These Factors Could Drive Newmont’s Free Cash Flow

Generating FCF (free cash flow) is very important for miners (GDX)(RING) as it helps them optimize their financial leverages, invest in projects supporting long-term value, and provide shareholder returns.

Nov. 1 2017, Updated 9:01 a.m. ET

Free cash flow

Generating FCF (free cash flow) is very important for miners (GDX)(RING) as it helps them optimize their financial leverages, invest in projects supporting long-term value, and provide shareholder returns. In this article, we’ll see how Newmont Mining (NEM) was able to generate cash in the current market environment in 3Q17.

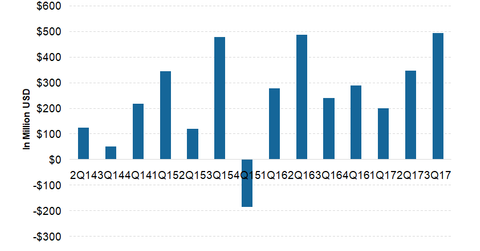

Significant FCF generation

Newmont Mining (NEM) achieved positive free cash flow of $494 million in 3Q17, up 107% year-over-year (or YoY). Year-to-date, the company had generated FCF of $1,039 million, 3.7% higher than the same period last year. The positive FCF in NEM’s latest quarter was its sixth consecutive quarter of positive FCF.

Dividends

Newmont Mining’s (NEM) management had revised its gold-linked dividend policy in 4Q16. The new policy was expected to potentially double payout levels. After declaring dividends of $0.075 per share for 2Q17, Newmont announced dividends of $0.075 for 3Q17 as well. Newmont has maintained that it would be looking to enhance its dividend even further.

Among its peers. Kinross Gold (KGC) has been generating decent FCFs since 2015. Its ability to generate FCF might come under pressure due to its limited growth options. Goldcorp (GG) has been lately generating negative FCF, but mainly due to the changes in working capital. Its projects and cost reduction should help generate significant FCF in 2018 and beyond. While Barrick Gold (ABX) generated 67% lower FCF YoY in 3Q16, it’s generating significant FCF due to lower costs.