Here’s What Might Help Kinross Gold Outperform in 2018

Apart from royalty and streaming companies, Kinross Gold (KGC) is one of the best-performing miners (GDX) (RING) in 2017.

Nov. 20 2020, Updated 1:59 p.m. ET

Returns for Kinross Gold

Apart from royalty and streaming companies, Kinross Gold (KGC) is one of the best-performing miners (GDX) (RING) in 2017. The stock has returned 30.9% YTD (year-to-date) as of December 18, 2017. It has significantly outperformed its peers in 2017. Its close peers Barrick Gold (ABX), Goldcorp (GG), Newmont Mining (NEM), and Agnico Eagle Mines (AEM) have returned -11.1%, -8.2%, 5.8%, and 3.1%, respectively, in the same period.

Reasons for outperformance

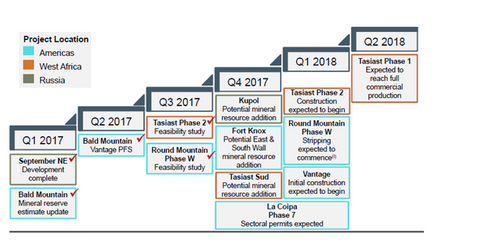

In 2017, Kinross Gold has consistently outperformed market expectations with its operational results and project execution. That led to KGC’s outperformance YTD. For more information about its 3Q17 results and outlook, be sure to read Can Kinross Gold Sustain Its Price Momentum after 3Q17 Results? In September 2017, the company announced it would go ahead with its Tasiast Phase Two Expansion and its Round Mountain Phase W. These projects will add to Kinross’s production and possibly reduce its costs. If you’re interested in knowing more about Kinross’s mine expansion, please read Kinross Gold’s Mine Expansion Plans: All You Need to Know.

Future outlook

Kinross has shown impressive progress on its projects, which has allayed some investor concerns over production growth in the medium to long term. Projects in the pipeline will also help it reduce costs, which are higher than its peers. Earlier, the company had too much exposure to Russia, which was considered a riskier mining jurisdiction. However, with the acquisition of assets in Nevada from Barrick, some of those concerns have been resolved.