Key Energy Events This Week

The EIA’s crude oil and natural gas inventory data are scheduled to be released on April 25 and April 26, 2018, respectively.

April 23 2018, Published 8:00 a.m. ET

Key energy events

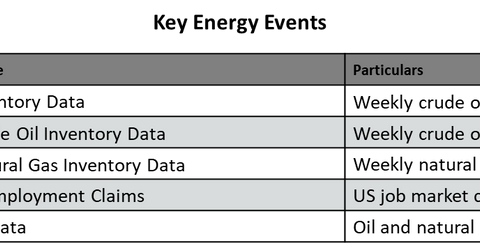

On April 23–27, 2018, the events listed in the following table could impact oil and natural gas prices.

The EIA’s (U.S. Energy Information Administration) crude oil and natural gas inventory data are scheduled to be released on April 25 and April 26, 2018, respectively. The data could be important for oil and natural gas prices.

Energy stocks and ETFs

Energy stocks like WPX Energy (WPX), Denbury Resources (DNR), and Whiting Petroleum (WLL) could be sensitive to oil and natural gas prices at least in the long term. Energy stocks are also impacted by moves in energy prices in the short term.

On April 13–20, 2018, WPX Energy, Denbury Resources, and Whiting Petroleum rose 9.4%, 5.1%, and 2.8%, respectively. During this period, US crude oil June futures and natural gas May futures rose 1.6% and 0.1%, respectively.

Energy ETFs like the SPDR S&P Oil & Gas Exploration & Production ETF (XOP) and the Energy Select Sector SPDR ETF (XLE) contain energy stocks. Any changes in oil and natural gas prices might be important for XOP and XLE. In the past five trading days, XOP and XLE rose 4% and 2.6%.