Analysts’ Recommendations for Southwest Airlines

Analysts’ recommendations Of the 17 analysts tracking Southwest Airlines (LUV), 36.8% of the analysts (seven analysts) gave a “strong buy” rating on the stock, while another 47.4% (nine analysts) gave a “buy” rating. The remaining 15.8% (three analysts) gave a “hold” rating. None of the analysts gave a “sell” or “strong sell” rating on the […]

Nov. 1 2017, Updated 9:00 a.m. ET

Analysts’ recommendations

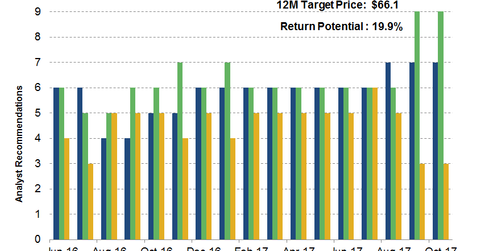

Of the 17 analysts tracking Southwest Airlines (LUV), 36.8% of the analysts (seven analysts) gave a “strong buy” rating on the stock, while another 47.4% (nine analysts) gave a “buy” rating.

The remaining 15.8% (three analysts) gave a “hold” rating. None of the analysts gave a “sell” or “strong sell” rating on the stock.

There have been two analyst rating changes after LUV’s earnings release. Deutsche Bank raised the target price from $63.00 to $71.00 and maintained its “buy” rating. Imperial Capital reduced its target price from $68.00 to $66.00.

There were a few analyst revisions earlier in October. Evercore ISI raised its target price from $56.00 to $62.00. Raymond James changed its rating to “outperform” from “market perform.” J.P. Morgan has raised its target price from $60.00 to $66.00 and increased the rating to “overweight” from “neutral.”

Target price

The stock’s consensus 12-month target has been decreased to $66.10 compared to $67.70 at the end of 2Q17. The current target price indicates a 19.9% return potential as of the October 26, 2017, closing price of $55.1. The highest target price for the stock is $80.00 and the lowest target price is $61.00.

Peer comparison

Analysts’ 12-month target prices for LUV’s peers follow:

- Delta Air Lines (DAL): $63.20 with a 24.2% return potential

- Alaska Airlines (ALK): $87.30 with a 33.5% return potential

- United Airlines (UAL): $71.00 with an 18.4% return potential

- American Airlines (AAL): $56.40 with a 16.1% return potential

- Spirit Airlines (SAVE): $40.20 with an 11.4% return potential

- JetBlue Airways (JBLU): $23.80 with a 24.4% return potential

Next, we’ll wrap up this series by looking at LUV’s valuation compared to its peers. Investors can gain exposure to Southwest Airlines by investing in the PowerShares BuyBack Achievers Portfolio ETF (PKW), which holds 1.5% of its portfolio in the stock.