Senseonics (SENS) Stock Is a Buy Amid Reddit Mania

Senseonics stock has been rising since it released its trial results. Reddit group WallStreetBets is also pumping the stock. How high can SENS go?

June 11 2021, Published 11:11 a.m. ET

Senseonics (SENS) stock is among the top 10 discussion topics on Reddit group WallStreetBets. The group has been instrumental in triggering a short squeeze in many stocks. How high can SENS stock go amid the Reddit mania?

SENS stock was trading sharply higher in the early price action on June 11 and continued its momentum from the previous day. Amid the recent rise, the stock has taken its YTD gains to over 315 percent even though it's still down almost 29 percent from the 52-week highs.

Why SENS stock is rising

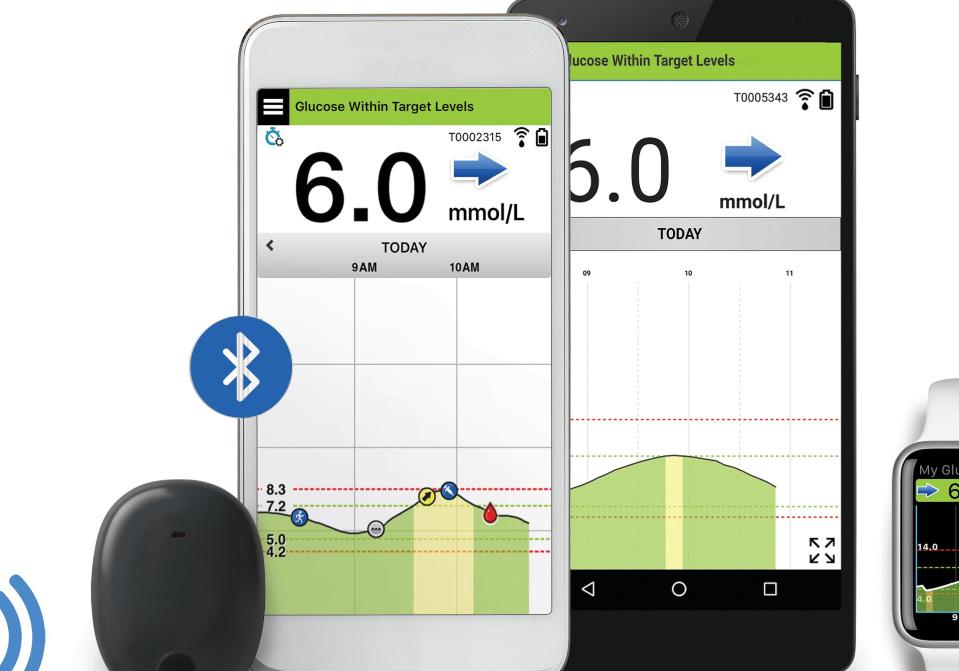

SENS stock surged sharply last week after it announced encouraging clinical trial results for its implantable CGM (continuous glucose monitoring) system. The company is working on an implantable CGM system called Eversense. The stock also became a hot discussion topic on Reddit groups, which added fuel to its rally.

We’ve seen a spike in several stocks including AMC Entertainment (AMC), Cleveland-Cliffs (CLF), Clover Health (CLOV), and Clean Energy (CLNE). However, a lot of these names later pared the gains. The stocks had arguably gotten ahead of the fundamental value.

SENS stock chart

SENS stock forecast on Reddit

Reddit traders have been largely positive about the forecast for SENS stock. A post on WallStreetBets, which was upvoted over 350 times, called SENS stock a "10x idea." The post talked about the market for diabetic care and also touted the company’s strategic partnership with Ascensia Diabetes Care. Like with all other WallStreetBets stocks, the comment also talked about the high short interest in SENS stock.

SENS stock’s high short interest could lead to a squeeze.

According to the most recent filing, SENS stock has a short interest ratio of almost 18 percent. The short interest looks high enough to trigger a short squeeze. To put that in perspective, according to the recent filings, CLF and CLOV, two of the trending names on WallStreetBets, have a short interest of just above 10 percent.

Is SENS a good stock to buy?

While short squeezes can provide a short-term bump to asset prices, we also need to look at the company’s fundamentals. A lot of Reddit names have crashed, so it's important to look at the margin of safety even though it might be an oxymoron in these markets.

Wall Street analysts don’t seem too optimistic on SENS stock. The stock’s target price implies a 17 percent downside, according to data compiled by TipRanks. However, we should also look at other metrics and not solely base the decision on analyst target prices, which can be behind the curve in many cases.

How high can SENS stock go?

Previously, I noted that while speculative, SENS looks like a good stock to buy. While the stock has risen sharply since mid-April, it's worthwhile to look at the stock’s risk-reward scenario now.

One positive development has been the positive trial results. Also, the company released its first-quarter earnings, which showed that it managed to narrow its operating losses by $32.5 million. It had cash and cash equivalents of $178.6 million at the end of March, while its debt was $110.6 million. The company said that it expects to post revenues between $12 million and $15 million in 2021.

Looking at the risk-reward scenario, while SENS stock looks better placed after the trial results, the stock price has run up as well. Given the short squeeze, the stock could rise higher in the short term. However, the risk-reward equation is somewhat less favorable now than it was a month ago.