How High Can GM Stock Go and Is $100 in Sight for the Automaker?

GM stock is trading near its all time highs. The stock could go up even more and hit $100 as its EV plans unfold. What can investors expect from GM?

June 17 2021, Published 9:42 a.m. ET

General Motors (GM) stock has gained 46 percent YTD and is among the S&P 500 Index's top 50 performers. Recently, the stock hit its all-time high since it emerged from bankruptcy in 2009. How high can GM stock go and can Reddit group WallStreetBets target it for a short squeeze and take the stock beyond $100?

GM stock was previously among the top discussion topics on WallStreetBets. Automotive stocks including Tesla, NIO, Nikola, Fisker, and Workhorse regularly feature among the top names in the group. WallStreetBets has been instrumental in triggering a short squeeze in many stocks.

Why GM stock is rising

GM and other legacy automakers like Ford are outperforming their pure-play EV (electric vehicle) competitors in 2021. A year ago, markets didn't see legacy automakers as competitors in the EV race. However, thanks to their focus on EVs, these companies have managed to change markets' perception.

General Motors' latest news

General Motors became the first Detroit automaker to commit to a zero-emission future by 2035. The company announced that it will increase its investments in electric cars and autonomous driving by 30 percent. GM expects to spend $35 billion between 2020 and 2025.

Earlier this year, Ford also bumped up its investments in EVs and autonomous driving. GM plans to double down on its new battery plans and will set up four instead of the previously planned two battery plants. The company expects to sell 1 million EVs globally by 2025. That will still be a fraction of Tesla, which is expected to sell over 1 million EVs in 2022.

GM stock on Reddit

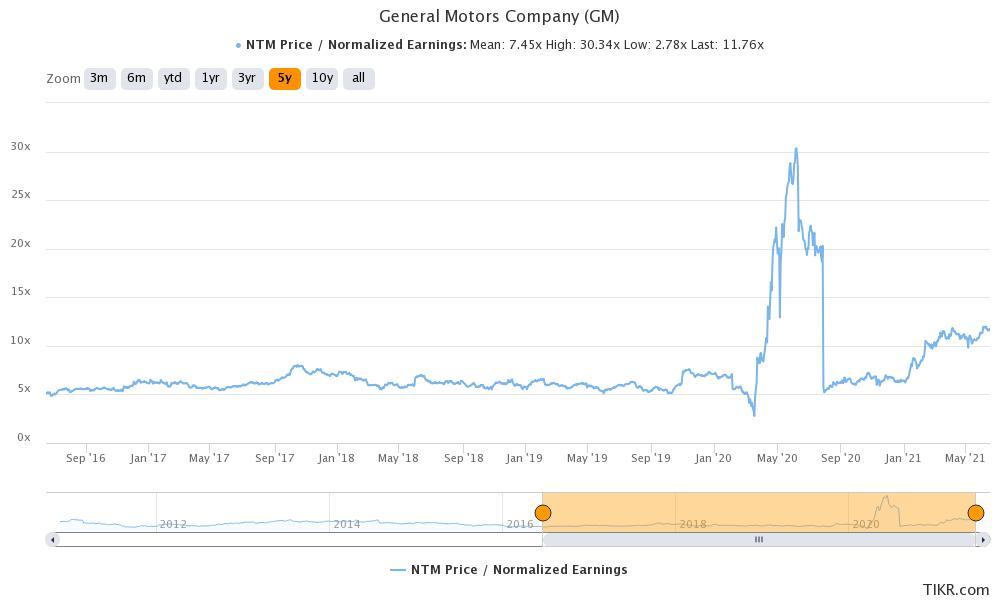

Currently, GM stock isn't very popular on Reddit. However, there are multiple reasons why WallStreetBets traders might see value in the stock. First, GM’s EV plans are a fundamental story and make the stock attractive. Second, from a valuation perspective, despite the spike this year, GM trades at an NTM PE multiple of 11.7x, which looks on the lower side.

GM stock valuation

GM short interest: Is a squeeze possible?

According to the data from Fintel, GM had a short volume ratio of 15.7 percent on June 16, which is the highest that we’ve seen in June so far. While GM isn't a prime candidate for a short squeeze, it still looks like a good stock to buy for the long term.

How high can GM stock go?

GM’s target price of $63.90 implies an upside of only 3.5 percent over the next 12 months. Its highest target price is $90. Meanwhile, over the last few months, several brokerages have boosted GM’s target price.

Citi has raised GM’s target price to a street high of $90. Earlier in June, Barclays and JPMorgan Chase raised the target price. In May, Tudor Pickering initiated coverage on the stock with a $76 target price and a buy rating.

The rally in GM stock might be far from over. As the company unveils its electric vehicles including the widely awaited Silverado pickup, which will compete with Ford’s F-150 electric and Tesla’s Cybertruck, markets might take a more favorable view of GM stock.

The stock has already seen some rerating and its valuation multiples have expanded. Going forward, the stock might see an upward earnings revision as well as further expansion of trading multiples. If General Motors can execute the electric vehicle plans well under the able leadership of its CEO Mary Barra, the stock might rise higher from these levels. I wouldn't be surprised if GM stock reaches $100 over the next year.