Yes, Customers Still Have to Pay Loans If a Bank Fails — All the Details

What happens to loans when a bank fails? Amid the downfall of two major banks, here's what to know if you have loans at a bank that has closed.

March 13 2023, Published 11:49 a.m. ET

This past week, regulators closed Silicon Valley Bank and Signature Bank amid their rapid downfall. After regulators placed the banks under the management of the Federal Deposit Insurance Corporation (FDIC), customers with deposits need to know whether their money is safe, but what happens to loans when a bank fails?

Banking customers are no doubt familiar with the phrases "member FDIC" and "FDIC insured." Those four letters that might seem like an afterthought to some actually mean everything to those who have accounts with banks that carry that designation. Not every product at an FDIC member institution is protected, so here's what you need to know about your own financial accounts.

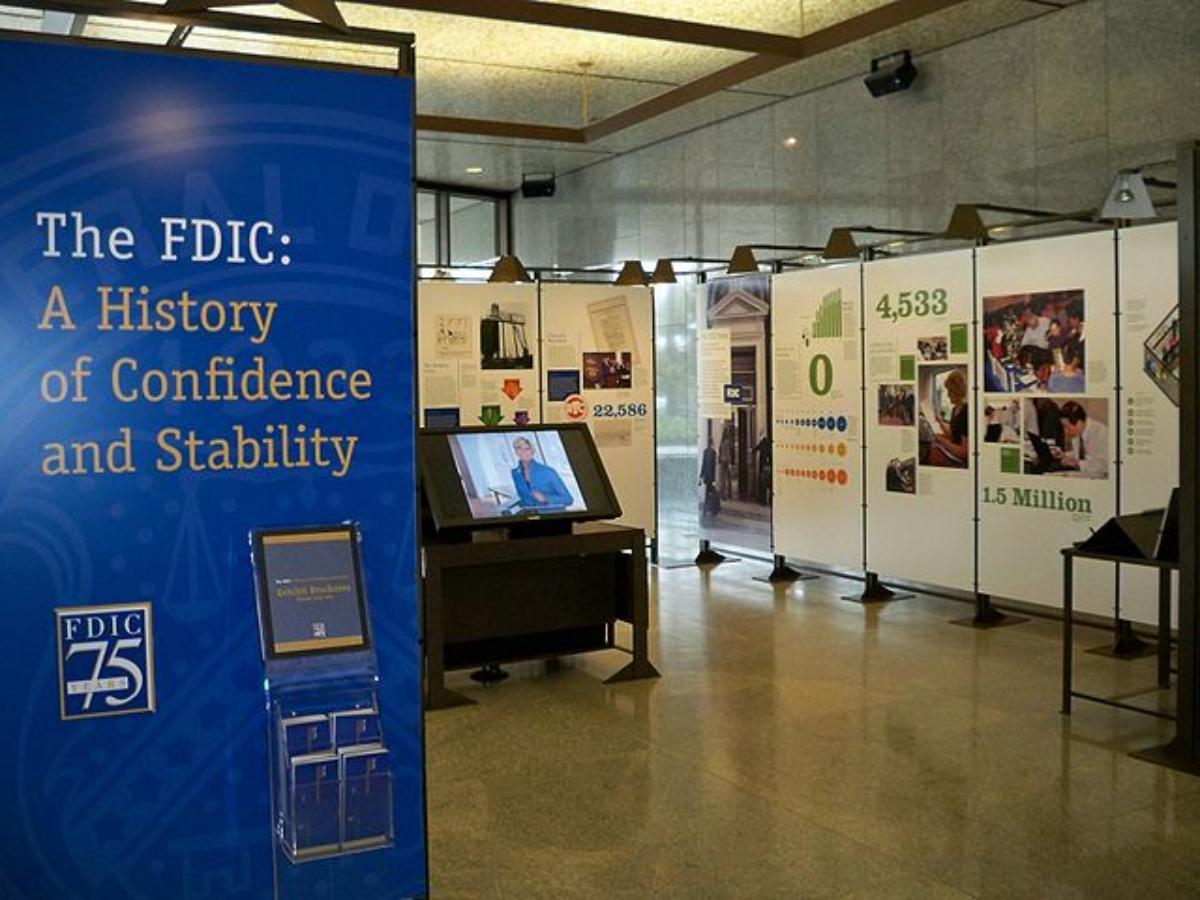

An FDIC exhibit near the White House, as pictured in 2009.

What is the FDIC and what do they do?

The Federal Deposit Insurance Corporation, or FDIC, was formed in 1933. Unsurprisingly, that was in the wake of the 1929 stock market crash and failures of thousands of U.S. banks. In addition to examining and supervising financial institutions, the FDIC insures deposits to help create stability in the the U.S. banking system.

As most Americans know, the FDIC provides insurance for financial accounts at its member banks. It covers deposits of up to $250,000 per depositor, per qualified account, per financial institution. This means that if you have an FDIC-insured checking account or other account at a bank that closes for some reason, the FDIC will make your money available to you.

In the case of the past week's upheaval with Silicon Valley Bank and Signature Bank, the FDIC insures qualifying accounts to the $250,000 maximum. Customers with covered accounts are able to access their money beginning on March 13, 2023, according to the FDIC. The FDIC transferred all assets of both banks to bridge banks.

The FDIC insures accounts and provides consumer information about financial products and protections.

What happens to loans if a bank fails?

Knowing that deposits are insured up to $250,000 per account, per accountholder, per institution, is reassuring. But what about loans you have through a bank that has collapsed? The FDIC's information for depositors, creditors, and borrowers explains that the agency has either sold the loan at closing or retained it temporarily.

Loans held at banks that have failed are still your obligation to pay. The FDIC says that borrowers should be notified within a few days of a bank closure by both the FDIC and the institution that has purchased the failed bank and its accounts. You should also receive notification of where and when to send all future loan installment payments.

What if you have a delinquent loan? If you haven't paid on a loan at a failed bank, any deposits you may have at that bank will be used first to offset your debt. If you have a non-delinquent loan, you may choose to “set off” the loan against your deposits to get back the value of uninsured funds. Uninsured funds refers to anything above the $250,000 limit on insurance.

The Federal Deposit Insurance Corporation headquarters building in Arlington, Virginia.

What does it mean for customers when banks fail?

Bank failures can be devastating, but since the inception of the FDIC, their impact is much smaller. If you hold your funds in FDIC-insured accounts, spreading them among different accountholders or institutions to avoid exceeding the $250,000 insured limit, you won't be affected much by a bank failure.

However, bank closures come with plenty of negative consequences. As the FDIC noted regarding SVB's collapse, "Shareholders and certain unsecured debt holders will not be protected." If you've invested in the bank or hold unsecured debts, you stand to lose a lot.

The FDIC states that money invested in the following aren't covered, even if you bought them at an insured bank:

Insured accounts include checking accounts, savings accounts, CDs, and MMDAs.

Accounts holding stocks are among those not covered by the FDIC.

When can I expect to receive my deposits?

The FDIC moves quickly — the agency announced that customers of both SVB and Signature Bank would be able to access their accounts already on March 13, 2023, just days after the banks' closures. They operate through "bridge banks," which are interim banks handling the failed banks' accounts. If you have loans at a failed bank, the loan may be sold to another bank, which will notify you of new repayment instructions.

How can you keep your money safe from bank failures?

While some react with fear and stuff their money under a mattress, that isn't the best way to keep money safe from bank failure. The FDIC insures accounts up to $250,000, and you could have multiple accounts up to that maximum to protect your money. Spouses might each have different types of accounts at the same institution to maximize coverage, and you can also spread out your risk by spreading funds among several banks.