Highlights of Iridian Asset Management’s holdings: 13G filing

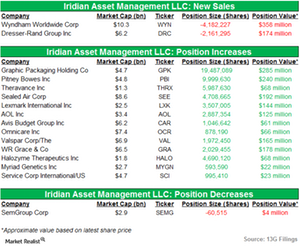

In its recent 13G filing, Iridian Asset Management disclosed the sale of two of its major holdings and amendments to 14 of its prevailing positions.

Nov. 20 2020, Updated 3:32 p.m. ET

Key updates to Iridian Asset Management’s holdings

Iridian Asset Management LLC is a value-oriented investment management firm. It pursues active equity investment strategies that cater to institutional investors, including public pension funds, endowments, and foundations.

In its 13G filing in January, Iridian Asset Management disclosed the sale of two of its major holdings and amendments to 14 of its prevailing positions. This series will take you through each of those positions.

Notable changes

According to its 13G filing, Iridian Asset Mnagement didn’t initiate any new positions.

The fund increased its holdings in the following companies:

- Myriad Genetics, Inc. (MYGN)

- Service Corporation International/US (SCI)

- Avis Budget Group, Inc. (CAR)

- Omnicare, Inc. (OCR)

- Halozyme Therapeutics Inc. (HALO)

- Theravance Inc. (THRX)

- AOL Inc. (AOL)

- Lexmark International, Inc. (LXK)

- The Valspar Corporation (VAL)

- W.R. Grace and Company (GRA)

- Sealed Air Corp. (SEE)

- Pitney Bowes Inc. (PBI)

- Graphic Packaging Holding Company (GPK)

- SemGroup Corporation (SEMG)

A significant aspect of the fund’s 13G filings is that Iridian Asset Management dropped the following two key positions:

The investment process that Iridian Asset Management employed is extremely rigorous. The process is designed to identify a wide range of opportunities and uncover value throughout the entire spectrum of the financial markets.

To find out more about Iridian Asset Management, read Market Realist’s Iridian Asset Management makes key position trades in 3Q14.

In the next part of this series, we’ll look at Iridian Asset Management’s increased position in Myriad Genetics, Inc. (MYGN).