FCX Stock Is a Good Buy for Investors as Copper Prices Top $10,000

Copper prices have hit the $10,000 per metric ton level. Here's why Freeport-McMoRan (FCX) looks like a good stock to buy now.

April 30 2021, Published 8:57 a.m. ET

Copper prices have hit $10,000 per metric ton for the first time in a decade amid the rally in industrial metals. Copper miners have also followed copper higher and Freeport-McMoRan (FCX) stock has risen by 330 percent over the last year. The rally in FCX stock might continue and it looks like a good copper stock to buy now.

Goldman Sachs correctly predicted copper prices rising to $10,000 per metric ton even though the metal hit the target much sooner than the brokerage, as well as other copper bulls, envisioned. Earlier in April, Goldman Sachs said that it expects copper prices to rise to $15,000 by 2025, which implies a 50 percent upside from the current levels.

Why copper prices are rising

Old-timers know copper as “Dr. Copper” for its ability to predict the economic cycle. Despite the COVID-19 pandemic showing no signs of dying down and major economies like India and Brazil going through a devastating wave, the global economy is expected to grow at a fast pace in 2021.

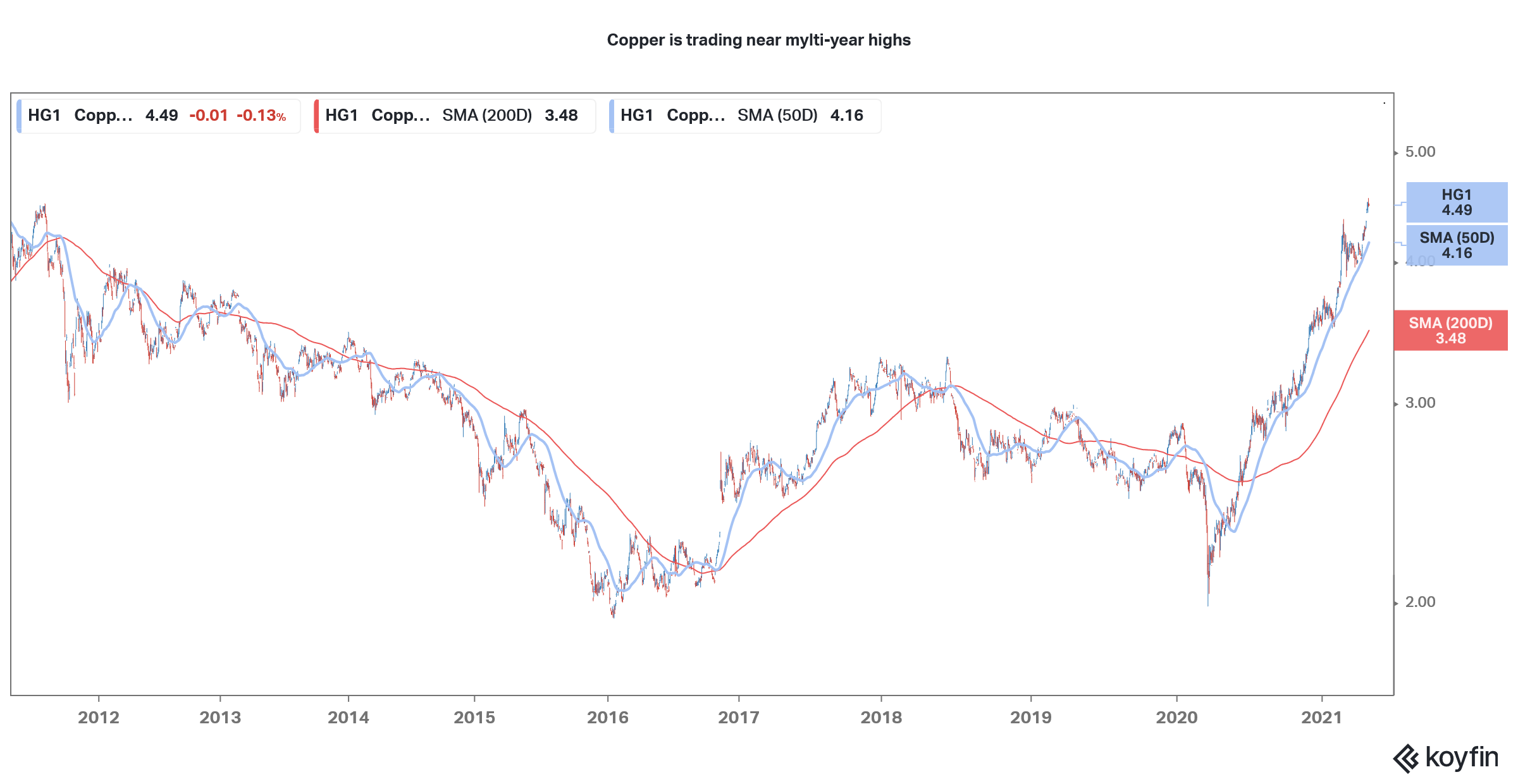

Copper is near a decade high

The Chinese economy is also on a fast path, which is helping copper prices. China is the largest copper importer and consumer.

Copper has been plagued by years of underinvestment and existing mines might not be able to ramp up capacity to meet the increased demand. We might be headed for a structural supply deficit in copper that most analysts were forecasting.

Add the expected increase in demand from electric cars and renewable energy generation, both of which have higher copper intensity, and copper lands in a sweet spot. Now, with copper prices expected to rise more, which copper mining stock should you buy?

Why Freeport-McMoRan is a good copper stock to buy

When selecting a good copper mining stock to buy, especially in a rising commodity pricing environment, I would look at the following attributes:

- A rising copper production profile

- Low unit production costs

- Strong balance sheet and manageable debt

- Operations in stable jurisdictions

- Reasonable valuations

Currently, Freeport-McMoRan stock ticks on all of the boxes, which makes it the best copper mining stock to buy now. The stars are aligned well for the company. Incremental production from its mines would hit the markets at just the right time when the prices are high.

Why FCX stock is expected to rise more

FCX expects its copper production to rise to 3.85 billion pounds in 2021—a rise of 20 percent YoY. The production is expected to rise 15 percent to 4.2 billion pounds in 2022 and 2023.

Also, the company’s gold production is expected to rise 55 percent in 2021 and 20 percent in 2022. Higher gold production combined with economies from scale after the ramp-up of the Grasberg mine's underground operations would help the company lower its unit cash cost more to $1.33 per pound in 2021.

On the debt front, the company has a stronger balance sheet after the asset sales in 2016. At the end of the first quarter of 2021, its net debt was only about $5.2 billion, which is almost a quarter of what it had at the peak in 2015.

Overall, looking at the uptrend in copper prices, I expect FCX stock to rise more from these levels. The company operates in safer jurisdictions and 42 percent of its reserves are in North America and 29 percent in South America.

While the company’s Indonesia operations, which account for another 29 percent of its reserves, were once relatively high risk, FCX has reached an agreement with the government there on stake dilution and smelter construction.

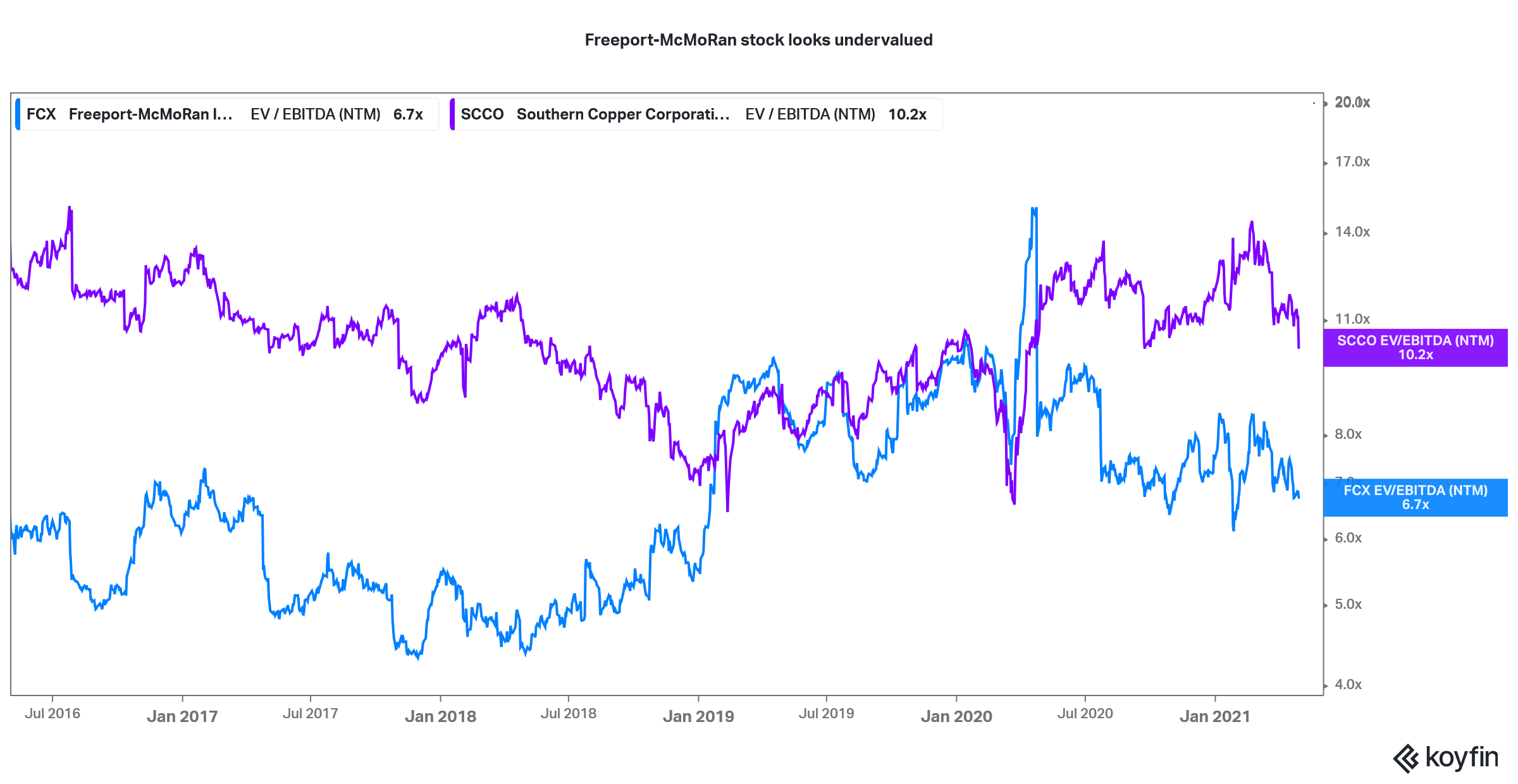

Why FCX stock is undervalued

FCX stock appears to be undervalued looking at the uptrend in copper prices. The company expects to post an average EBITDA of $12.5 billion annually in 2022 and 2023 if copper prices average $4 per pound and gold prices average $1,750 per ounce. The EBITDA forecast rises to $17 billion assuming copper at $5 per pound. Currently, copper trades around $4.50 per pound.

FCX versus SCCO NTM EV-EBITDA multiple

FCX has a market capitalization of around $56.2 billion and adding $5.2 billion net debt we get an EV (enterprise value) of around $61.5 billion. At an average 2022/2023 EBITDA forecast of $12.5 billion, it would mean a 2022/2023 EV-to-EBITDA multiple of around 4.9x, which looks attractive.

I would give a premium to FCX over other copper plays considering its strong balance sheet and diversified portfolio of copper assets. To sum it up, FCX stock looks like a good buy at these prices and a proxy play on the pivot towards green energy and electric vehicles.