What Do the MLP Funds Flows Indicate?

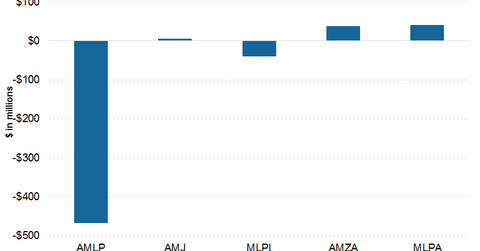

AMLP has seen a net outflow of $467.8 million over the past one-month period ended March 16, 2018.

March 26 2018, Updated 7:34 a.m. ET

MLPs’ funds flow

The funds flow is an important metric to reveal investors’ interest in MLPs. The Alerian MLP ETF (AMLP), which is currently the largest MLP exchange-traded fund in terms of market capitalization, has seen a massive outflow of funds since the start of this year.

AMLP has seen a net outflow of $467.8 million over the past one-month period ended March 16, 2018, and $689.6 million since the start of this year.

On the other hand, the JPMorgan Alerian MLP ETN (AMJ) has seen a net inflow of $5.5 million over the past one-month period and a net outflow of $3.5 million since the start of this year. AMJ’s lower YTD net outflows compared to AMLP might reflect a shift in investors toward ETNs amid the increase in volatility in the equity markets.

On the other hand, a rise in US Treasury bond yields could weigh more on exchange-traded notes compared to exchange-traded funds.

The InfraCap MLP ETF (AMZA) and the Global X MLP ETF (MLPA) have seen respective net inflows of $55.9 million and $128.8 million in funds. The UBS ETRACS Alerian MLP Infras ETN (MLPI) has seen a net outflow of $24.1 million.

MLPs versus other investments

The Alerian MLP ETF’s massive outflow of funds isn’t expected to pose concerns to investors, as the huge fund outflow isn’t limited to the MLPs. The SPDR S&P 500 ETF Trust (SPY), which serves an important benchmark for the US markets, has seen a net outflow of ~$13.3 billion since the start of this year.

On the other hand, the Utilities Select Sector SPDR ETF (XLU) has seen a net outflow of $241.4 million during the same timeframe.