NUE, X, or CLF: Which Is the Best Infrastructure Bill Stock to Buy?

Steel stocks like NUE, X, and CLF will benefit from the infrastructure bill. However, Nucor is among the best ways to play the bill.

Aug. 11 2021, Published 8:23 a.m. ET

The Senate has passed the bipartisan $1 trillion infrastructure bill. There was a rally in stocks that benefit from infrastructure spending. Steel is among the industries that will benefit from physical infrastructure creation. Nucor (NUE) is the largest U.S.-based steel company. Cleveland-Cliffs (CLF) and U.S. Steel Corporation (X) are the other leading steel producers in the country. What are the best stocks to buy and play the infrastructure bill?

Steel stocks are outperforming in 2021 anyway as U.S. steel prices have jumped to record highs. U.S. steel companies are posting record earnings and the trend is expected to continue in the coming quarters.

Infrastructure bill stocks to buy

Several other industries will benefit from the infrastructure bill. Charging infrastructure companies like ChargePoint will gain given the Biden administration's thrust on charging infrastructure and electric vehicles. Companies like Caterpillar will also benefit. Within the metals space, aluminum and copper producers will benefit from the infrastructure bill.

Copper is a proxy play on the renewable energy and electric vehicle industry and its intensity is higher in these industries. Freeport-McMoRan (FCX) is the largest U.S.-based copper miner.

What the infrastructure bill means for the steel industry

Higher spending on physical infrastructure would invariably lead to higher demand for steel. Nucor estimates that $100 billion of infrastructure investments would lift the annual U.S. steel demand by 5 million tons. Meanwhile, the impact of the infrastructure bill won't be the same for all of the steel companies.

First, companies with high exposure to infrastructure-related steel products like rebars would benefit more. Nucor and Commercial Metals Company (CMC) are leading rebar plays in the U.S. market.

Also, companies with a higher spare capacity to serve the expected increase in demand will benefit more. Here again, Nucor would fit the bill since the company has been investing heavily over the last two years to ramp up its capacity.

Which stocks will benefit from the infrastructure bill?

Generally, steel prices tend to move in tandem. The infrastructure bill is positive for the entire industry and not just rebar producers. Flat steel producers like CLF and X would also benefit from higher steel prices. Since the infrastructure bill will lead to higher steel demand, it will support prices. Higher steel prices will help lift domestic mills' earnings.

Best steel stock to buy

As I mentioned previously, Nucor is the one steel stock that you can actually hold across the cycle. The company has high margins which are much more stable than companies like CLF and X. This doesn't mean that CLF and X aren't good stocks. However, NUE is a diverse and attractive pick for investors.

The company has a dividend yield of 1.4 percent and it has been following a progressive dividend policy. Nucor has an investment-grade credit rating and management has proved its mettle across the business cycle. Also, given its rising shipment profile, it looks like a good way to play the infrastructure bill.

Jim Cramer and Nucor stock

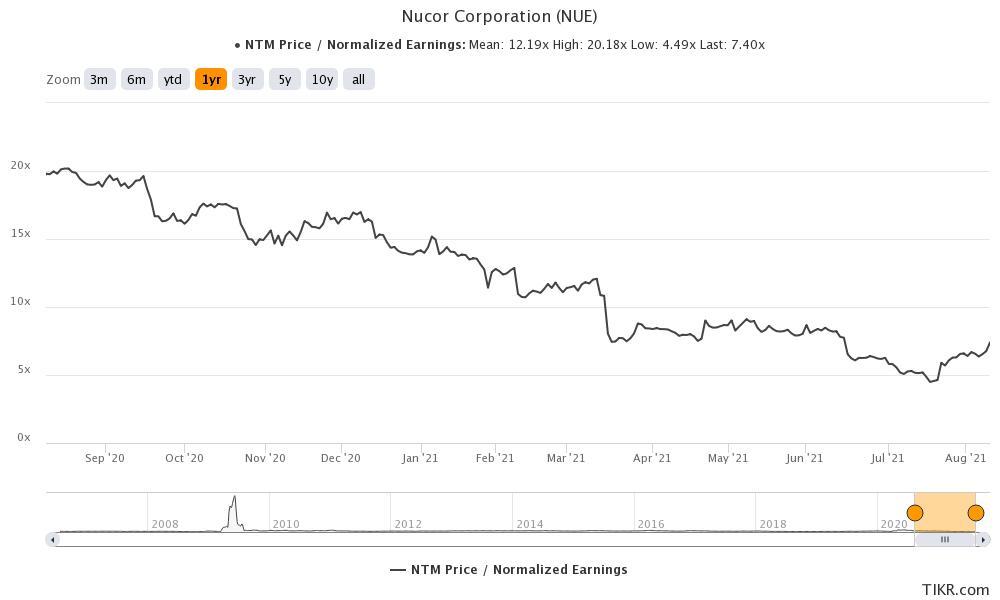

From a valuation perspective, Nucor trades at an NTM PE multiple of 7.4x. The stock looks undervalued and cheap at these prices based on the current steel supercycle. CNBC Mad Money host Jim Cramer is also bullish on Nucor stock and said that it's a cheap stock.

Nucor realizes the importance of the infrastructure bill and called its passing by the Senate a “significant day” while speaking with Cramer on his Mad Money show.

Nucor stock has more than doubled this year and is among the top three gainers in the S&P 500 index. The stock could see more upside after the infrastructure bill. Nucor stock is still one of the best ways to play the Biden administration’s infrastructure push.