Oil’s Futures Spread: Have Supply Glut Concerns Increased?

On August 29, 2017, US crude oil (USL) October 2018 futures traded at a premium of $2.37 to October 2017 futures.

Aug. 30 2017, Updated 3:06 p.m. ET

Futures spread

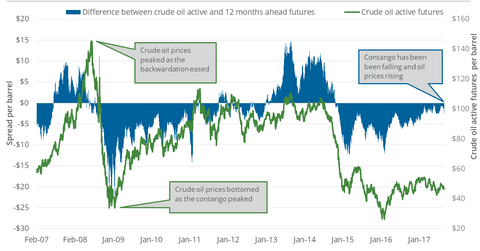

On August 29, 2017, US crude oil (USL) October 2018 futures traded at a premium of $2.37 to October 2017 futures. On August 22, 2017, the premium between the two contracts was at $1.04. In fact, US crude oil October futures fell 2.9% during this period.

Oil prices in contango

In “contango” the futures spread is at a premium. When the premium expands, oil usually moves lower. On February 11, 2016, the premium rose over $12. On the same day, US crude oil active futures settled at their 12-year low.

Oil prices in backwardation

In “backwardation” the futures spread is at a discount. The contract for delivery later trades at a lower price compared to the contract for delivery sooner. When the discount rises, oil usually moves upward. On June 20, 2014, the discount rose over $10. On the same day, US crude oil active futures settled at their pre-crisis high of $107.26 per barrel.

In the trailing week, US crude oil prices fell 2.9%. The contango has more than doubled during this period. Refinery outages due to Hurricane Harvey could have increased concerns regarding the supply glut situation.

Energy stocks

US crude oil producers’ (XOP) (DRIP) (IEO) hedging decisions and midstream (AMLP) oil storage and transportation businesses could be influenced by the shape of the oil futures forward curve. In contango, energy companies and traders could store the current production to sell it at a higher price in the future.

On August 29, 2017, US crude oil futures contracts until December 2025 settled at progressively higher prices than current US crude oil active futures. Contango could also disappoint investors in the ETFs that track crude oil futures like the United States Oil Fund LP (USO).

To learn more, visit Market Realist’s upstream guide.