Cheap Growth Stocks to Buy Now for the Long Term as Markets Fall

Some of the growth stocks have started to look cheap, especially if you're willing to buy and hold them for the long term. What are some cheap growth stocks in 2022?

May 23 2022, Published 8:22 a.m. ET

About a year ago, the term “cheap growth stock” would have appeared as an oxymoron. Investors were willing to pay almost any price for growth stocks that catapulted their valuations to astronomical levels. Value-oriented asset managers like Warren Buffett underperformed the markets badly in 2019 and 2020 as investors ditched value names for growth stocks.

At the same time, fund managers like Cathie Wood, who were chasing growth, innovation, and disruption, outperformed by a wide margin. Things started to change in 2021 when the Fed started to raise rates. Fast forward to 2022, there has been a sell-off in growth names, which is reminiscent of the dot-com crash. However, some of the growth stocks have started to appear somewhat cheap, especially if you're willing to buy and hold them for the long term.

Why have growth stocks been falling?

To answer whether growth stocks are a good investment right now, we need to analyze why growth stocks have crashed with many trading at less than 10 percent of their all-time highs.

First, the kind of valuations that investors had bid up on growth stocks were never going to be sustained. Add the growth slowdown, which is even more severe for the “stay-at-home” growth stock universe, and the valuations have started to appear even uglier.

Rising inflation has prompted the Fed to raise rates quickly, which has squeezed the supply of easy money — one of the key enablers of high valuations. Amid the uncertain economic outlook and high interest rates, investors have pivoted toward value stocks and ditched growth stocks. Investors aren't looking to trade off high cash burn and losses in the near term for high growth in the future.

Are growth stocks a good investment now?

Along with the macro sell-off, some of the industry and company-specific factors are also at play. For example, the crash in cryptocurrencies has led to a steep fall in all companies in the digital asset ecosystem. These include crypto exchanges like Coinbase, crypto miners like Riot Blockchain, as well as companies like MicroStrategy that hold a lot of bitcoins on their balance sheets.

Some of the growth names might never rise to their all-time highs, at least in the fairly foreseeable future. However, some of the growth stories haven't gone bust like the “stay-at-home” names and look like good investments for the long term if you can be patient and hold them for the long term.

Cheap electric vehicle stocks to buy now

In the EV (electric vehicle) ecosystem, Tesla looks like a good stock to buy after the crash. The company expects its vehicle sales to rise at a CAGR of over 50 percent in the medium term. At the same time, it has been posting record profits, which might make even established automakers envious.

Tesla stock looks like a good buy.

The Elon Musk-run company has managed the supply chain issues much better than the established automakers as well as startup EV companies, most of which have scaled down their production forecasts.

Tesla has demonstrated good pricing power and if the company can deliver on the robotaxis and full vehicle autonomy, it can continue its good run. At an NTM PE multiple of 51x, Tesla looks like a good cheap growth stock to buy.

In the startup EV ecosystem, Rivian is worth a look. The company’s models have received a good response and it's also scaling up production capacity to 600,000 vehicles annually. While Rivian has a market cap of $26 billion, it also holds $17 billion on its balance sheet. The enterprise value of $9 billion doesn't look too high.

Cheap tech stocks to buy now in 2022

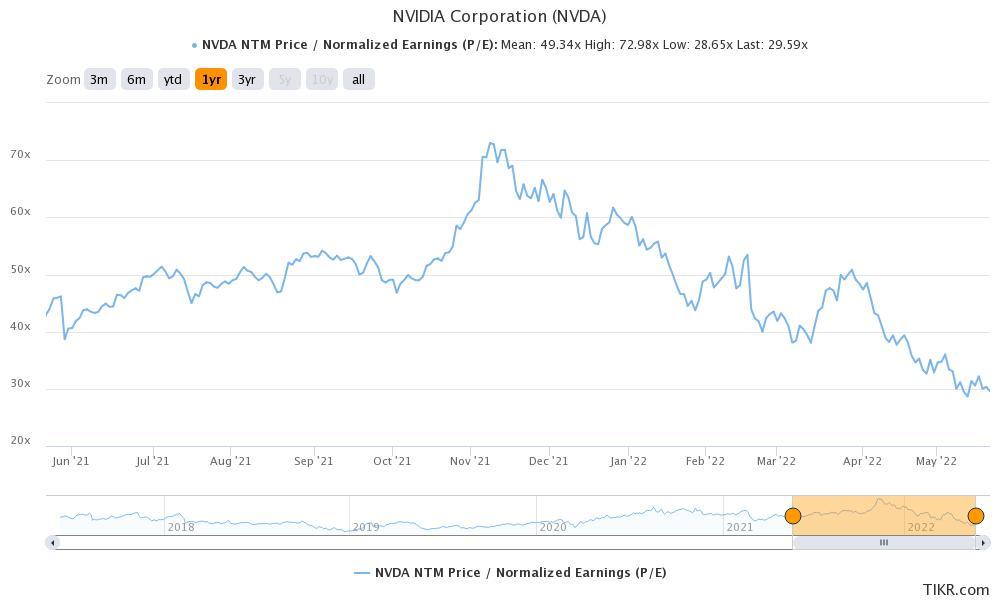

Some of the tech stocks also look attractive at these prices. Nvidia trades at an NTM PE multiple of just under 30x. The risk-reward looks favorable for the company, which is a play on several themes like data centers, digital transformation, metaverse, as well as gaming.

Cheap e-commerce stocks to buy for the long term

The e-commerce space is witnessing a lot of turmoil amid fears of slowing retail spending in the U.S. and globally. Amazon stock has crashed in 2022 amid the broader market sell-off. The company's top-line growth has come down, but it's battling higher costs which are denting its profitability.

Amazon stock looks attractive.

However, all of Amazon’s businesses, from e-commerce, cloud, streaming, and digital advertising, are secular long-term growth stories. The company’s market cap is now down to $1.09 trillion. The fall in Amazon stock is a good opportunity to buy for long-term investors.

SoFi looks like a good fintech stock to buy now.

In the fintech space, SoFi stock looks like a good buy. The stock momentarily fell below $5 and has quickly rebounded over 50 percent from those levels. The company’s student loan refinancing business has taken a hit from the multiple extensions to the moratorium, but the other business verticals are performing well.

SoFi trades at an NTM price-to-sales multiple of 4.1x. The multiples look attractive given the kind of growth that the fintech company brings to the table.

ARKK ETF looks like a good fit for the long term.

Talking of growth stocks, it's hard to not talk about ARK Innovation ETF (ARKK). While the ETF has recovered somewhat from the 2022 lows, it still trades at less than a third of its all-time highs. Wood went about buying the dip in her favorite names, which in the hindsight turned out to be falling knives. However, if an investor is bullish on the outlook for growth stocks over the long term, ARKK would appear a good fit for the portfolio.

Growth stocks might continue to be under pressure longer and get even "cheaper." However, the quality names should eventually recover and the current crash looks like a good opportunity to own some of the beaten-down growth names at attractive valuations.