Pharma Stocks in Review: A Valuation Comparison

In this article, we’ll compare the valuations of Eli Lilly and Company (LLY), Pfizer (PFE), Merck & Co. (MRK), Allergan (AGN), and GlaxoSmithKline (GSK).

Sept. 19 2018, Updated 7:31 a.m. ET

Pharma stocks’ valuations

In this article, we’ll compare the valuations of Eli Lilly and Company (LLY), Pfizer (PFE), Merck & Co. (MRK), Allergan (AGN), and GlaxoSmithKline (GSK).

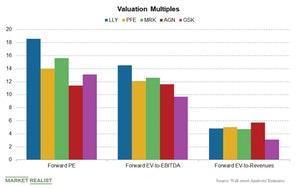

The chart above compares the valuation multiples of these companies, including their forward PE, forward EV-to-EBITDA (enterprise value-to-EBITDA), and forward EV-to-revenue multiples.

Forward PE

On September 14, Eli Lilly was trading at a forward PE multiple of ~18.6x, Pfizer was trading at ~14.0x, Merck & Co. was trading at 15.6x, Allergan was trading at 11.4x, and GlaxoSmithKline was trading at 13.1x. The industry average forward PE multiple was ~15.5x.

Forward EV-to-EBITDA

On a capital-structure-neutral and excess-cash-adjusted basis, Eli Lilly was trading at a forward EV-to-EBITDA multiple of ~14.5x on September 14. Pfizer was trading at 12.1x, Merck & Co. at 12.6x, Allergan at 11.6x, and GlaxoSmithKline at 9.7x. The industry average forward EV-to-EBITDA multiple was ~12.4x.

Forward EV-to-revenue

On September 14, Eli Lilly was trading at a forward EV-to-revenue multiple of ~4.8x, Pfizer at 5.0x, Merck & Co. at 4.7x, Allergan at 5.7x, and GlaxoSmithKline at 3.1x. The industry average forward EV-to-revenue multiple was ~4.7x.

The First Trust NASDAQ Pharmaceuticals ETF (FTXH) holds 4.6% of its total investments in Eli Lilly, 4.6% in Allergan, 8.7% in Pfizer, and 8.3% in Merck & Co. (MRK).