Bank of America Picks 5 Semiconductor Stocks: Should You Buy?

Admid the semiconductor shortage, these Bank of America-stock picks could help you profit from the high demand.

April 21 2021, Published 12:01 p.m. ET

There is a shortage of semiconductors or chips globally which is leading to production bottlenecks in industries ranging from smartphones, white goods, and automotive. However, the shortage is also a boon for some of the companies that manufacture them. Bank of America has picked five semiconductor stocks that could benefit from the chip shortage.

The global semiconductor shortage has resulted from a demand-supply mismatch. While the demand for chips bounced back amid the uptrend in the global economy, chip supply hasn’t kept pace. Semiconductor companies are investing billions of dollars in ramping up capacity, but it would take a few quarters to come online. Until then, the chip shortage is expected to persist.

Bank of America has its own semiconductor stock list to compete with Goldman Sachs' picks.

Semiconductor shortage is among the most prominent investing themes currently. Last week, Goldman Sachs came out with its list of semiconductor stock picks to play the chip shortage. Now, Bank of America has listed five stocks that it believes would benefit from the semiconductor shortage:

- ASML sells lithography equipment to semiconductor companies. The Dutch company is the top pick for Bank of America to play the global chip shortage

- Infineon sells semiconductors used in electric vehicles. Automotive companies including Ford, Volvo, and NIO had to curtail production due to the chip shortage. The demand for automotive chips has been particularly strong amid the growing electric vehicle sales.

- STMicroelectronics supplies chips to smartphone companies like Apple.

- Soitec produces semiconductor materials and is based in France.

- ASMI produces wafer processing equipment used in the fabrication of semiconductors. The company is based out of Netherlands.

Which semiconductor stock to buy now:

From the semiconductor companies that Bank of America has highlighted, I find ASML and Infineon particularly interesting. Semiconductor equipment manufacturers like ASML are among the best ways to play the chip shortage as semiconductor companies are investing big time in new plans which would mean more revenues for equipment companies.

As for Infineon, the demand crunch for semiconductors is particularly acute in the automotive industry. The automotive industry’s chip demand is expected to remain strong for quite some time as electric cars generally use more chips than ICE (internal combustion engine) cars.

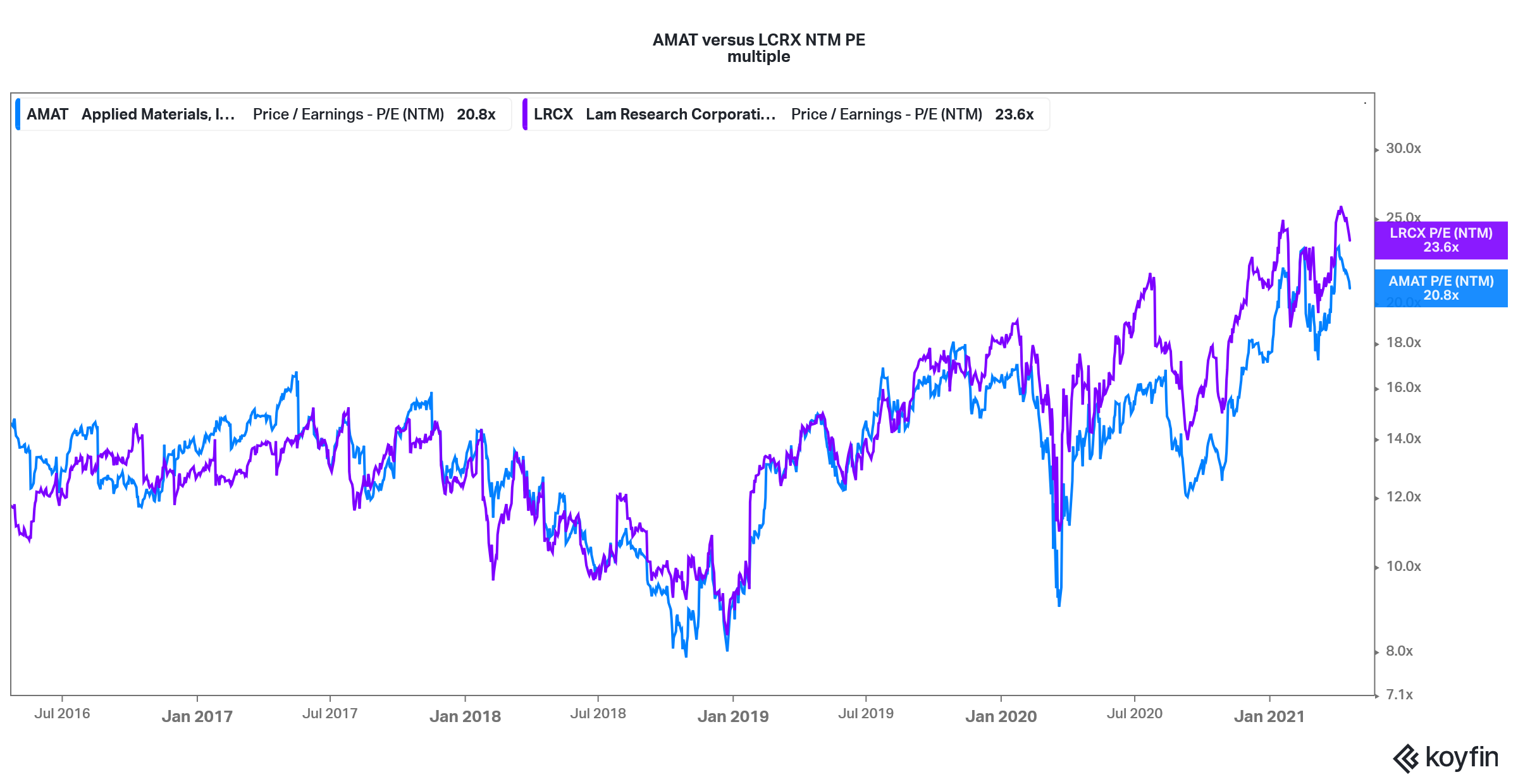

AMAT versus LCRX valuation

Also, as automotive companies produce more smart cars with autonomous driving features, it would keep their chip demand high. This would make Infineon a proxy play on both global semiconductor shortage as well as electric vehicles.

What are the best semiconductor stocks to invest in?

Apart from the names that Bank of America has highlighted, there are some other stocks that you can invest in to play the global semiconductor shortage. Lam Research (LRCX) and Applied Materials (AMAT), which produce equipment for semiconductor companies, are among the companies that would benefit as chipmakers pour billions into new plants.

LRCX stock trades at an NTM PE multiple of 23.6x while AMAT has an NTM PE multiple of 20.8x.

Micron is another semiconductor stock that you can invest in to play the chip shortage story. Almost 70 percent of Micron’s revenues come from the sales of DRAM chips, which are witnessing a severe supply shortage. Micron’s main competitors in the DRAM chip market are Samsung and SK Hynix. Micron stock trades at an NTM PE multiple of 9.8x which looks attractive.