What’s Priced into Delta’s Valuation?

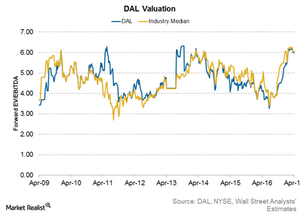

Delta Air Lines (DAL) is currently valued at 5.3x its forward EV-to-EBITDA (enterprise value to earnings before interest, tax, depreciation, and amortization) multiple.

April 11 2017, Updated 9:06 a.m. ET

Current valuation

Delta Air Lines (DAL) is currently valued at 5.3x its forward EV-to-EBITDA (enterprise value to earnings before interest, tax, depreciation, and amortization) multiple. This valuation is slightly lower than its average valuation since DAL’s listing in November 2008 of 5.4x.

As can be seen from the above chart, DAL has traded close to the industry median except for short periods in 2010 and 2013.

Peer comparison

American Airlines (AAL) and Alaska Air Group (ALK) are trading at a similar valuation of 6.6x, followed by Southwest Airlines (LUV) at 6.3x, and Spirit Airlines (SAVE) at 6.0x. United Continental (UAL) is trading at 5.9x, and JetBlue Airways (JBLU) is trading at 5.6x.

The market is expecting DAL to see EBITDA per share fall 2.9% in the next one year. EBITDA expectations for DAL’s peers are as follows:

- AAL: 0.1% fall

- UAL: 4% fall

- ALK: 13% rise

- LUV: 1.5% fall

- JBLU: 2.7% fall

- SAVE: 11.5% rise

- ALGT: 0.7% rise

Our analysis

In the short term, if fuel prices fall further and travel demand is still robust, the market will have a good reason to be excited about airline stocks.

Airlines are a cyclical industry. The fragile nature of the industry’s profitability ensures that investors tread with caution. Most airlines are now boasting about having found the key to remain profitable across cycles. In the long term, this is what will affect valuation multiples.

If industry fundamentals deteriorate or investors’ risk appetite falls, valuation multiples can fall too. A company’s leverage will magnify the extent of the share price fall, thus reminding us why investors should also keep a close eye on leverage.

In Delta’s upcoming earnings, investors should watch out for DAL’s unit revenue guidance and also keep an eye on capacity cuts and utilization trends. Delta Air Lines forms 1.6% of the PowerShares BuyBack Achievers Portfolio (PKW).