Pharma Stocks: Pfizer’s Revenue Trend and 2018 Estimates

Pfizer (PFE) reported revenue of ~$13.5 billion in the second quarter, a 4% YoY (year-over-year) rise in revenue.

Sept. 19 2018, Updated 10:30 a.m. ET

Pfizer’s earnings

Pfizer (PFE) reported revenue of ~$13.5 billion in the second quarter, a 4% YoY (year-over-year) rise in revenue compared to its revenue of ~$12.9 billion in the second quarter of 2017.

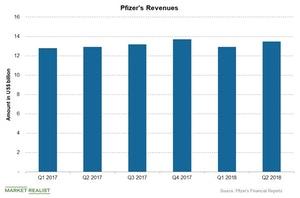

The chart above shows Pfizer’s quarterly revenue trend since the first quarter of 2017.

Revenue performance in the last quarter

Pfizer reported a rise of 4% in its top line to ~$13.47 billion, including a 2% rise in operating revenue and a 2% favorable impact of foreign exchange, in the second quarter. Its net adjusted income rose to ~$4.8 billion in the second quarter, an 18.8% rise compared to ~$4.1 billion in the second quarter of 2017.

The company’s sales in US markets totaled $6.23 billion in the second quarter, a 2% fall compared to its US sales of ~$6.35 billion in the second quarter of 2017. The fall in revenue was driven by 14% lower sales of essential health products at $1.6 billion during the quarter. However, the decrease was offset by a 3% increase in the sales of innovative health products at $4.6 billion.

The company’s international markets reported an 11% rise in revenue to ~$7.2 billion in the second quarter, including a 5% rise in operating revenue and a 6% favorable impact of foreign exchange.

Estimates for 2018

Analysts expect Pfizer to report a 3.2% YoY rise in revenue to $54.2 billion in 2018 compared to ~$52.5 billion in 2017. Its adjusted EPS are expected to rise ~12.8% to $2.99 in 2018.

The iShares US Healthcare ETF (IYH) holds 6.5% in Pfizer, 4.9% in Merck & Co. (MRK), 2.6% in Eli Lilly and Company (LLY), and 9.7% in Johnson & Johnson (JNJ).