Brent-WTI Spread Might Push Oil Exports and Downstream Stocks Up

On September 10, 2018, Brent crude oil November futures settled ~$9.83 higher than WTI crude oil October futures, the highest level for the Brent-WTI spread since June 19, 2018.

Sept. 11 2018, Updated 1:59 p.m. ET

Brent-WTI spread

On September 10, 2018, Brent crude oil November futures settled ~$9.83 higher than WTI crude oil October futures, the highest level for the Brent-WTI spread since June 19, 2018. On August 31, 2018, the spread was ~$7.84.

Between August 31 and September 10, 2018, Brent crude oil November futures fell just 0.3%. WTI, or US crude oil October futures, fell 3.2% during that period. In the past five trading sessions, the United States Brent Oil ETF (BNO) fell 0.3%, and the United States Oil ETF (USO) fell 3.4%. BNO tracks Brent crude oil futures, while USO follows US crude oil futures.

US crude oil exports

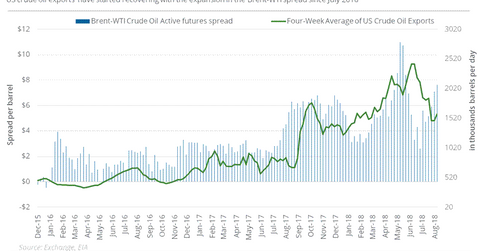

The above chart shows the broadly positive relationship between US crude oil exports and the Brent-WTI spread since December 2015. Exports seem to follow the Brent-WTI spread with a lag. The US lifted the ban on US crude oil exports in December 2015. Since then, US crude oil production has increased ~19.8% to ~11 MMbpd (million barrels per day) in the week ended August 31, 2018.

In the week ended August 31, 2018, US crude oil exports rose ~1.3% MMbpd year-over-year. However, in the same week, US crude oil exports fell ~0.3 MMbpd to ~1.5 MMbpd. If the Brent-WTI spread expands more because of looming US sanctions on Iran oil exports discussed in part one, it could be a positive development for US crude oil exports in the coming weeks.

Brent-WTI spread and US energy companies

A widening Brent-WTI spread is good for US refiners and US oil exporters, but it’s a disadvantage for US oil producers selling in the US market. A narrowing spread has the opposite impact. On July 20, 2018, the Brent-WTI spread fell to $2.61, the lowest level since July 31, 2017. Between July 20 and September 10, 2018, the Brent-WTI spread expanded ~$7.22, while the VanEck Vectors Oil Refiners ETF (CRAK) rose 4.3%.

Phillips 66 (PSX) and Valero Energy (VLO) account for ~16.5% of CRAK. These stocks have risen 3.3% and 8.5%, respectively, since July 20, 2018. Another expansion in the Brent-WTI spread could be favorable for US refining stocks in the days ahead.