Gold Prices Recover amid Sell-Off

Demand for Gold Withstood Recent Selloff Despite the drop in the gold price in October, demand for gold bullion-backed exchange traded products (ETPs) held firm. Inflows have no doubt slowed down compared to earlier in the year (0.4% increase in holdings in October compared to 12% and 6% increases in February and June respectively), but […]

Dec. 14 2016, Published 10:27 a.m. ET

Demand for Gold Withstood Recent Selloff

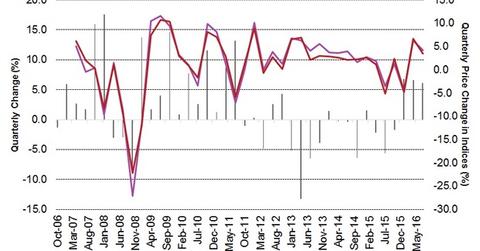

Despite the drop in the gold price in October, demand for gold bullion-backed exchange traded products (ETPs) held firm. Inflows have no doubt slowed down compared to earlier in the year (0.4% increase in holdings in October compared to 12% and 6% increases in February and June respectively), but demand continued during the recent selloff. We believe this is positive since investments in gold bullion ETPs typically represent longer-term, strategic investment demand. In contrast, the latest Commitment of Traders reports shows a significant decline in COMEX[6. COMEX is the primary market for trading metals such as gold, silver, copper and aluminum. Formerly known as the Commodity Exchange Inc., the COMEX merged with the New York Mercantile exchange in 1994 and became the division responsible for metals trading.] net long positions, which reached record levels this year. We think COMEX positioning reflects more speculative and shorter-term demand for gold, and the recent decline suggests perhaps some of those weaker players liquidated positions during the October selloff.

Gold stocks underperformed the metal, as expected when bullion prices fall. The NYSE Arca Gold Miners Index (GDMNTR)[7. NYSE Arca Gold Miners Index (GDMNTR) is a modified market capitalization-weighted index comprised of publicly traded companies involved primarily in the mining for gold.] fell 7.3%, and the MVIS Global Junior Gold Miners Index (MVGDXJTR)[8. MVIS Global Junior Gold Miners Index (MVGDXJTR) is a rules-based, modified market capitalization-weighted, float adjusted index comprised of a global universe of publicly traded small- and medium-capitalization companies that generate at least 50% of their revenues from gold and/or silver mining, hold real property that has the potential to produce at least 50% of the company’s revenue from gold or silver mining when developed, or primarily invest in gold or silver.] dropped 8.8% during the month. This decline trimmed gains for the year to 79% for GDMNTR and 110% for MVGDXJTR as of October 31, while gold bullion gained 20.3% during the same year-to-date period.

Market Realist – Inflationary hedging

The demand for metals (GLD) (GDX) (SLV) as an alternative asset class increased due to weakness in the US dollar (UUP). The dollar shed some of its previous gains as investors bet on the inflation resulting from Trump’s fiscal policies to cut US taxes and increase infrastructure spending. Analysts believe that, as an asset, gold is oversold—its 14-day RSI (relative strength index) slipped below 30 for three consecutive sessions. As gold provides a good inflationary hedge, low prices boost the demand for gold. Additionally, lower prices for the metal may tempt physical buyers back to the market.

However, gold may face short-term headwinds due to uncertainty surrounding the Fed’s rate hike. Moreover, strengthening of the dollar, rising large-cap (VTI), mid-cap (MDY), and small-cap (RWM) equities and high-interest rates may keep dragging down gold prices. In the next part, we’ll discuss how the demand for gold has increased in Asian markets due to demonetization in India.