Is IPOE Stock Next on WallStreetBets' Target List?

IPOE is one of the most closely watched SPACs. Currently, the stock’s momentum is on a declining trend. What’s IPOE’s short interest telling us?

March 17 2021, Updated 12:30 p.m. ET

Social Capital Hedosophia Holdings V (IPOE) is one of the most closely watched SPACs. IPOE stock lost 5.3 percent on March 16 and was trading lower in pre-market trading on March 17. The stock is down 35 percent from its 52-week high. IPOE is one of the heavily shorted SPACs. So, what’s IPOE’s short interest telling us?

The IPOE SPAC is scheduled to take SoFi (Social Finance) public at an implied pro forma equity valuation of $8.65 billion. SoFi is a leading financial services platform. The blank-check company is led by billionaire investor Chamath Palihapitiya. The IPOE and SoFi merger is expected in the first quarter of 2021.

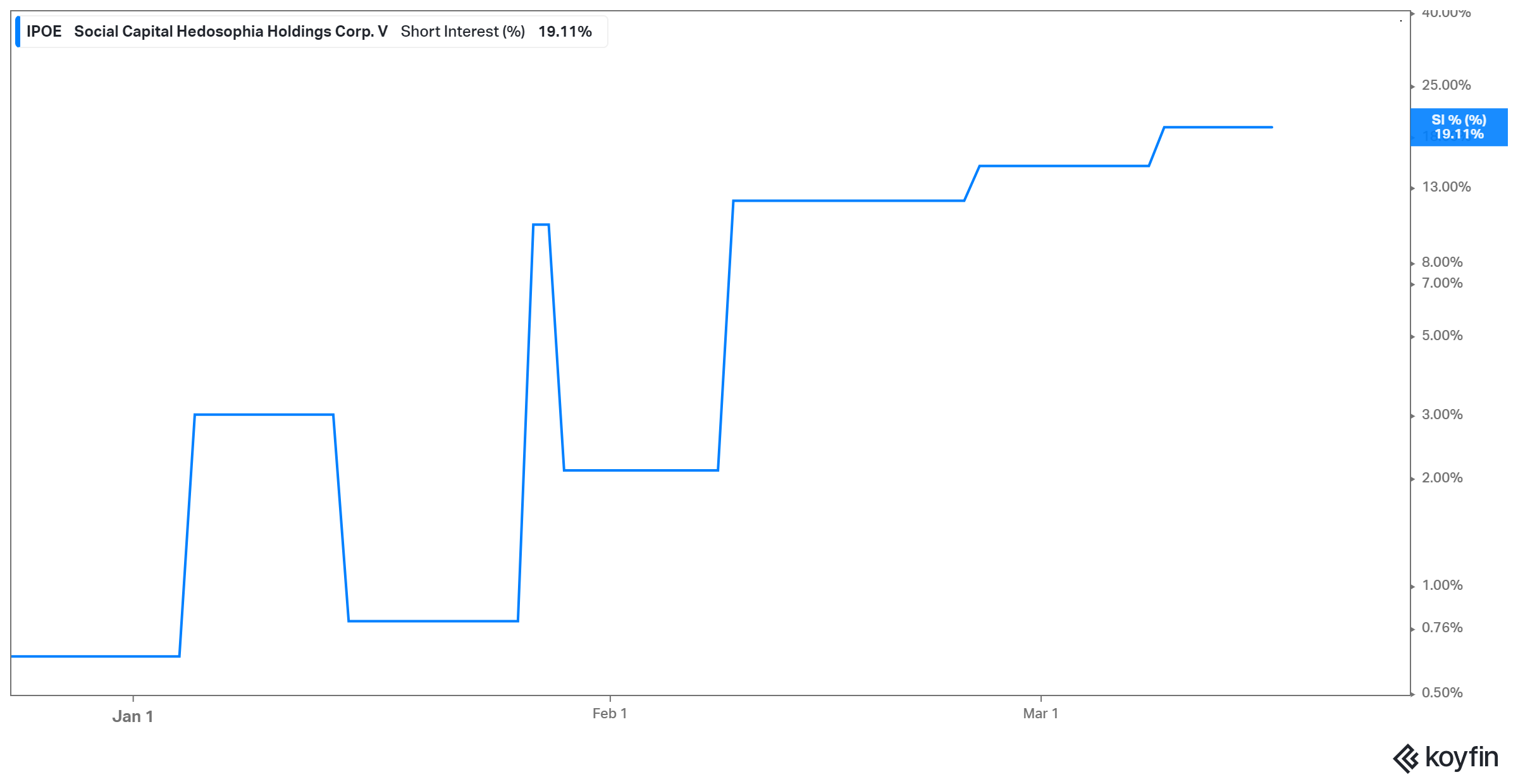

IPOE's short interest is rising consistently.

IPOE’s short interest has increased consistently over the last few weeks. According to Koyfin, IPOE’s short interest as a percentage of outstanding shares rose to 19.1 percent on March 16 from 14.9 percent on March 8. The stock had a short interest ratio of 11.9 percent on Feb. 24.

Most shorted SPACs

According to S3 Partners, the short positions in SPACs is at $2.7 billion compared to $724 million at the end of 2020. The firm thinks that the short interest has risen since SPAC stocks have run up significantly. According to a Wall Street Journal report, IPOE is heavily shorted and is a popular target for a short squeeze. Also, the short interest in Churchill Capital Corp IV (CCIV) more than doubled in March to around 5 percent. The CCIV SPAC is backed by former investment banker Michael Klein. CCIV is merging with electric vehicle startup Lucid Motors.

IPOE Stock Short Interest

IPOE might be on WallStreetBets' radar.

Retail investors on the popular "r/WallStreetBets" (WSB) Reddit group have been pumping stocks with a high short interest ratio since January. IPOE’s high short interest and fintech story make it a perfect short-squeeze candidate for WSB.

On March 2, Rocket Companies stock surged by over 70 percent and closed at $41.60. This was mainly fueled by the WSB traders behind the meteoric rise of AMC Entertainment and GameStop. Rocket became a prime target for a short squeeze because it had a short interest of nearly 40 percent. However, Rocket stock fell significantly after the initial euphoria, which generally happens in short squeezes. Rocket stock is up 0.2 percent at $25.04 on March 17 as of 10:25 a.m. ET.

Outlook for IPOE SPAC stock

IPOE stock could be a good buying opportunity because the recent market correction brought the valuations in line with the future growth outlook. SoFi expects to generate sales of $710 million in 2021 and projects its sales growing by 35 percent in 2022 and 22 percent in 2023.

Currently, SoFi has 1.8 million customers. SoFi expects to be able to add a large number of new customers as it expands its product offerings. The company projects to reach 3 million users by the end of 2021. However, IPOE stock is a speculative bet until the SoFi merger closes.