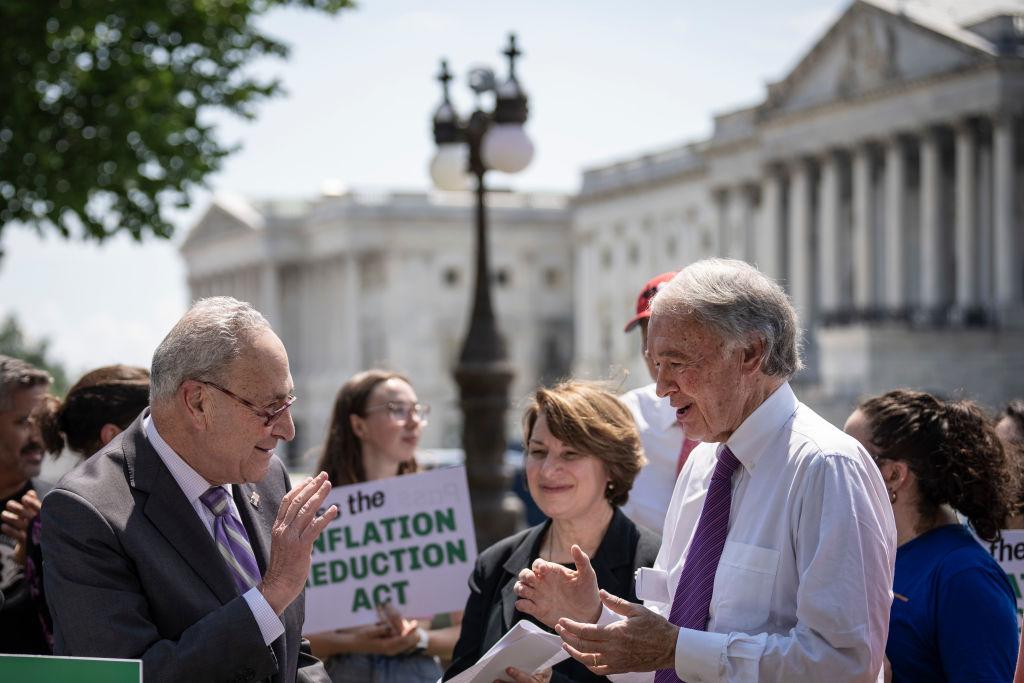

EV Tax Credit Set to Change After the Inflation Reduction Act

President Joe Biden has signed the Inflation Reduction Act of 2022 and the EV (electric vehicle) tax credit system is also set to change.

Aug. 19 2022, Published 8:28 a.m. ET

President Joe Biden has signed the Inflation Reduction Act of 2022. The law makes sweeping changes to the country’s fight against climate change while also increasing the minimum corporate tax rate to 15 percent. The EV (electric vehicle) tax credit system is also set to change.

Under the previous EV tax credit regime, the federal tax credit for EVs is capped at $7,500. However, the tax credit started phasing out once an automaker sells 200,000 electric cars. General Motors, Toyota Motors, and Tesla are the three automakers whose EVs didn't qualify for the federal tax credit.

There's a new EV tax credit under the Inflation Reduction Act.

The Inflation Reduction Act puts in place a new EV tax credit system that replaces the old system. There's a $7,500 tax credit for buying a new electric car and $4,000 for buying a used car.

However, beginning in 2023, the vehicle cap will be lifted. This would mean that EV models from General Motors, Toyota Motors, and Tesla will also be eligible for the EV tax credit. This is especially good news for Tesla since it will start delivering its Cybertruck in 2023 and Semi truck in 2022.

The EV must be assembled in North America to be eligible for the tax credits.

Importantly, only vehicles assembled in North America will qualify for the tax credits. The automotive industry in North America is quite integrated and would benefit from the provision. However, electric cars assembled outside North America don’t qualify for the tax credit.

Beginning 2024, there are also sourcing requirements on the battery. In 2029, only cars with batteries fully made in North America will qualify for the tax credit. The Biden administration has been trying to reduce the reliance on China for imports of key materials and the Inflation Reduction Act is a step in that direction.

Which cars qualify for the EV tax credit?

The U.S. Department of Energy has made a list of models that qualify for the EV tax credit. It also asks buyers to check the vehicle’s build location using the Vehicle Identification Number (VIN). Some of the approved models are also built in different locations, including outside of North America. It also said that the list would be updated periodically as the Department gets more details from car manufacturers.

There is an income limit for the EV tax credit.

Beginning in 2023, there will be an income limit to claim the EV tax credit. Single taxpayers with an annual income up to $150,000 and joint filers with income up to $300,000 will only be eligible for the tax credit beginning next year.

There's also a cap on the vehicle price. So, cars with an MSRP (manufacturer suggested retail price) of up to $55,000 and pickups and SUVs of up to $80,000 will qualify for the EV tax credit. China has a similar policy and high-end vehicles don’t qualify for the subsidy.

Is the EV tax credit retroactive?

The EV tax credit isn't retroactive. However, if someone signed a binding contract to purchase one of the qualifying models before the enactment of the Inflation Reduction Act, the new changes won't apply. The catch here is on the “binding contract” because most companies, including Tesla, give an option to book cars with refundable money.