Stuart McKenzie

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Stuart McKenzie

AQR Capital Increases Holdings in Apple

In 4Q14, AQR Capital raised its holdings in Apple (AAPL). AAPL constituted 1.46% of the fund’s fourth-quarter portfolio.

Oaktree Capital Sheds Nearly Half Its Holdings in NRG Energy

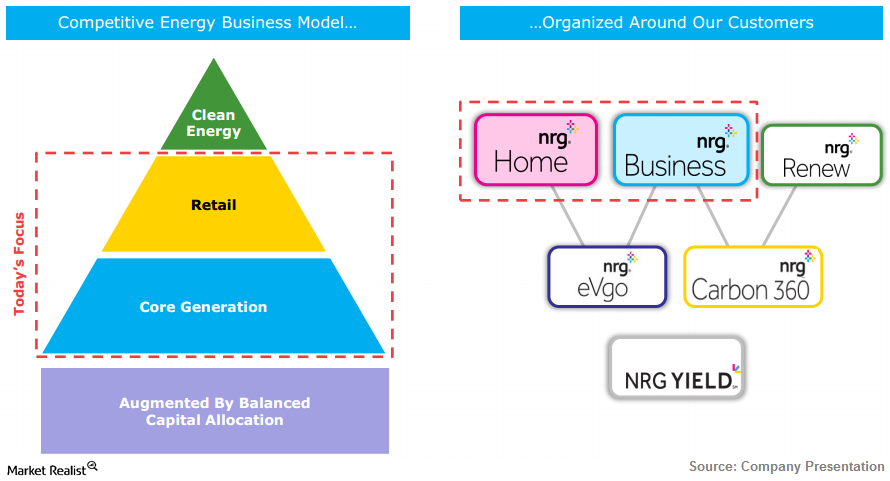

NRG Energy is a US-based integrated retail electricity and wholesale power-generation firm. The company has 2.5 million residential customers across the US.

Davidson Kempner Initiates Stake in Apple

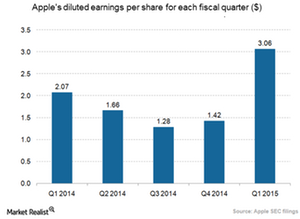

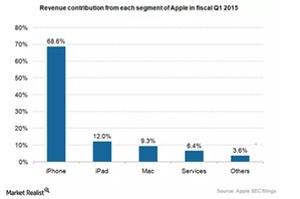

In February 2015, Apple announced its 1Q15 results and once again beat all analysts’ estimates.

Oil Majors Keep New Projects Worth $200 billion on Ice

Wood Mackenzie research shows that the oil majors have deferred more than 45 significant oil and gas projects since the beginning of the crude oil price collapse last year.

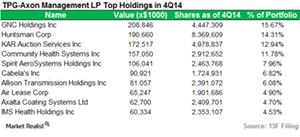

TPG-Axon Capital Management Increases Four Positions in 4Q14

In 4Q14, TPG-Axon Capital Management increased holdings in Huntsman (HUN), Allison Transmission Holdings (ALSN), KAR Auction Services (KAR), and Zynga (ZNGA).

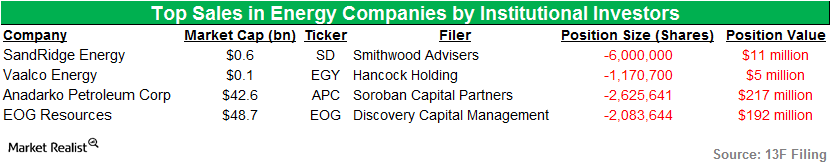

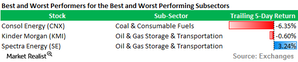

Smithwood Advisers and Hancock Sell Stakes in Energy in 1Q15

Smithwood Advisers was among the hedge funds that sold their stakes in SandRidge Energy in 1Q15. Hancock Holding was one of the firms that sold stakes in Vaalco Energy.

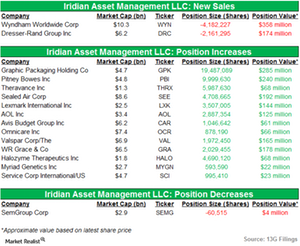

Highlights of Iridian Asset Management’s holdings: 13G filing

In its recent 13G filing, Iridian Asset Management disclosed the sale of two of its major holdings and amendments to 14 of its prevailing positions.

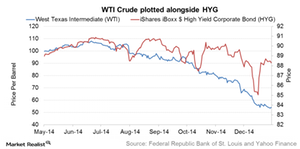

Credit Default Swaps as Insurance against Junk Bond Market Crash

Carl Icahn mentions the use of credit default swaps as a form of protection against credit events. He implies that investors should possess sophisticated knowledge of the fixed income markets to enter that playing field.

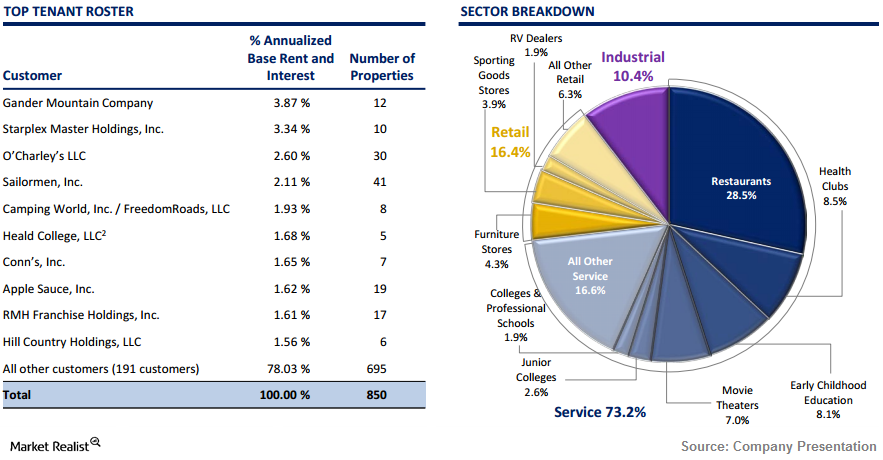

Store Capital Gets Added to Oaktree Capital’s Portfolio

Oaktree Capital initiated a new position in Store Capital (STOR) by purchasing 82,148,645 shares in the company.

US Crude Production Dropped in Week Ended July 24, but Why?

According to data from the U.S. Energy Information Administration, US crude production dropped to 9.4 million barrels per day in the week ended July 24.

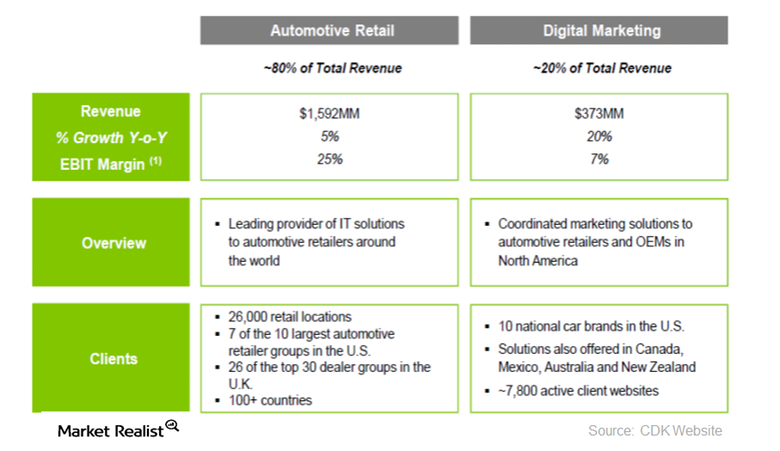

OZ Management Opens New Position in CDK Global

OZ Management commenced a stake in CDK Global Inc. (CDK) by purchasing 4,521,952 shares of the company, representing 0.5% of the fund’s 4Q14 portfolio.

Highlights of TPG-Axon Management’s Dropped Positions in 4Q14

In 4Q14, TPG-Axon sold its stakes in Macy’s (M), Monsanto (MON), Alibaba Group Holding (BABA), and Vantiv (VNTV).

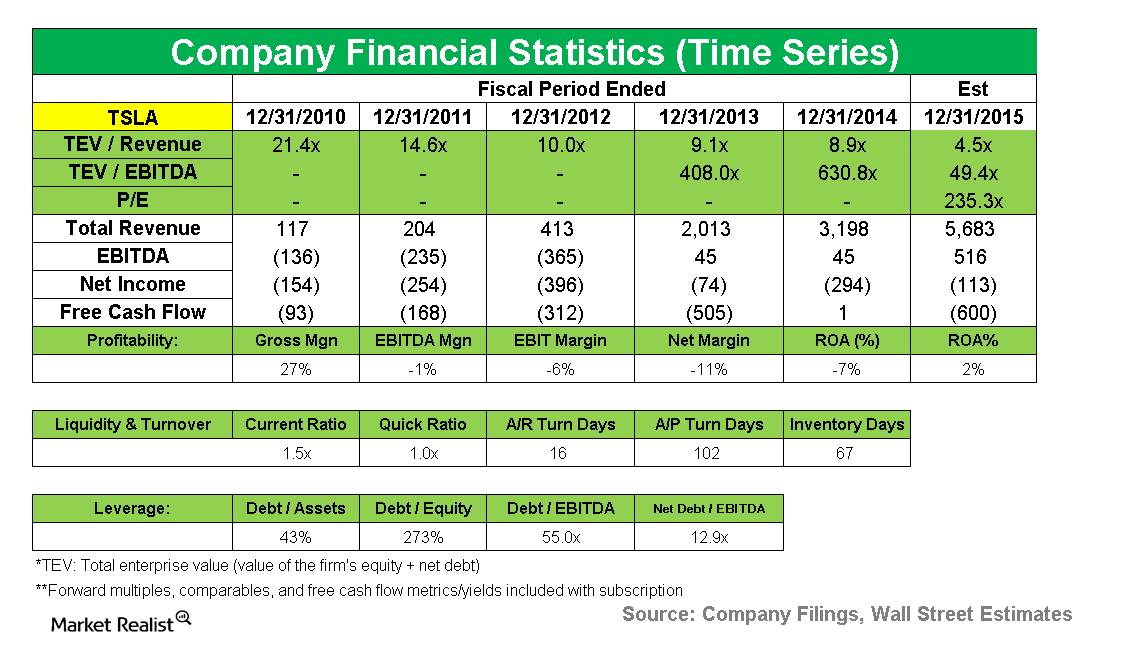

Highfields Capital Initiates a Stake in Tesla Motors

Tesla Motors is involved in the design, development, manufacturing, and sales of electric vehicles and advanced powertrain components for electric vehicles.

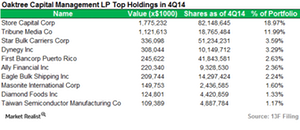

Oaktree Capital Trades Key Positions in 4Q14

Oaktree Capital is an investment management firm that focuses on alternative markets. Store Capital (STOR) ranked among the fund’s top holdings in 4Q14.

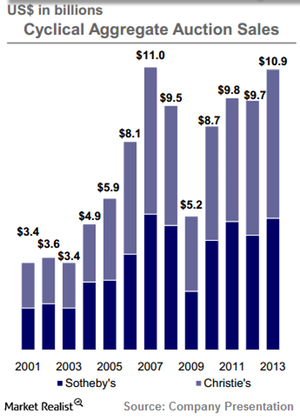

Christie’s Maintains Lead over Sotheby’s

While Sotheby’s was facing Daniel Loeb’s activist pressure, the new management team at Christie’s was implementing a global strategy.

A summary of Caxton Associates’ key 4Q14 holdings

Caxton Associates’ portfolio fell from $3.04 billion in 3Q14 to $1.29 billion in 4Q14.