SandRidge Energy Inc

Latest SandRidge Energy Inc News and Updates

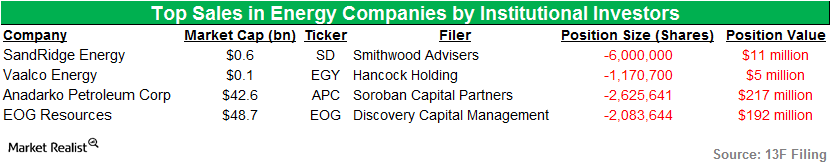

Smithwood Advisers and Hancock Sell Stakes in Energy in 1Q15

Smithwood Advisers was among the hedge funds that sold their stakes in SandRidge Energy in 1Q15. Hancock Holding was one of the firms that sold stakes in Vaalco Energy.

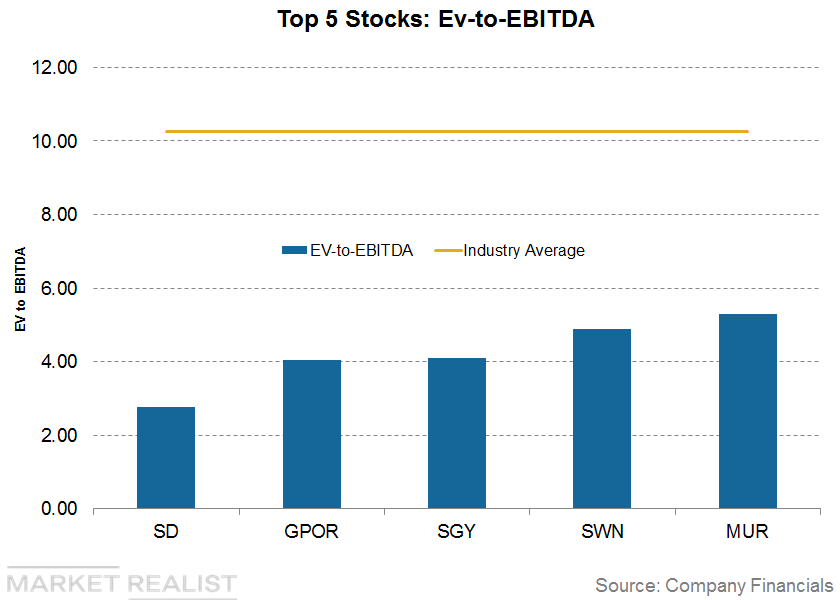

Upstream Companies with the Lowest EBITDA Multiples

As of the first quarter, Sandridge Energy’s (SD) EV-to-adjusted EBITDA ratio was ~2.77x. The company has a market capitalization of $529.83 million.

Overview of SandRidge Energy

SandRidge is expanding its low-cost multilateral program and is successfully extending its mid-continent resource base with Chester and Woodford production.