As Cathie Wood Knows, Blade (BLDE) Stock Is a Bargain

Blade's (BLDE) stock forecast is in focus since the EXPC SPAC stock has fallen. The merger date should be here soon. Is the stock a bargain?

May 7 2021, Published 9:00 a.m. ET

Blade (BLDE) is going public in a SPAC merger with Experience Investment Corp. (EXPC) valuing it at $825 million. The transaction is about to close. What's BLDE's stock forecast after the EXPC SPAC merger date? Is the stock a good buy now?

Blade is a helicopter taxi company that focuses on the urban air mobility market. After the transaction closes, EXPC SPAC public shareholders and sponsors will own 41.7 percent of Blade, while PIPE investors will own 15.2 percent. Blade’s competitors are Joby Aviation and Archer, both of which plan to go public through SPAC deals.

When Blade will start trading

Blade is expected to complete its business combination with EXPC on or around May 7. Blade’s common stock and warrants will start trading on the Nasdaq under the ticker symbols “BLDE” and “BLDEW,” respectively, from May 10 onwards. The merger was approved by EXPC shareholders on May 5. The companies expected the merger deal to close in the first half of 2021.

BLDE’s stock forecast after the EXPC merger date

Currently, no Wall Street analysts cover Blade stock. However, given that it's the first urban air mobility company to get listed, analysts should start covering it soon.

Blade is estimated to generate revenue of $52 million in 2021. The company expects its revenue to rise 63 percent YoY to $85 million in 2022. Between 2021 and 2025, Blade expects its revenue to grow 211 percent compounded annually to $601 million in 2025. The company also expects to turn adjusted EBITDA in 2024.

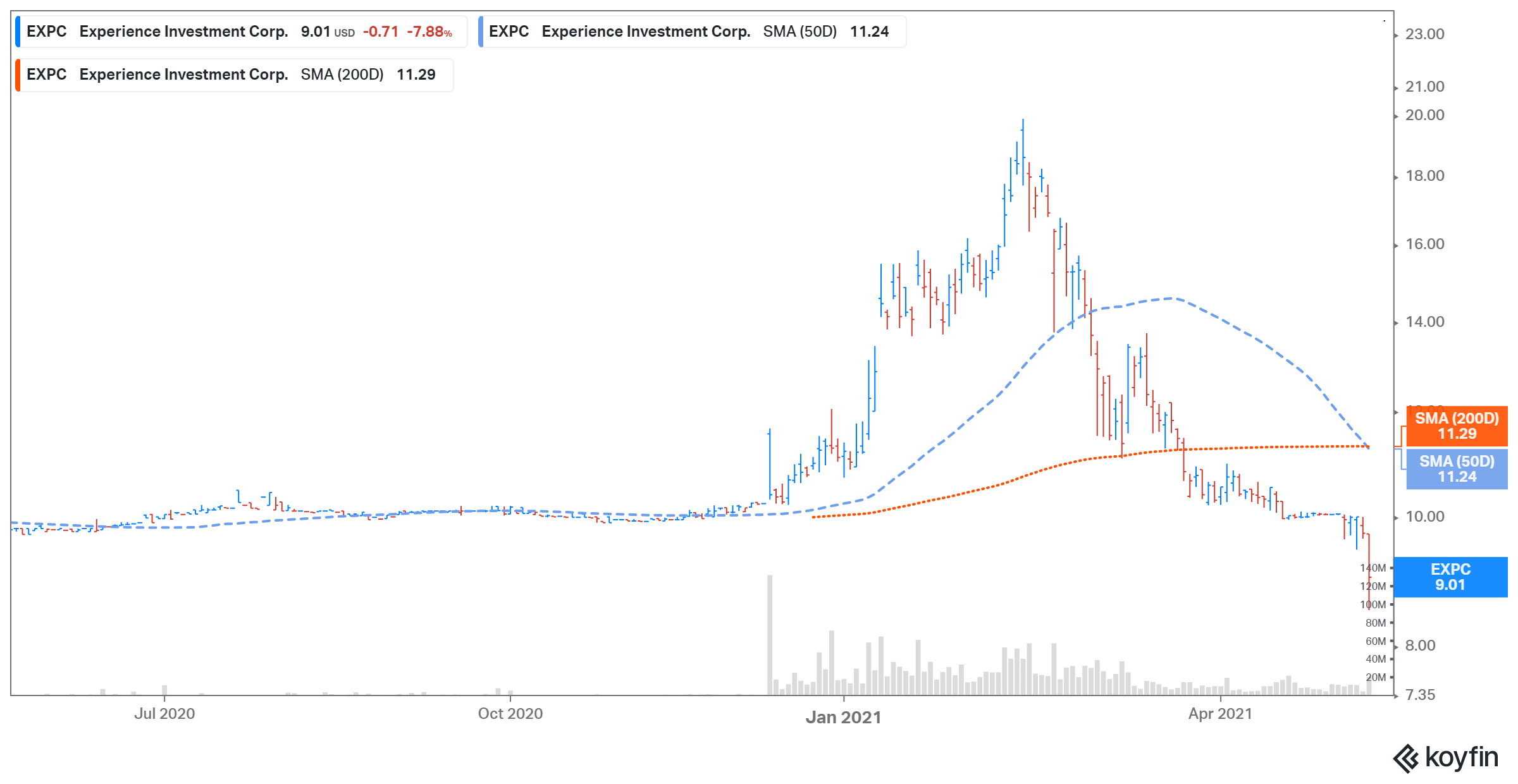

EXPC Stock Price

BLDE stock is expected to rise after the merger

On May 6, EXPC stock was down 7.3 percent at $9.01. The SPAC stock is expected to trade close to its IPO price of $10 as the transaction closing date draws close. However, BLDE stock is expected to rise after the merger deal closes due to the company's strong growth outlook. Blade thinks that the urban air mobility market could be worth $125 billion by 2025 and rise to $650 billion over the next decade.

ARK Invest’s Cathie Wood owns EXPC stock

ARK Investment Management CEO Cathie Wood owns shares of EXPC SPAC. The move indicates that Wood is betting big on urban air mobility. The Ark Autonomous Technology and Robotics ETF (ARKQ), which Wood backs, owns 2.7 million shares of EXPC SPAC worth $24.3 million.

Blade is a good urban air mobility stock to buy now.

EXPC stock’s 55 percent pullback from the 52-week high has opened a discount entry opportunity to Blade, which has bright growth prospects. Blade is also a well-funded business. It's set to receive $400 million in cash as part of the EXPC deal. KSL Capital Partners, Hedosophia, and HG Vora Capital Management have also invested in EXPC stock.

EXPC has given Blade a pro forma implied equity value of $825 million. Meanwhile, at EXPC’s current stock price, Blade is valued at around $743 million. Based on this market value and Blade’s projected total revenue, its valuation multiples for 2021 and 2022 are 14.3x and 8.7x, respectively. The company’s 2025 price-to-sales multiple of 1.2x looks very attractive.