Will Biden Forgive Student Loans? Costs and Economic Impact, Explained

Will President Joe Biden forgive student loans. What would the economic costs and benefits be if he forgives the loans?

Nov. 22 2021, Published 8:41 a.m. ET

Student loan forgiveness has been a hot political topic. Proponents of a blanket cancelation of student loans were disappointed when the $2 trillion Democratic spending bill didn't talk about student loan forgivingness. Will President Joe Biden forgive student loans? What would the economic costs and benefits be if he forgives student loans?

Student debt in the U.S. has risen multi-fold over the last 20 years. The Federal Reserve estimated that total student debt in the U.S. was $1.73 trillion in the second quarter of 2021, which is roughly 8.2 percent of the country’s 2020 GDP.

Student loan statistics

The total student loan in the U.S. is more than credit card and auto loans. Over the last 10 years, student loans have increased 91 percent. The growth rate surpasses that of the U.S. GDP and as a result student loans as a percentage of GDP have ballooned. According to Education Data Initiative, the average federal student loan debt is $36,510, while the private student debt average is even higher at $54,921.

The average student loan balance varies by state. While states like New Hampshire and Delaware have a student loan balance above the national average, others like Utah and New Mexico have a lower average student loan.

Student loan defaults

Over a quarter of borrowers who have taken a student loan are in delinquency or default. Meanwhile, there was a moratorium on student loan repayments under the CARES Act. The moratorium is ending in February 2022 and repayments would start again.

Biden on student loan waivers

In his election campaign, Biden had talked about waiving a minimum of $10,000 in student loans for all. However, while it would solve some of the problems, some Democrats who are on the left want him to raise the limit to $50,000.

Biden has already waived around $9.5 billion worth of student loans. However, the borrowers were cheated by colleges on their loans or had a physical disability. The administration has also revamped the PSLF (Public Service Loan Forgiveness) to make it more friendly for borrowers.

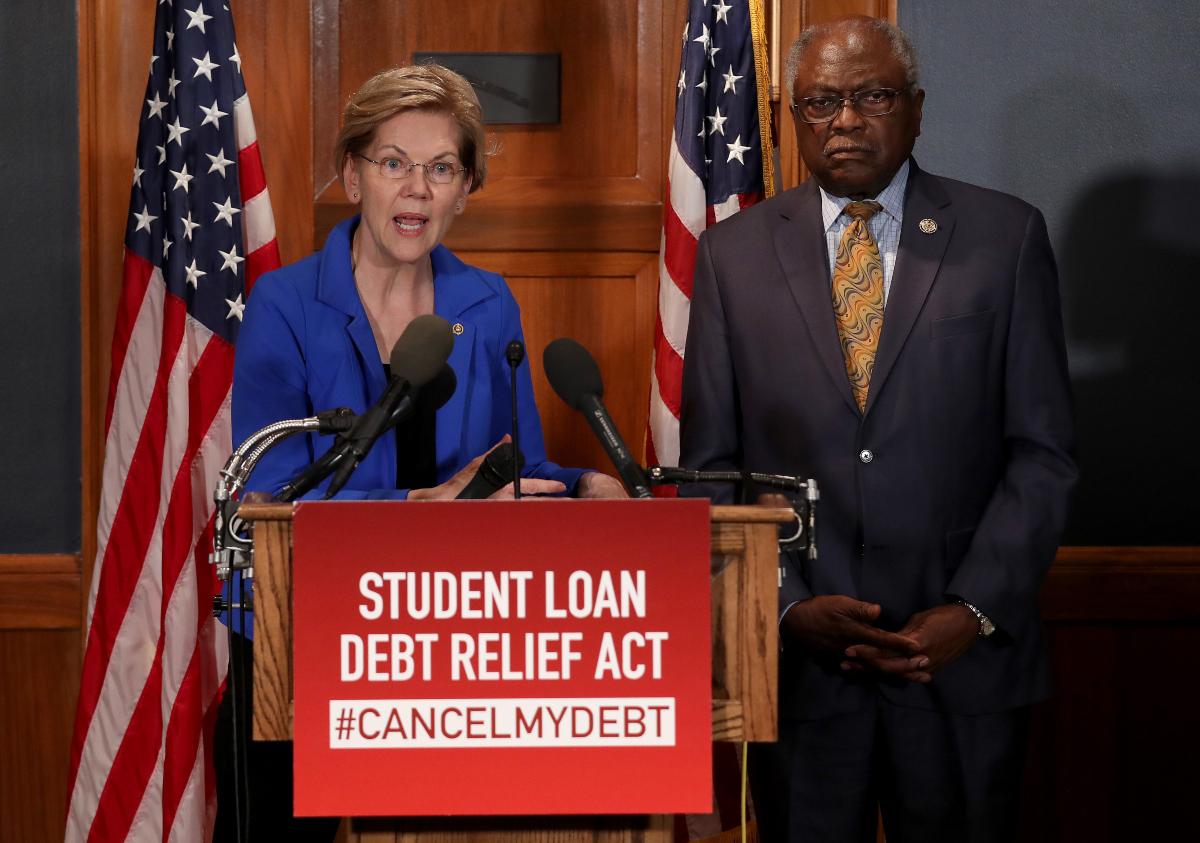

Senator Elizabeth Warren on student loans

Senator Elizabeth Warren has been among the most vocal supporters of forgiving student loans. She has called upon Biden to cancel student loans through executive action. Warren also wants Biden to legalize marijuana through executive action.

Some of the other progressive Democrats like Rep. Nikema Williams, Rep. Pramila Jayapal, and Rep. Ilhan Omar have also called on Biden to cancel student loans.

How would the debt waiver help the U.S. economy?

Waiving off the student loans would help borrowers spend more money on other activities, which could spur economic activity in the country. Warren sees student loan forgiveness as a racial equality issue. Black student loan borrowers have a higher student loan default rate than their white counterparts.

What do the critics of student loan forgiveness say?

Critics of student loan forgiveness have a fair argument too. Blanket loan waivers are seldom good for the economy because it impacts the credit culture in the country. There have been examples from other countries. For example, India has waived farmer loans multiple times. It hasn't solved the problems of the country's vast farmer population.

Another argument against a blanket loan waiver is that even wealthy individuals and those who graduated from top colleges would get their loans forgiven. Student loans are a burning issue in the country waiting for some sort of solution. Not doing anything and a blanket waiver are two ends of the extremes. However, the answer might lie somewhere in between.

More importantly, steps have to be taken to ensure that student loans don't emerge as a problem in years to come and that forgiveness now doesn't impact the willingness of future buyers to repay their loans.