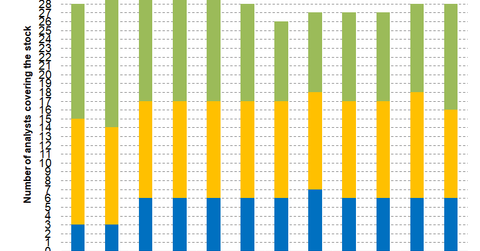

Gilead Sciences: Analysts’ Recommendations

In November, six analysts recommended a “strong buy,” ten recommended a “buy,” and 12 recommended a “hold” for Gilead Sciences.

Nov. 5 2018, Updated 9:00 a.m. ET

Analysts’ recommendations

In November, among the 28 analysts covering Gilead Sciences (GILD), six recommended a “strong buy,” ten recommended a “buy,” and 12 recommended a “hold.” The mean rating for Gilead Sciences stock is 2.21 with a target price of $86.15, which implies an upside potential of 22.5% over Gilead Sciences’ closing price of $70.31 on November 1.

Peers’ ratings

In comparison, Bristol-Myers Squibb (BMY), Merck (MRK), and Pfizer (PFE) analysts have mean ratings of 2.5, 1.84, and 2.74, respectively, and target prices of $59.83, $79.17, and $43.44, respectively.

Gilead Sciences’ long-term debt-to-equity ratio stands at 1.20. In comparison, Bristol-Myers Squibb, Merck, and Pfizer’s long-term debt-to-equity ratios stand at 0.42, 0.61, and 0.41, respectively.

The company’s quick ratio stands at 2.90. In comparison, Bristol-Myers Squibb, Merck, and Pfizer’s quick ratios stand at 1.40, 1.0, and 0.90, respectively.

Gilead Sciences’ price-to-free cash flow ratio stands at 11.76. Bristol-Myers Squibb, Johnson & Johnson (JNJ), and Pfizer’s price-to-free cash flow ratios stand at 76.37, 40.86, and 31.54, respectively.