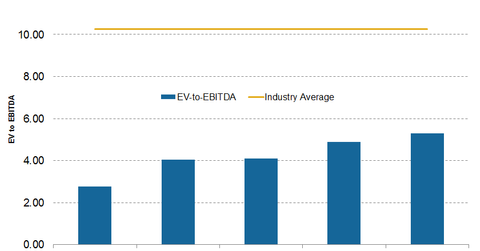

Upstream Companies with the Lowest EBITDA Multiples

As of the first quarter, Sandridge Energy’s (SD) EV-to-adjusted EBITDA ratio was ~2.77x. The company has a market capitalization of $529.83 million.

Nov. 20 2020, Updated 1:09 p.m. ET

Top five upstream stocks by EV-to-EBITDA

In this part, we’ll discuss the EV-to-adjusted EBITDA (earnings before interest, tax, depreciation, and amortization). The EV (enterprise value) is the sum of a company’s market capitalization and debt, less cash and cash equivalents. Let’s look at the top five upstream companies that are the cheapest when comparing the EV-to-adjusted EBITDA multiples.

sandridge Energy

As of the first quarter, Sandridge Energy’s (SD) EV-to-adjusted EBITDA ratio was ~2.77x. The company has a market capitalization of $529.83 million. As of March 31, the company didn’t have any debt. Sandridge Energy repaid its $36 million building note. The company’s trailing 12-month adjusted EBITDA as of the first quarter was $160 million. Sandridge Energy’s forward EV-to-EBITDA multiple is 3.2x. Analysts expect the company’s EBITDA to be lower this year compared to the last 12 months.

Gulfport Energy

Gulfport Energy’s (GPOR) EV-to-adjusted EBITDA ratio as of the first quarter was ~4x. Currently, the company’s market capitalization is $1.91 billion. Gulfport Energy’s long-term debt as of March 31 was ~$2.94 billion. The company’s adjusted trailing 12-month EBITDA as of the first quarter was ~$887.7 million. Gulfport Energy’s forward EV-to-EBITDA multiple is 4.3x.

Stone Energy

Stone Energy’s (SGY) EV-to-adjusted EBITDA ratio as of the first quarter was ~4.1x. The company’s current market capitalization is $709.6 million. As of March 31, Stone Energy’s total outstanding debt was ~$235.39 million. The company’s trailing 12-month adjusted EBITDA for the 12 months as of the first quarter was $152.42 million.

On May 10, Talos Energy (TALO) announced the completion of the strategic combination between Talos Energy and Stone Energy.

Southwestern Energy

As of the first quarter, Southwestern Energy’s (SWN) EV-to-adjusted EBITDA ratio was ~4.9x. The debt makes up a considerable portion of Southwestern Energy’s enterprise value. The company has a market capitalization of $2.72 billion. As of March 31, the total debt was ~$4.4 billion. The company’s adjusted trailing 12-month EBITDA as of the first quarter is ~$1.25 billion. The company’s forward EV-to-EBITDA multiple is 4.5x. Analysts expect Southwestern Energy’s EBITDA to be higher this year compared to the last 12 months.

Murphy Oil

Murphy Oil’s (MUR) EV-to-adjusted EBITDA ratio as of the first quarter was ~5.30x. The current market capitalization is ~$5.55 billion, while the long-term debt as of March 31 was $2.9 billion. The adjusted trailing 12-month EBITDA as of the first quarter was $1.29 billion.

Murphy Oil has a forward EV-to-EBITDA multiple of 4.4x. The EBITDA could be higher this year compared to the last 12 months.

Next, we’ll discuss these companies’ stock performances.