Why American Airlines Has Higher Debt Compared to Its Peers

As opposed to most other airlines that have been reducing their debts, American Airlines’ (AAL) debt has risen, partly due to its focus on completing its integration with US Airways.

April 21 2017, Updated 9:06 a.m. ET

High debt

As opposed to most other airlines that have been reducing their debts, American Airlines’ (AAL) debt has risen, partly due to its focus on completing its integration with US Airways following their merger.

American Airlines’ debt rose to $22.5 billion at the end of 4Q16, compared to $18.5 billion at the end of 4Q15.

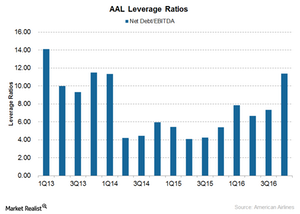

AAL’s net debt-to-EBITDA (earnings before interest, tax, depreciation, and amortization) ratio rose from 5.4x at the end of 4Q15 to 11.4x at the end of 4Q16. This level was the highest among its peers.

At the end of 4Q16, Delta Air Lines (DAL) had a net debt-to-EBITDA ratio of 2.8x, United Continental (UAL) had a ratio of 4.6x, Alaska Air Group (ALK) had a ratio of -0.56x, JetBlue Airways (JBLU) had a ratio of 0.52x, Southwest Airlines (LUV) had a ratio of 0.03x, and Allegiant Travel had a ratio of 3.2x.

Cash flows and future plans

At the end of 4Q16, the company had ~$6.4 billion in cash and investments on its balance sheet, compared to its total debt of ~$22.5 billion.

Despite its cash balance, American still has huge debt on its balance sheet. Its management still doesn’t have a clear plan to reduce its debt. Investors should likely keep an eye on this going forward.

It’s important for investors to track AAL’s leverage, especially given that AAL only came out of bankruptcy in 2013. In 2011, its former company, AMR, filed for bankruptcy while trying to restructure its high debt.

On the other hand, if AAL does manage to significantly reduce its leverage, it will be in a much better position to weather the next industrial downturn, whenever that happens.

Investors can gain exposure to American Airlines by investing in the PowerShares Dynamic Large Cap Value ETF (PWV), which invests ~1.4% of its portfolio in the stock.