Four Reasons PSTH Stock Is a Strong Buy Right Now

SPACs including PSTH are in a free fall. However, there are four reasons why the blank-check company led by Bill Ackman looks like a strong buy.

March 25 2021, Published 10:11 a.m. ET

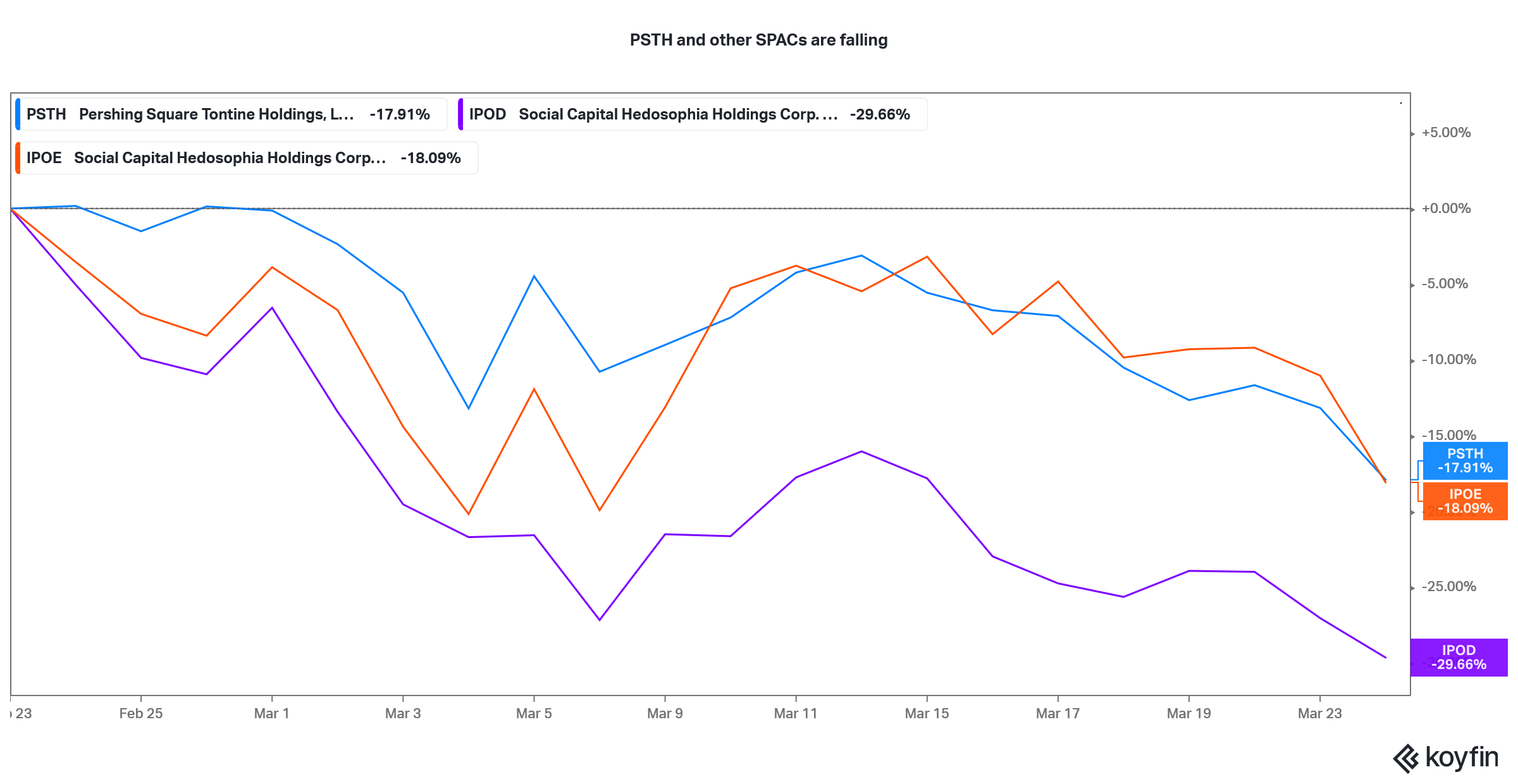

There has been a widespread sell-off in growth stocks as well as SPACs (special purpose acquisition companies). Pershing Square Tontine Holdings (PSTH), the blank-check company sponsored by billionaire hedge fund manager Bill Ackman has been in the penalty box. It fell 5.5 percent on March 24. Now, it's down almost 30 percent from its 52-week highs. However, the SPAC stock looks like a strong buy now.

First, we should remember that, unlike the usual convention where most SPACs priced their IPO at $10, PSTH priced the IPO at $20. Based on the current prices, the SPAC is trading at a premium of only about 20 percent from the IPO price.

PSTH versus other SPACs

Looking at some of the other SPACs, Social Capital Hedosophia Holdings IV (IPOD) and Social Capital Hedosophia Holdings IV (IPOF) are only trading at a premium of 10 percent and 7 percent. Both of these SPACs are led by Chamath Palihapitiya. They have been under pressure after Hindenburg Research accused Clover Health of withholding information.

PSTH versus IPOD and IPOF

IPOD and IPOF are both down 40 percent from their peaks. While they still trade above the IPO price of $10, there are a bunch of SPACs that have fallen below their IPO price. So, with SPACs available at a discount to the IPO price, what makes PSTH special?

Why PSTH stock is a buy.

There are four reasons why I think PSTH stock is a good buy. First, the stock is trading at only about a 20 percent premium to the IPO price. Second, with the recent crash in growth stocks as well as newly listed IPOs, companies wanting to go public might also tone down their valuation expectations. PSTH might be able to find merger targets at attractive valuations.

One of the reasons why PSTH hasn’t been able to find a merger target could be because of the lofty expectations that many companies have. Apparently, Ackman was snubbed by both Stripe and Airbnb. While Airbnb stock more than doubled on the IPO, Stripe recently raised private capital at elevated valuations.

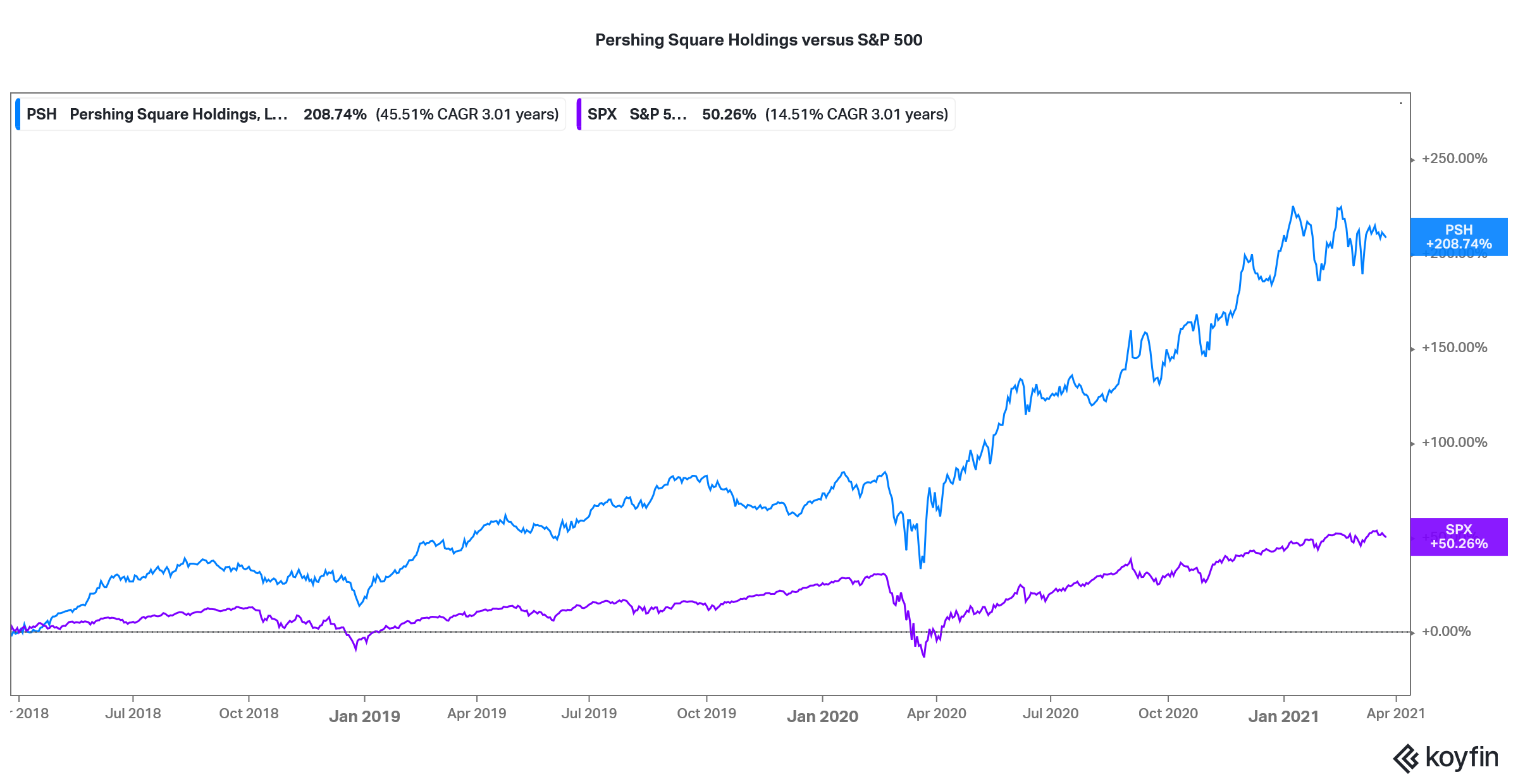

Bill Ackman's experience

This brings us to the third reason why PSTH looks like a strong buy, which is its sponsor Ackman. If Ackman was indeed looking at Airbnb and Stripe, then he surely has a knack for good private companies. He was also an early investor in Coupang, which just had a blockbuster listing. His recent stock moves have also been brilliant and his hedge fund Pershing Square Holdings outperformed the S&P 500 by a wide margin in 2019 and 2020.

Pershing Square versus S&P 500

The fourth reason I see PSTH stock as a buy is because of the differentiated acquisition criterion that the SPAC has set. Ackman is looking at mature unicorns that generate good cash flows. That’s in stark contrast to most other SPAC mergers where the targets were burning cash.

PSTH is looking at companies that might eventually get included in the S&P 500 and have moats and a competitive advantage. The SPAC would also consider strong balance sheets and reliable management before finalizing the merger target.

Ackman is looking at mature unicorns.

As I have noted in the past, the merger criterion looks like a leaf from Warren Buffett’s book. Incidentally, Ackman’s Pershing Square Capital was an investor in Berkshire Hathaway but offloaded all the stake in 2020.

I disagreed with Ackman dumping Berkshire Hathaway stock and continue to hold that view. The Warren Buffett-led company is outperforming the S&P 500 in 2021 and might continue to do so in the medium term.

Overall, Ackman is looking for a jewel for PSTH and like all good things, it will take time. While Ackman has had his share of duds during his investing career, I would buy PSTH at these prices.