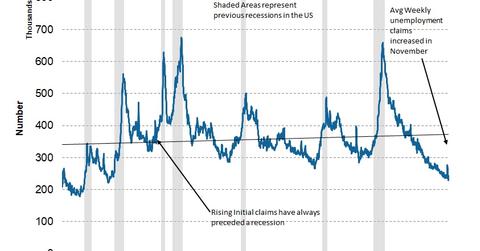

Should We Worry about Rising Unemployment Claims?

Average weekly claims and the economy Average weekly unemployment claims are a constituent of the Conference Board LEI (Leading Economic Index). Claims have a 3% weight in the LEI. Weekly unemployment claims, if adjusted for seasonality, give investors a clear understanding of changes in the employment market. Though the Bureau of Labor Statistics releases a monthly […]

Jan. 4 2018, Updated 3:20 p.m. ET

Average weekly claims and the economy

Average weekly unemployment claims are a constituent of the Conference Board LEI (Leading Economic Index). Claims have a 3% weight in the LEI. Weekly unemployment claims, if adjusted for seasonality, give investors a clear understanding of changes in the employment market.

Though the Bureau of Labor Statistics releases a monthly non-farm payroll report, which is widely followed by markets, the LEI uses average weekly claims, as these are more sensitive to underlying business conditions. This sensitivity makes weekly claims a preferred forward indicator for the US economy. Continuous declines in unemployment claims is a positive economic sign.

Average weekly claims inch higher in November

In November, weekly unemployment claims increased from the six-month low seen in October. Claims had peaked in September after the hurricanes but cooled off in October, led by demand for construction (XHB) workers to help rebuild. Whereas hiring slowed down in November, there may be no reason to worry, as weekly claims remained below 250,000, which is considered an acceptable level.

According to the latest report, average weekly claims rose from 232,700 in October to 241,800 in November. Unemployment claims had a net impact of -0.13 (or 13%) on the LEI in November.

Market implications

Any surprises in employment data increase volatility (VXX) in fixed income (BND) and the currency markets (UUP). The Fed has listed lower unemployment as one of its mandates in monetary policy decisionmaking, and changes in employment conditions impact markets. The Fed increased interest rates by 0.25% at its December meeting, and with unemployment remaining low, it could continue its monetary tightening if US inflation (TIP) inches higher. In the next part of this series, we’ll discuss the manufacturing sector’s rebound in new orders.