Was Bank of America Hacked? Scam Signs to Watch Out For

Bank of America customers may worry about hackers, as they often target bank customers. Did Bank of America get hacked? Rumors have been going around.

Jan. 18 2023, Updated 4:15 p.m. ET

If you're a Bank of America customer, you may have heard rumors of the financial institution being hacked. Although it isn't exactly uncommon for a banking customer to be the victim of a hacking scheme, there are ways to protect yourself and your financial information.

Did Bank of America get hacked? And perhaps most importantly to you, has your bank account been hacked? A number of customers complained on social media on Jan. 18, 2023, that Zelle transactions already posted had disappeared again from their accounts, causing a negative account balance.

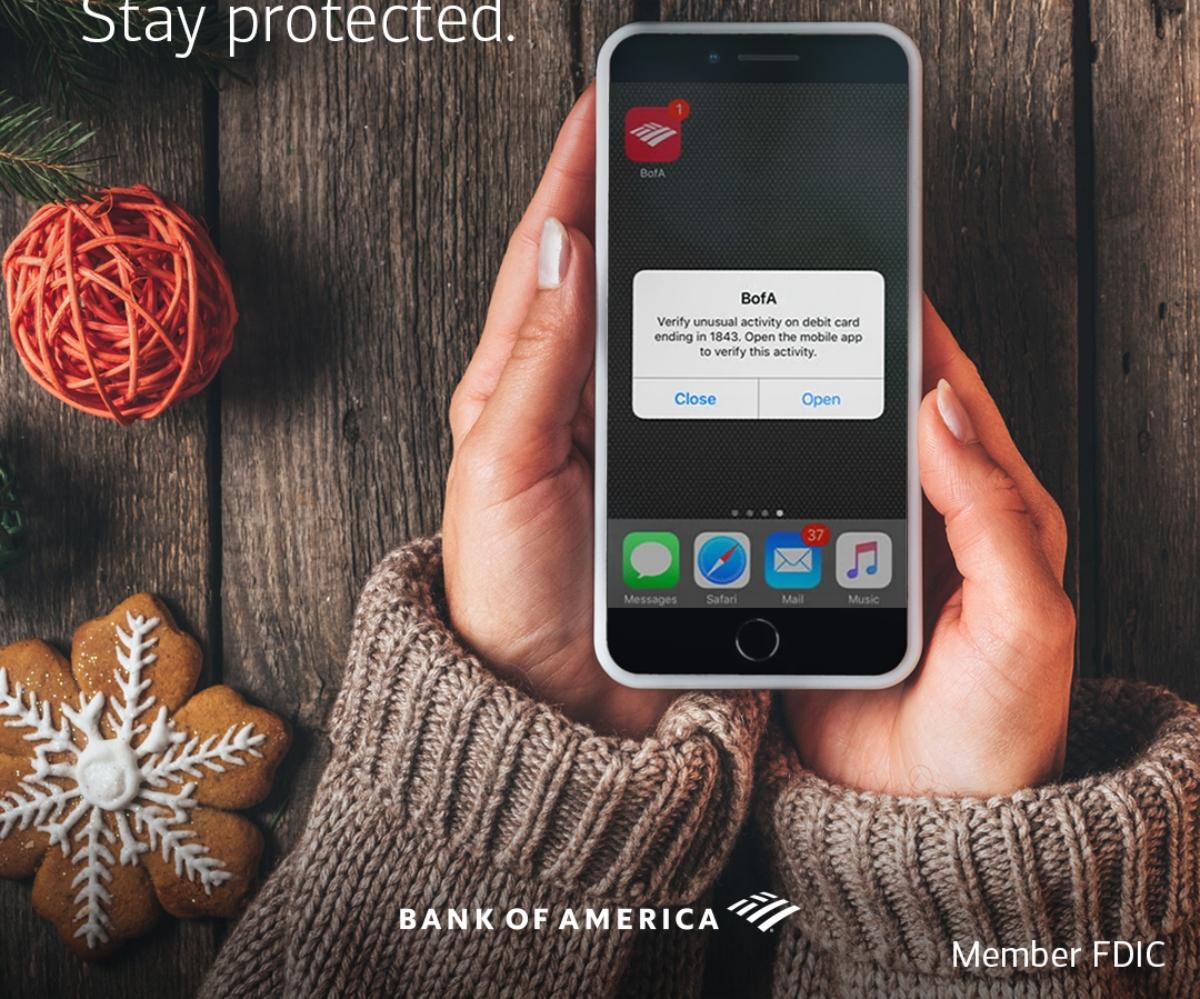

Bank of America has an app and means to set up push notification, but be cautious about any messages you receive that aren't verified as from BofA.

Bank of America customers had troubles with their account balances on January 18th.

As NPR reported, many bank customers shared on social media that their accounts had suddenly shown negative balances or that money was missing. DownDetector reported a spike in outage reports for both Zelle and Bank of America in the morning.

What happens if you have a negative balance on your Bank of America account?

Customers do sometimes overdraft their accounts — meaning they withdraw or spend more than their available checking account balance. A negative balance typically results in the bank charging you a fee.

In 2022, Bank of America announced it would be reducing its overdraft fees beginning in May. As CNBC reported, the bank said it was decreasing the fee for overdrafts from $35 to $10. In addition, it announced an elimination of the fee to have overdraft protection.

Bank of America says the issue has been resolved.

As of 3:00 p.m. EST on Jan. 18, Bank of America stated the problem had been resolved. So, if you experienced issues, you can check your account again to see if your balance is back to normal.

Watch out for these common Bank of America scams.

Fraudsters know the right things to say to get customers to hand over their personal information such as login credentials and identifying details. But you can prepare yourself by avoiding certain pitfalls and recognizing red flags in Bank of America scams (and any financial scams).

Bank of America shares tips about the most common scams and how to avoid them. Prevention is key, because, as the bank says, if you authorize a money transfer to a scammer, "there's often little we can do to help get your money back." Fake emails, text messages, voice calls, and letters are common ways scammers try to contact customers.

Here are some major red flags to avoid:

- any unexpected or unsolicited message asking for personal information or money

- pressure to act immediately

- a request to pay in an unusual way, such as with Bitcoin, gift cards, or using Zelle to resolve fraud

- a request for personal or account information (PIN, account number, etc.)

- offers for free products or something else too good to be true

One common scam is a message claiming to be from Bank of America saying that they suspect fraudulent activity. By text, phone, or email, the scammer will worry you by saying there was a suspicious transaction, but that they can help you protect your money if you "verify" your identity or account number.

Another common banking scam involves payment apps like Zelle, Venmo, or CashApp. No bank should ask you to send money to any of these apps. They work like cash, so it's nearly impossible to recover the money once you've authorized a transfer.

Banking tools are useful, but beware of unsolicited text messages, emails, or phone calls claiming to be from your bank.

Protect your money and your identity with these guidelines.

Whether you use Bank of America or any other bank, protect yourself and all of your sensitive information. Bank of America will never ask for personal information via text message or email. You should also be cautious about phone calls. Set up two-factor authentication to prevent unauthorized access.

If you receive any type of message from Bank of America asking for sensitive information, don't respond. Don't click on links in texts or emails, or hang up the phone. Then contact the bank using verified contact information (Bank of America's "Contact Us" page, for example).

Here are a few other warning signs to beware of:

- account "verification" requests

- requirements to send money

- requests to download attachments

- messages not from verified bank addresses

- grammar and spelling mistakes

Any message that tries to create urgency about your sending information is a major red flag. You shouldn't need to send your PIN, account number, Social Security number, or any other personal or identifying information in an email, text, or phone call.

If you think your account may have been hacked, use the bank's online system or call a verified customer service phone number to safely monitor the situation.