Reading the Technicals of Mining Shares in September 2017

Most mining shares witnessed an up day on Monday, September 25, 2017, as precious metals increased over the ongoing global tensions.

Sept. 26 2017, Published 1:33 p.m. ET

Technical analysis

Most mining shares witnessed an up day on Monday, September 25, 2017, as precious metals increased over the ongoing global tensions. However, before investors opt for mining shares, they should analyze technical indicators such as RSI (relative strength index) levels and implied volatility.

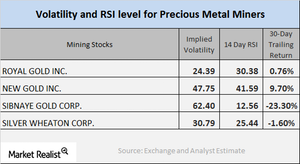

In this part of the series, we’ll look at Royal Gold (RGLD), New Gold (NGD), Sibanye Gold (SBGL), and Silver Wheaton (SLW).

Implied volatility

Call-implied volatility is a measurement tool of the variations in a stock’s price with respect to variations in the price of its call option. As of September 25, 2017, Royal Gold, New Gold, Sibanye Gold, and Silver Wheaton had implied volatilities of 24.4%, 47.8%, 62.4%, and 30.8%, respectively. Remember, mining shares are often known to be more volatile than precious metals.

RSI level

A stock’s RSI level indicates whether it has been overbought or oversold. If a stock’s RSI score is higher than 70, it may be overbought, and its price may soon correct downward. If a stock’s RSI score is lower than 30, it could be oversold and might soon increase.

The RSI scores for the miners mentioned above have recuperated recently. Royal Gold, New Gold, Sibanye Gold, and Silver Wheaton have RSI scores of 30.4, 41.6, 12.6, and 25.4, respectively. These deliberately low RSI levels signal a possible revival in price.

Leveraged mining funds such as the Direxion Daily Junior Gold Miners Bull 3X ETF (JNUG) and the Proshares Ultra Silver (AGQ) have lost much of their pricing during the past week. They have a 30-day trailing loss of 11.0% and 5.7%, respectively.