Best Cheap Stocks for Investors to Buy Now and Hold Long Term

While U.S. markets are near record highs, you can still find cheap stocks. Here's the list of cheap stocks that you can buy now for the long term.

Aug. 10 2021, Published 10:02 a.m. ET

Many investors crave cheap stocks. Now, there are two ways to look at cheap stocks. Some investors consider stocks with low absolute dollar values as cheap. However, that would be a fallacy since cheapness is a function of valuation and not absolute stock price. What are the best cheap stocks that you can buy now and invest in for the long term?

U.S. stock markets are trading near record highs and the broader market valuations aren't cheap, at least for seasoned value investors like Warren Buffett. He has been a net seller of stocks for three straight quarters, which says a lot about how the Oracle of Omaha feels about the market. However, there are still small pockets of undervalued stocks that you can consider.

What are cheap stocks?

Cheap stocks are those stocks that are trading below their fundamental value. The stocks are often overlooked by the markets. At times, a near-term headwind leads to depressed stock prices, while the long-term outlook is positive. In an efficient market, cheap stocks eventually trade at what they are worth or at least in theory.

Best cheap stocks to buy now

The following is the list of cheap stocks that you can buy now.

- Ford

- General Motors

- Fisker

- U.S. Steel Corporation

- Nucor

- Freeport-McMoRan

Legacy automakers look cheap

Legacy automakers like Ford and General Motors are outperforming in 2021. They have come off their recent highs and look like good cheap stocks to buy now. Both of these companies are posting record earnings and are also pivoting from ICE (internal combustion engine) cars to electric cars.

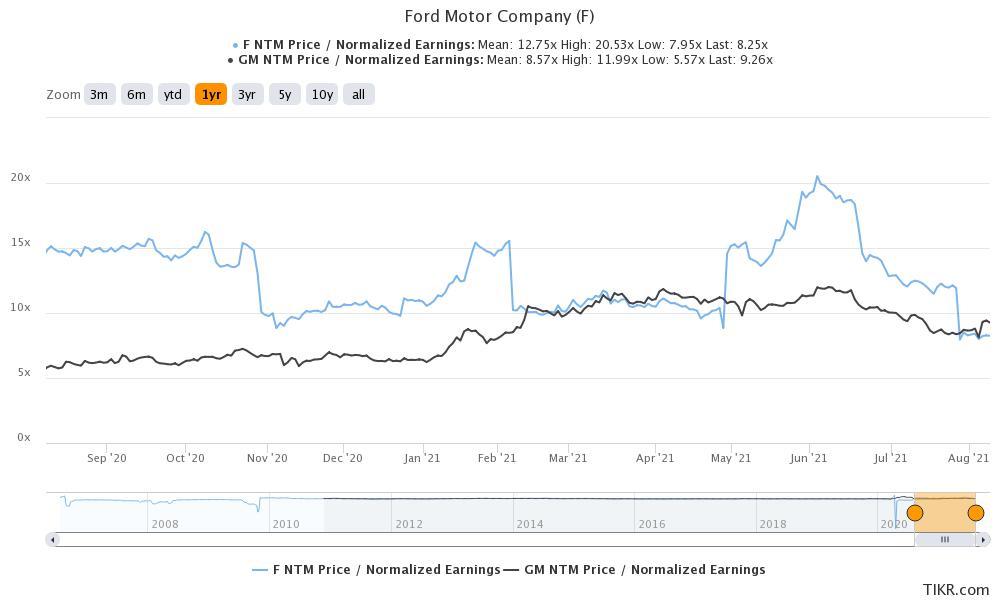

The valuations for Ford and General Motors are way below what the trendier pure-play EV (electric vehicle) stocks trade at. Both of these stocks trade at a single-digit NTM PE multiple, while EV stocks trade at a double-digit price-to-sales multiple.

Fisker looks like a cheap EV stock to buy

The startup EV space has gotten battered and names like Nikola and Lordstown Motors have tumbled. However, Fisker looks like a good EV name that has been free from controversies like many other startup EV names. The company has a market cap of only about $4.5 billion and looks cheap.

Metals and mining stocks

As I noted previously, markets are underestimating the strength of the current commodity supercycle. U.S. Steel Corporation has already bounced back from the recent lows and still looks cheap. The company is posting record earnings and the current valuations don’t look in sync with its fundamentals.

Nucor looks like another cheap steel stock to buy. The company would be among the biggest beneficiaries of higher infrastructure spending since it has high exposure to the non-residential construction market. The stock trades at an NTM PE multiple of only 6.7x, which looks cheap.

Freeport-McMoRan (FCX) stock has also fallen sharply from the peaks and looks cheap now. It's among the best ways to play the copper story. The company has an attractive portfolio of copper assets spread across low-risk jurisdictions. With a rising production profile and the expected fall in unit cash costs, FCX looks like a good cheap stock to buy now.

Jim Cramer on cheap stocks

Jim Cramer, the host of the Mad Money show on CNBC, has also weighed in on cheap stocks to buy now. He listed Ford and Walmart as cheap stocks. Cramer also identified homebuilder stocks like Toll Brothers, KB Home, Lennar, and DR Horton as cheap stocks.