iShares ST National AMTFree Muni Bnd

Latest iShares ST National AMTFree Muni Bnd News and Updates

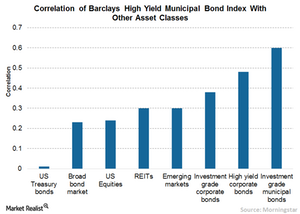

Municipal Bonds Are the Ballast to Equity Risk

Historically, investment-grade and high-yield municipal bonds (MUB) have a very low correlation with most other asset classes.

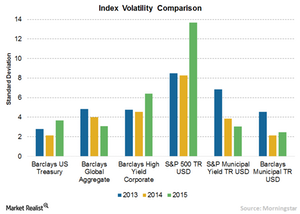

Why Municipal Bonds Are Immune to Market Volatility

Generally, municipal bonds (SUB) are immune to market volatility, thus providing considerable support to a portfolio.

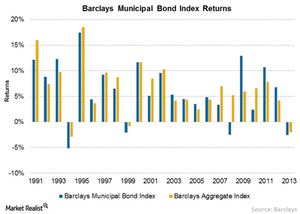

Yield Is the Workhorse of Municipal Bond Returns

Over the years, average returns from municipal bonds (CMF) are in line with the broader index. They outperformed in some years and underperformed in others.

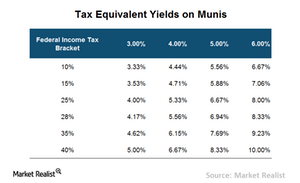

Are Municipal Bonds Really for Me?

Municipal bonds (MUB) have provided an excellent return in the past year. The returns are even better if we account for their tax benefits.