A Look at Opdivo’s Performance in 2016

Bristol-Myers Squibb’s (BMY) latest drug, Opdivo, was the seventh drug to be approved by the FDA for the treatment of melanoma.

March 17 2017, Updated 7:38 a.m. ET

Oncology drug Opdivo

Bristol-Myers Squibb’s (BMY) latest drug, Opdivo, was the seventh drug to be approved by the FDA for the treatment of melanoma. Apart from melanoma, the drug has also been approved for the treatment of lung cancer.

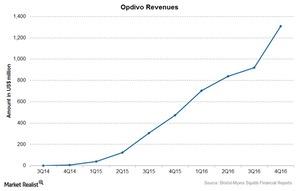

Opdivo reported revenue of $3.8 billion in 2016, compared to $942 million in 2015.

Opdivo is a blockbuster drug that’s expected to be one of BMY’s major revenue contributors in the next five years. The drug has already been approved for the treatment of melanoma and some forms of lung cancer, renal cell carcinoma (or kidney cancer), and for expanded use in the treatment of previously treated non-small cell lung cancer.

Recent Opdivo developments

In US markets, lung cancer treatment is an important area of opportunity for Bristol-Myers Squibb. BMY is the first company to market drugs for squamous cell cancer. Opdivo has already been approved for the treatment of non-squamous cell carcinoma.

Recent developments in Opdivo include the following:

- In February 2017, the FDA approved Opdivo for the treatment of patients with previously treated urothelial carcinoma, a type of bladder cancer, in patients who have shown disease progression during or after platinum-based chemotherapy.

- In January 2017, Bristol-Myers Squibb and Ono Pharmaceutical Company announced a global patent license agreement with Merck & Co. (MRK) to settle all Keytruda-related patent infringement litigations.

- In November 2016, the FDA approved Opdivo for the treatment of patients with squamous cell carcinoma of the head and neck who have shown disease progression during or after platinum-based chemotherapy.

- In November 2016, the European Commission approved Opdivo for the treatment of classical Hodgkin’s lymphoma after an autologous stem cell transplant and treatment with brentuximab vedotin.

- In December 2016, Bristol-Myers Squibb and Ono Pharmaceutical Company announced the approval of Opdivo in Japan for the treatment of patients with classical Hodgkin’s lymphoma.

- In December 2016, Ono Pharmaceutical Company submitted a supplemental application for the approval of Opdivo for the treatment of gastric cancer.

Apart from Opdivo, Yervoy is used for the treatment of melanoma. The FDA and the European Commission have validated Opdivo’s combination with Yervoy for the treatment of metastatic melanoma.

Other drugs used for the treatment of melanoma are Merck & Co.’s Intron A, Sylatron, and Keytruda, Novartis’s (NVS) Proleukin, GlaxoSmithKline’s (GSK) Mekinist and Tafinlar, and Roche’s Zelboraf.

Investors may want to consider the PowerShares Dynamic Large Cap Growth ETF (PWB), which holds 2.8% of its total assets in Bristol-Myers Squibb.