A Look at Elanco, Eli Lilly’s Animal Health Business

Eli Lilly’s Elanco reported a 1% YoY (year-over-year) rise in revenue to $792.1 million in the second quarter.

Oct. 3 2018, Updated 10:30 a.m. ET

Elanco

Elanco is Eli Lilly and Company’s (LLY) Animal Health segment. Elanco reported a 1% YoY (year-over-year) rise in revenue to $792.1 million in the second quarter compared to $784.8 million in the second quarter of 2017.

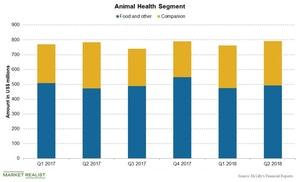

The above chart shows Elanco’s revenues since the first quarter of 2017. Eli Lilly announced in July that it had plans to separate Elanco through a potential IPO.

Revenue

Elanco’s revenue includes the sales of food animal products and companion animal products in US markets as well as outside US markets.

The US animal health business reported revenue of $378.3 million, a 7% YoY fall, and the animal health business outside US markets reported revenue of $414.0 million, a 9% YoY rise, in the second quarter.

Food and other products

Elanco’s food and other products business reported revenue of $491.7 million in the second quarter, a 4% YoY rise compared to the second quarter of 2017.

This revenue growth included an 11% increase in sales from outside US markets to $320.3 million offset by a 7% YoY fall in US sales to $171.4 million in the quarter. The business’s sales growth outside US markets included an 8% increase in operating revenue and a 2% favorable impact of foreign exchange.

Companion animal products

Companion animal products reported revenue of $300.6 million in the second quarter, a 4% YoY fall compared to the second quarter of 2017.

The fall in revenue was the result of a 7% fall in US sales to $206.9 million offset by a 5% rise in sales outside US markets in the quarter. The business’s growth in sales outside US markets included a 1% increase in operating revenue and a 5% favorable impact of foreign exchange.

The iShares Core High Dividend ETF (HDV) holds 1.6% in Eli Lilly, 3.8% in Merck & Co. (MRK), 6.1% in Pfizer (PFE), and 7.2% in Johnson & Johnson (JNJ).