Myriad Genetics Inc

Latest Myriad Genetics Inc News and Updates

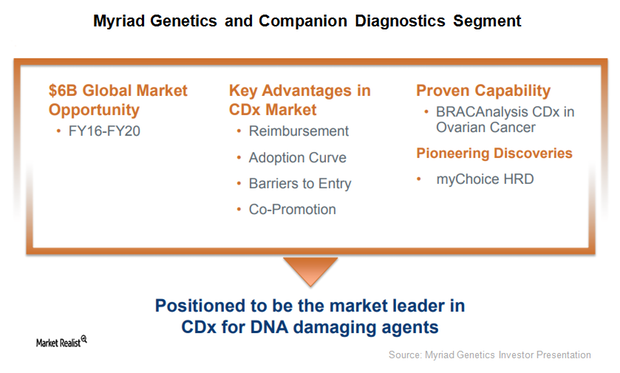

This Could Be a Solid Growth Driver for Myriad Genetics in 2018

Myriad Genetics (MYGN) announced the U.S. Food and Drug Administration’s (or FDA) acceptance of its supplementary premarket approval application for BRACAnalysis CDx, a DNA sequencing companion diagnostic test.

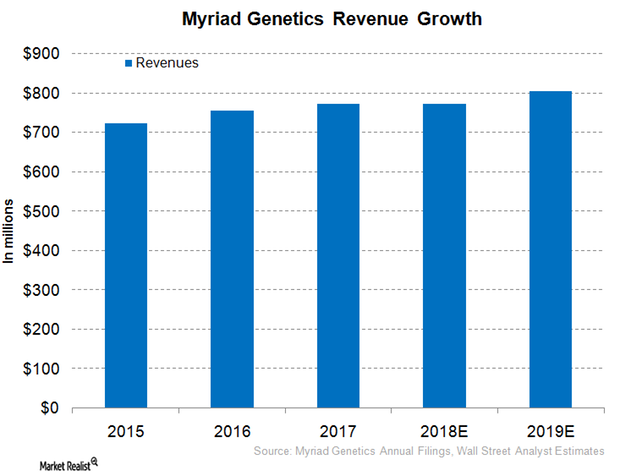

Myriad Genetics Expected to Report Flat Revenue Growth in Fiscal 2018

Myriad Genetics (MYGN) expects to report revenues in the range of $750 million–$770 million in fiscal 2018 (ended June 30, 2018).

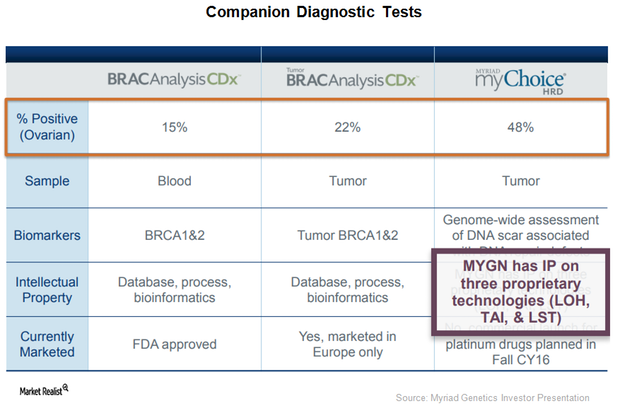

BRACAnalysis CDx Received FDA Approval for Ovarian Cancer Indication

On March 27, 2017, the FDA also approved BRACAnalysis CDX test as a complementary diagnostic test to be used with ovarian cancer maintenance therapy Tesaro’s (TSRO) Zejula (miraparib).

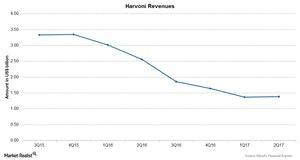

How Did Gilead’s Blockbuster Drug Harvoni Perform in 2Q17?

Harvoni is the top-selling drug in Gilead Sciences’ (GILD) portfolio. The drug is used for the treatment of genotype-1 hepatitis C virus (or HCV) infection.