8x, respectively. The 2025 EV-to-EBITDA multiple would be 10.2x. Square, which forms part of some of ARK ETFs trades at an NTM price-to-sales multiple of 7.9x, which is lower than IPOE. However, in the medium term, SoFi is expected to grow its top line at a faster pace compared to SoFi.

Overall, SoFi could be a good fit for ARK ETFs. IPOE stock has been very volatile amid the sell-off in SPACs. If it falls more from these levels, it could become attractive for fund managers betting on the fintech space.