CytoDyn Stock Forecast: Should You Buy CYDY Amid the Proxy Fight?

There's a proxy war going on between CytoDyn and activist investors. The forecast for CYDY stock looks positive amid the leronlimab trials.

Aug. 13 2021, Published 9:28 a.m. ET

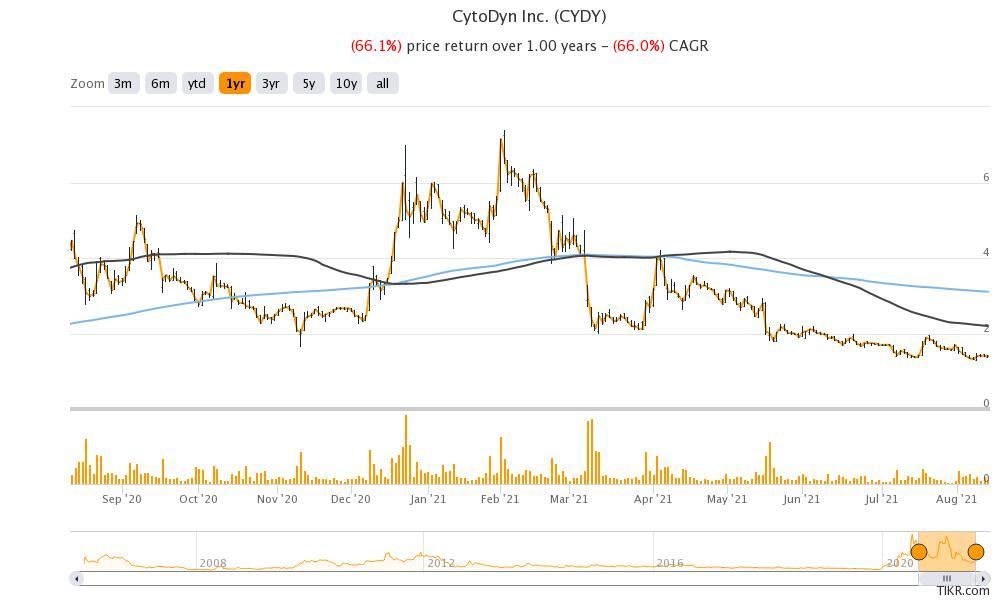

There's a proxy war going on between CytoDyn (CYDY) and activist investors led by Paul Rosenbaum and Bruce Patterson. CYDY stock has been in a freefall after hitting a high of $7.40. What’s the forecast for the stock and is it a good buy amid the proxy fight?

CytoDyn is a late-stage biotechnology company. The company’s product pipeline includes HIV, cancer, COVID-19, and GVHD (graft-versus-host disease). The company is developing leronlimab, which has been administered to treat COVID-19 in some patients.

Latest news on CytoDyn stock

On July 19, CytoDyn released encouraging preliminary trial results from its Phase 1b/2 trials on 30 metastatic triple-negative breast cancers. The patients were treated with a combination of leronlimab and carboplatin.

Leronlimab is a monoclonal antibody therapy that has potential in several medical conditions including several forms of cancer, HIV, and also COVID-19. Previously, short-seller Citron Research accused CytoDyn of hyping leronlimab, but later withdrew the report.

Earlier in August, CYDY announced that Brazil approved the enrolment of severe COVID-19 patients for the phase 3 trials. The company has also been doing trials in the Philippines where leronlimab was given to several patients under the CSP (Compassionate Special Permit).

While activist investors have nominated five directors to the company’s board, management has called it unlawful. Earlier this month, it also filed a lawsuit accusing the activist investor group of misleading investors through what it called the “unlawful proxy contest.”

CYDY stock forecast

H.C. Wainwright is the only brokerage that’s covering CYDY stock. In 2020, it downgraded the stock from a buy to neutral and assigned a target price of $4. The target price implies an upside of 184 percent over the current prices.

Meanwhile, being a clinical-stage company, CytoDyn’s success (or failure) depends on the performance of the products that it's developing. The first key milestone for the company would be to get FDA approval, which could be a game-changer.

CYDY leronlimab FDA approval

Activist investors think that CYDY's management hasn’t been able to form a good relationship with the FDA. They think that the company needs new management to expedite the approval process. CytoDyn has accused the activist group of misleading investors on multiple grounds, including:

- The group didn't disclose that Jeffrey Beaty, who’s part of the activist investors, and board nominee Bruce Patterson previously proposed a $350 million transaction to CytoDyn, which would have personally benefited them.

- The group falsely claims that its members are outsiders while some of them have been associated with CYDY including two former directors.

- It also accused the activist group of falsely claiming that there are no “adverse proceedings” between the company and them.

Should you buy or sell CYDY stock?

It's always tough to predict the outlook for clinical-stage companies because their futures hinge on the success of the drug or therapy under development. Meanwhile, leronlimab seems to offer potential especially considering the rising COVID-19 cases in the U.S. and some other parts of the world.

There have been instances of vaccinated people experiencing breakthrough cases. A drug to treat COVID-19 could be a game-changer in the fight against the deadly virus. The proxy war and developments on the FDA approval and other trial results could keep impacting CYDY's price.

While CYDY and leronlimab seem to offer a lot of potentials, it’s a risky bet—just like other clinical-stage companies. However, the return potential is also commensurate. The successful commercialization of leronlimab could take the stock much higher.