Breaking Down the Best Copper Mining Stocks to Buy in 2021

Copper prices are trading at multiyear highs and brokerages see more upside. What are the best copper mining stocks that you can buy in 2021?

Feb. 22 2021, Published 2:03 p.m. ET

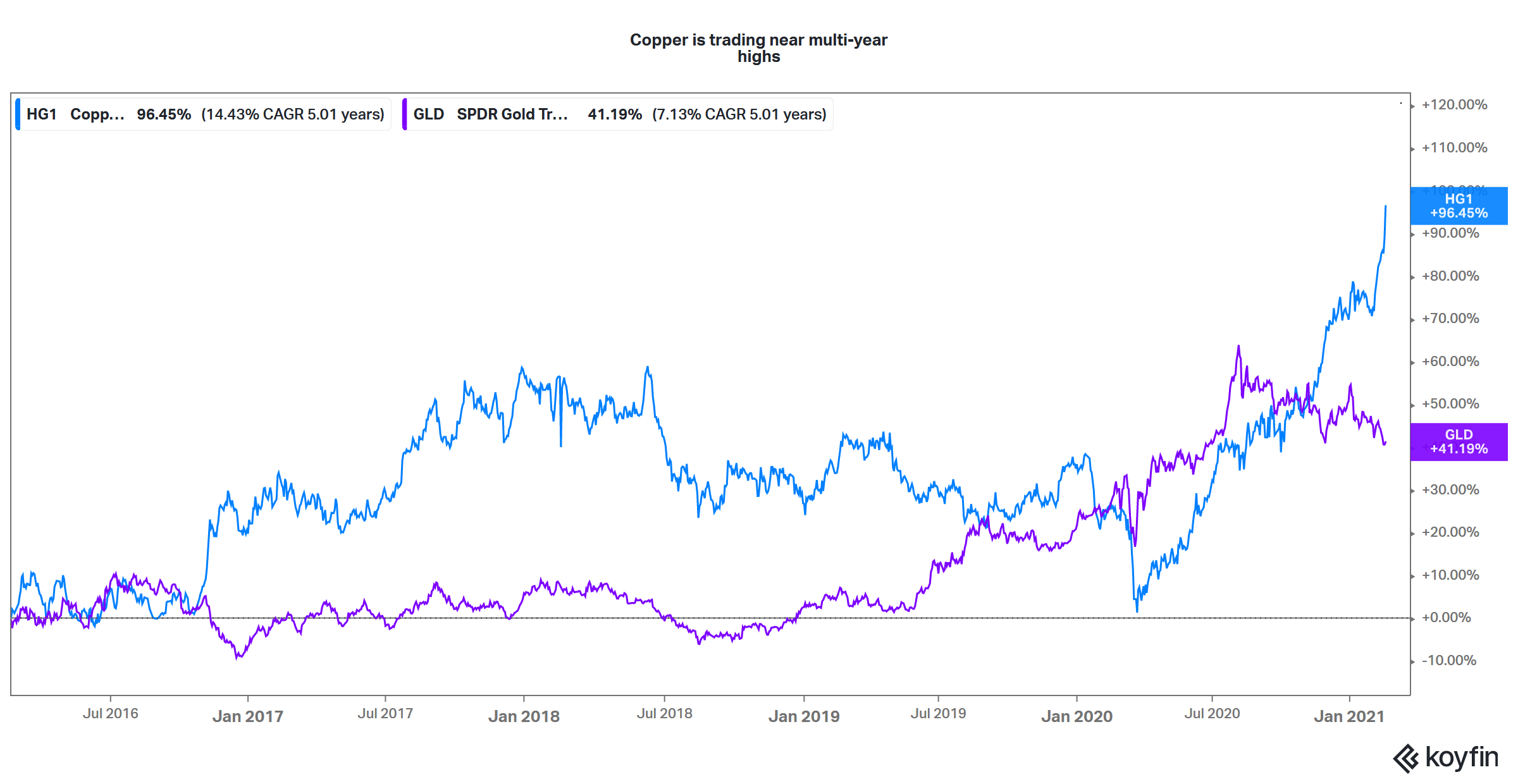

Copper prices are trading near their highest level since 2012 and money managers see the red metal rising even more towards $10,000 per metric ton. The rise in copper prices has also lifted copper mining companies' stocks. What are the best copper mining stocks to buy right now since copper looks hot in 2021?

Copper has earned its reputation as “Dr. Copper” for its ability to predict the economic cycle. Given its diverse use across different industries, copper demand and its prices are a reflection of the global economic cycle.

Why copper is rising

Copper prices are rising for many reasons. First, the demand outlook looks strong in top consumer China as well as the rest of the world. Second, after years of underinvestment, we are heading towards a period of a structural copper deficit, which means demand surpassing the supply.

Copper versus gold prices

The massive liquidity unleashed by central banks is also leading to fund flows into commodities. Copper is among the most prominent “risk-on” trades. Finally, as the world transitions from fossil fuels to green energy, the demand for copper is expected to rise.

Copper and electric vehicles

The copper intensity in electric cars, as well as renewable energy generation, is higher than ICE (internal combustion engine) cars and nonrenewable energy generation, respectively. According to a study from the International Copper Association, copper usage in an ICE car is about 23 kilograms, while it's 83 kilograms for a battery-electric vehicle.

The best copper stocks

Diversified mining companies like BHP Billiton and Rio Tinto also produce copper. However, these companies aren't pure-play copper miners. The earnings from copper operations are a small part of their total earnings. Therefore, we should look at companies that get most of their earnings from copper.

The following companies are good copper stocks for investors in 2021:

- Freeport-McMoRan

- Southern Copper

- First Quantum Minerals

These companies get most of their earnings from copper. Also, they are expanding their operations, which would mean more production in the coming years.

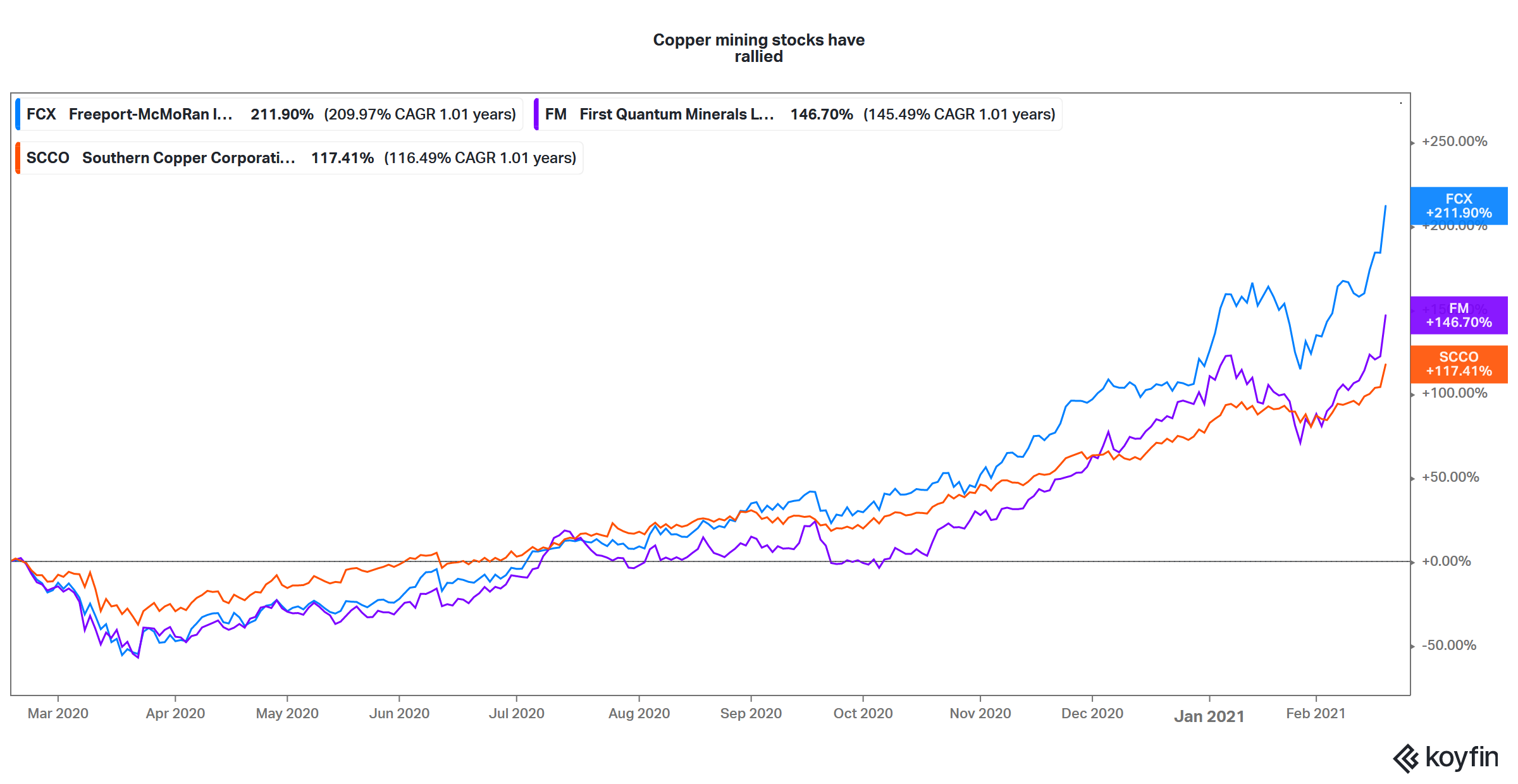

Copper stocks' price movement

Freeport-McMoRan is the largest publicly-traded copper miner

Freeport-McMoRan (FCX) is the largest publicly-traded copper miner. Its mines are spread across the Americas. The company also operates the Grasberg mine in Indonesia, which is its most profitable mine.

Meanwhile, Freeport-McMoRan expects its copper sales to rise from 3.2 billion pounds in 2020 to 4.4 billion pounds by 2023. The company expects its gold sales, most of which come from the Grasberg mine, to double to 1.8 million ounces from the current levels. Its unit cash costs would also come down as the Grasberg mine ramps up operations.

If copper stays at $4 per pound, Freeport-McMoRan expects an EBITDA of $12 billion on average in 2022 and 2023. Looking at the growth outlook, FCX stock is attractively valued even after the surge.

Southern Copper

Southern Copper (SCCO) prides itself as the lowest-cost copper miner globally. It produced 1 million metric tons of copper in 2020. However, Southern Copper expects its copper production to be below that level in 2021 and 2022. The company expects its copper production to recover to 1 million metric tons by 2023 and then gradually rise to 1.9 million metric tons by 2028.

While SCCO would miss the current spike in copper prices since its copper production is expected to be lower in 2021 and 2022, it's a good play on copper’s long-term fundamentals. Its low-cost operations and strong balance sheet make it an attractive stock to invest in.

First Quantum Minerals

First Quantum Minerals is another copper miner with a rising production profile. It produced 778,911 metric tons of copper in 2020. The production is expected to rise gradually and the company expects to produce between 820,000 and 880,000 metric tons in 2023.

Copper mining ETFs

There aren’t any ETFs that only invest in copper mining companies. The United States Copper Index Fund (CPER) and the iPath Series B Bloomberg Copper Subindex Total Return ETN (JJC) give investors exposure to copper futures.