Store Capital Gets Added to Oaktree Capital’s Portfolio

Oaktree Capital initiated a new position in Store Capital (STOR) by purchasing 82,148,645 shares in the company.

Nov. 20 2020, Updated 12:35 p.m. ET

Oaktree Capital’s holdings in Store Capital

Oaktree Capital initiated a new position in Store Capital (STOR) by purchasing 82,148,645 shares in the company. The purchase represents 18.97% of the fund’s 4Q14 portfolio.

Store Capital is a 0.09% part of the iShares Russell 2000 Value ETF (IWN).

As you can see in the above chart, Store Capital has outperformed its peers National Retail Properties (NNN), Realty Income (O), and Spirit Realty Capital (SRC). Store Capital also outperformed the MSCI US REIT Index (RMZ) and its secondary peers, according to the company’s recent investor presentation slides. These companies include American Realty Capital Properties (ARCP), EPR Properties (EPR), and W. P. Carey (WPC).

Store Capital overview

Store Capital is a “net-lease real-estate investment trust (REIT)” that’s internally managed. It is the leader in the management, investment, and acquisition of “Single Tenant Operational Real Estate,” otherwise known as STORE properties. These properties are the firm’s target market.

The firm is among the fastest-growing and largest net-lease REITs, with a well-diversified, large portfolio that includes investments in ~950 property locations. The market value of the 1.5 million STORE-type properties is estimated to be over $2.3 trillion.

The firm is taxed as a REIT. In order to qualify as such, it must ensure that its assets are comprised mainly of real estate assets, that its income is mainly earned from real estate assets, and that a minimum of 90% of its REIT taxable income, besides net capital gains, is distributed on an annual basis to stockholders. Despite being a public company, the firm is a “controlled company,” meaning that a major portion of its common stock is indirectly owned by funds managed by Oaktree.

Successful completion of initial public offering

Store Capital completed its initial public offering on November 21, 2014. The transaction involved 31.6 million shares of common stock, the net proceeds of which were ~$545 million. Most of this amount was used for portfolio acquisitions and for paying down credit facility debt that had been outstanding.

Key competitive strengths

Store Capital believes it has “superior” origination and “proven” processes for investment underwriting. It has the broadest sector in its target market, covering large- and middle-market companies. The pipeline of potential investments at the company’s disposal is estimated to be worth $5.6 billion. The company’s investment portfolio consists of a majority of contracts that have investment-grade ratings. The firm’s capital structure is conservative yet flexible.

High-quality portfolio

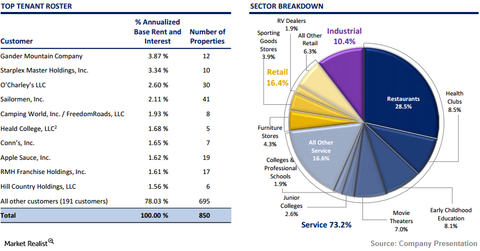

The firm’s portfolio has “superior term and diversification over market comparables.” It’s diversified across geographies—46 states—and across industries and tenants. None of the firm’s customers made up more than 4% of the company’s portfolio as of December 31, 2014.

Impressive 4Q14 financial results

Store Capital’s 4Q14 revenues were $55.2 million compared to $33.4 million reported in 4Q13. This represents a 65.3% increase. Net 4Q14 income was $17.4 million—a considerable increase from $7.5 million reported in 4Q13.

In the next part of this series, we’ll take a look at Oaktree Capital’s position change involving NetApp (NTAP).