Akili Interactive IPO Will Send Prescription Gaming Mainstream

ADHD prescription video game company Akili Interactive is going public via a SPAC. Here’s what to know about the IPO and whether or not you should invest.

Jan. 27 2022, Published 11:05 a.m. ET

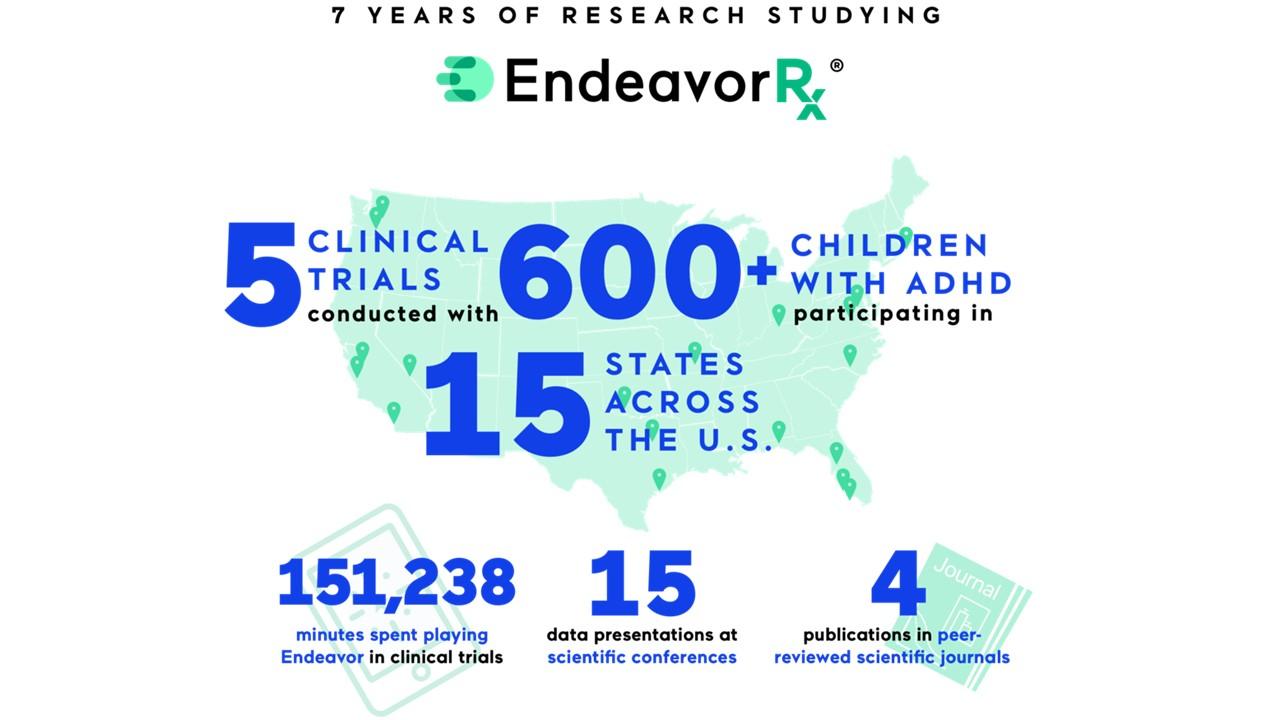

Research on ADHD (attention deficit hyperactivity disorder) has come a long way in the 21st century. Still, the CDC says, “There are many unanswered questions about ADHD.” Prescription video game company Akili Interactive is working to treat symptoms of the disorder using an FDA-approved game called EndeavorRx.

Akili just announced that it will go public through a SPAC run by Chamath Palihapitiya, a billionaire, former big tech executive, and serial SPAC creator. Here’s what to know about the IPO and whether or not you should invest.

What is Akili Interactive?

The tagline for Akili’s EndeavorRx game is “It's time to play your medicine.”

Spearheaded by CEO Eddie Martucci, Akili is “passionate about bringing together top science and entertainment with great user experience to forever change how medicine is designed and delivered.”

The company offers a first-of-its-kind ADHD treatment delivered through a video game experience. The game is FDA-approved and suited for children ages 8–12 years old with inattentive or combined-type ADHD.

EndeavorRx is considered a part of a larger treatment protocol that includes therapy, medication, educational programs, or a combination of treatments. About 1,000 doctors have written a prescription for EndeavorRx so far and full commercialization is to come.

Akili Interactive has provided the SPAC IPO details.

A Palihapitaya SPAC called Social Capital Suvretta Holdings Corp. (NASDAQ:DNAA) has announced that it’s targeting Akili Interactive for a reverse merger. The blank-check firm hit the market in June of last year and has dropped about 2.9 percent in value while public.

After the SPAC IPO, the combined company is poised to have a post-money equity valuation of about $1 billion, with $412 million in gross cash proceeds.

Naturally, the Palihapitiya SPAC is also contributing most of a $162 million PIPE (private investment in public equity). The other investors include Apeiron Investment Group, Temasek, Polaris Partners, and more.

Is FDA-approved gaming for ADHD a metaverse play?

Not all gaming is a metaverse play, although that might not be the case forever. Akili could be in a position to transition into the metaverse if—or when—the trend toward immersive digital experiences continues. This depends on the success of the company as it goes fully commercial, as well as the game’s therapeutic efficacy in a more encompassing virtual setting.

Akili is boldly going public in a bear market.

Akili hasn’t yet announced when it will take over the "DNAA" ticker. However, the current bear market makes it difficult for SPACs to time their entrance. This week, four blank-check companies—Murphy Canyon Acquisition Corp., CAVU Technology Acquisition Corp., Do It Again Corp., and TCG Growth Opportunities Corp.—pulled their IPO registrations to avoid going public due to market volatility.

DNAA is already on the market, so it’s committed. However, it will still need a decent entrance point for Akili if it wants any sort of success.

Should you invest in Akili Interactive stock after the SPAC IPO?

DNAA stock jumped about 2 percent this week, but it’s still in the red. A fledgling SPAC play might be risky in the current market, days after the second-largest intraday point swing on the S&P 500. Akili is still in its early stage, which means that it’s still vying for profit and IPO investors should proceed with caution.