Is Energy Transfer Partners Exploring a C Corporation Structure?

High leverage and a complex capital structure have been a drag on Energy Transfer Partners’ market performance.

May 17 2018, Updated 2:50 p.m. ET

Why the simplification required?

Energy Transfer Partners (ETP) posted strong earnings growth in the recent quarter. However, the market’s reaction to the company’s strong earnings hasn’t been so positive. High leverage and a complex capital structure have been a drag on Energy Transfer Partners’ market performance. While the partnership’s leverage position improved considerably in recent quarters due to balance sheet strengthening measures and earnings growth, its cost of equity continued to stay higher.

Having said that, simplifying Energy Transfer Partners’ capital structure seems imminent. Plains All American Partners (PAA), Williams Partners (WPZ), and Buckeye Partners (BPL) are among the MLPs that have simplified their capital structure through the removal of IDRs.

Energy Transfer Partners’ options

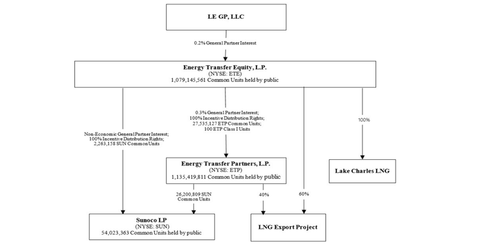

The simplified transactions that Energy Transfer Partners has been exploring include a C corporation in the Energy Transfer family and the simple merger of Energy Transfer Partners into Energy Transfer Equity (ETE). The disadvantage of the C corporation structure is double taxation. However, the structure provides broader access to the markets.

According to Kelcy Warren, Energy Transfer Partners’ CEO, “We are evaluating a C corp structure within our partnership. We are very, very carefully evaluating that. We do not want to do something that is irreversible and something that we would regret. So that is something we are studying. As far as the simplification that you referred to, it would most certainly be a structure whereby ETE acquires ETP. There’s — we’ve looked at every scenario possible to us and we don’t see any mathematical scenario that makes any sense other.”

The C corporation structure could result in significant tax liabilities for investors. The simplified transactions could eventually backfire. Kinder Morgan’s (KMI) move from an MLP to a C corporation is a good example.