Solar Stocks to Buy Now as Manchin Backs Clean Energy Deal

Joe Manchin has backed the spending bill for reaching the climate change goal. What are the best solar stocks for investors to buy now?

July 29 2022, Published 8:22 a.m. ET

Clean energy stocks rose sharply on July 28 after Joe Manchin backed the spending bill for reaching the climate change goal. The Inflation Reduction Act of 2022 proposes a massive $369 billion for the clean energy transition. Solar stocks rose sharply after the announcement. Previously, Manchin said that he wouldn't back climate spending. What are the best solar stocks to buy now?

Solar and other green energy stocks have whipsawed over the last two years. There was a rally of a lifetime in the sector after Joe Biden was elected as the U.S. President. The honeymoon continued in early 2021 as the Democrats took control of Congress.

Solar stocks have been volatile.

The euphoria toward green energy and solar stocks is best reflected by the new listings in this space between 2020 and 2021. Biden didn't disappoint green energy enthusiasts and the administration took a series of steps to increase the green energy transition.

The steps include re-joining the Paris Climate deal, mandating the conversion of the federal fleet to zero-emission vehicles, and spending on the green energy sector under the infrastructure bill.

However, solar and other clean energy stocks came under pressure in the back half of 2021 amid concerns about their soaring valuations. The sell-off only deepened in 2022 as investors shunned growth stocks amid rising interest rates. Manchin’s opposition to the BBB (Build Back Better) didn't help matters either for clean energy stocks.

These are the best solar stocks to buy now.

There's little denying that climate change is a pressing emergency for mankind even as the green energy transition has taken a back seat in the short term after Russia invaded Ukraine. The long-term outlook for solar stocks looks positive. Clean energy is crucial if the world has to transition to electric cars. The following solar stocks look like good buys now.

- Enphase Energy (NYSE: ENPH)

- Sunrun (NYSE: RUN)

- First Solar (NYSE: FSR)

Enphase Energy stock is outperforming the markets in 2022.

While most clean energy stocks are in the red in 2022, Enphase’s price action stands out with a YTD gain of nearly 50 percent. The stock is among the top 10 S&P 500 gainers, a spot that has mostly been reserved for fossil fuel companies. ENPH is the largest supplier of microinverter-based solar and battery systems in the world and has also expanded into EV (electric vehicle) charging.

Enphase is growing its business organically as well as inorganically and has completed five acquisitions in the last six quarters. The company reported strong results for the second quarter of 2022 and also provided positive guidance. It was added to the S&P 500 Index also, a sign of the growing importance of clean energy companies.

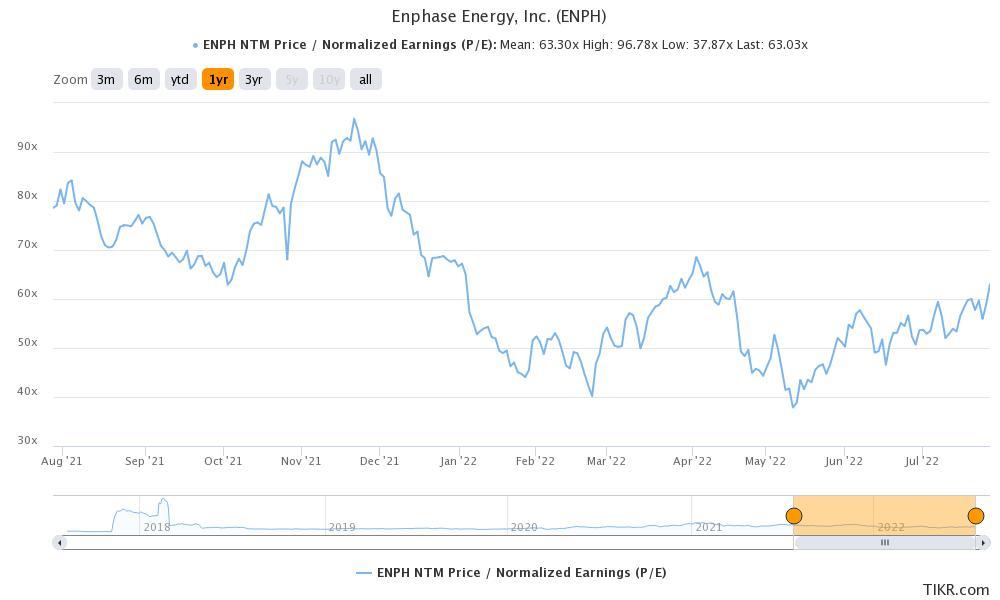

ENPH stock trades at an NTM (next-12 month) PE of 63x, which seems reasonable considering the valuation of other solar companies. Markets have also been bullish on the stock amid the clean energy pivot, and its sales are expected to keep growing at a fast pace in the foreseeable future.

Sunrun is a play on residential solar sector

Sunrun is a play on the residential solar sector. In the first quarter of 2022, the company saw a 39 percent increase in customer orders. The company has tied up with the top 80 homebuilders, which provides it with revenue visibility. Sunrun has also partnered with Ford for the company's Intelligent Backup Power starting with the all-electric F-150. Meanwhile, Sunrun is a loss-making company and analysts don’t expect it to be profitable in 2023 either.

First Solar looks like another good solar stock after the clean energy deal.

Like fellow solar stocks, FSLR also jumped sharply on July 28 and turned positive for the year. It posted revenues of $621 million in the second quarter, which was $254 million higher than the corresponding quarter in 2021. First Solar has a strong order backlog stretching to 2026. The stock trades at an NTM PE multiple of almost 138x.