Are Municipal Bonds Really for Me?

Municipal bonds (MUB) have provided an excellent return in the past year. The returns are even better if we account for their tax benefits.

June 13 2016, Published 3:47 p.m. ET

Investors know by now that good income is hard to find. Peter Hayes explains the benefits of crossing over to the tax-exempt side of the fixed income marketplace.

Are municipal bonds really for me? The popular perception is that tax-exempt income only benefits those investors in the highest tax brackets. While that may have been true in the past, times have changed.

After-tax benefit for all

Municipal bonds have recently displayed an income benefit to investors across all marginal tax brackets. The expansion of the after-tax income advantage derives largely from the broad repricing of fixed income assets since the financial crisis. Massive fiscal and monetary stimulus since 2008, including bond buying on the part of the Federal Reserve (Fed), held Treasury yields at bay while propping up their prices. This meant that municipal bonds, which typically yield less than Treasuries before tax, began to offer yields higher or comparable to federal government debt on a pre-tax basis.

After tax, which applies to Treasuries but not munis, the income advantage is clear.

Consider that, as of the end of April 2016, the 10-year Treasury offered a yield of 1.83% while the Barclays Municipal Bond Index had a yield of 1.84%. For illustrative purposes (you can’t invest in an index), that 1.84% becomes 2.04% for those in the 10% bracket and 3.05% for those in the 39.6% bracket. Factor in the 3.8% tax on investment income under the Affordable Care Act and the yield for an investor in the highest tax bracket becomes 3.25%. Of course, past performance is no guarantee of future results and muni-to-Treasury ratios could change and, therefore, the outcomes could fluctuate.

Market Realist – Municipal bonds and their tax advantages

Municipal bonds (MUB) have provided an excellent return in the past year. The returns are even better if we account for their tax benefits. Municipal bonds (SUB) became attractive as Treasury yields fell due to the government’s huge bond-buying (AGG) program that pushed down long-term interest rates. Government bond purchases increased the price of bonds and lowered the yield on those bonds due to their inverse relationship.

Tax benefits

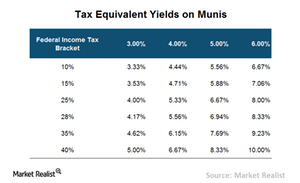

As we’ve already seen, the after-tax yield on municipal bonds needs to be calculated based on an investor’s marginal tax bracket and pre-tax yield on the municipal bonds. For example, an investor who falls in a marginal tax rate of 25% and is considering investing in a tax-exempt municipal bond that yields 3% will earn an after-tax yield of 4%. The other taxable security needs to provide higher than a 3.8% yield to attract investors.

Additional tax-exempt benefits

In addition to being exempt from federal income tax, income from municipal bonds (CMF) is also exempt from state income tax in many cases. Add to this the tax benefit from the Affordable Care Act. If an investor adds these additional tax exemptions to municipal bonds, the benefits are much higher compared to government bonds (IEF).