Commodities Are Weaker amid the Firmer Dollar

Gold (GLD) and silver (SLW) are weaker in the early hours due to the firmer dollar and expectations of a US interest rate hike in the Fed’s March meeting.

March 8 2017, Published 8:29 a.m. ET

Crude oil

After closing flat for two days amid increased volatility, crude oil prices are weaker in the early hours on Wednesday. The rise in inventory levels and US shale oil production are offsetting the impact of producers’ output cuts.

According to data released by the API (American Petroleum Institute), crude oil inventory levels rose by 11.60 MMbbls (million barrels) in the week ending on March 3. The build in inventory levels was better than the market’s expectation of an increase by 1.660 MMbbls. The market is looking forward to crude oil inventory data from the U.S. Energy Information Administration. The data will be released at 10:30 AM EST today. On the other hand, Khalid al-Falih, the Energy Minister of Saudi Arabia, commented on March 7 that oil market fundamentals are improving due to the output cut agreement.

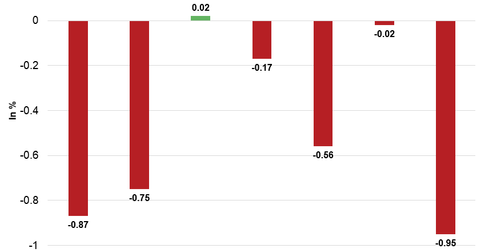

At 6:20 AM EST on March 8, the West Texas Intermediate crude oil futures contract for April 2017 delivery was trading at $52.74 per barrel—a fall of ~0.75%. The Brent crude futures contract for May 2017 delivery fell ~0.63% to $55.57 per barrel. The SPDR S&P Oil & Gas Exploration & Production ETF (XOP) closed at $37.56 after falling 1.4% on March 7.

Metals

After falling for two consecutive trading days, copper prices are stable in the early hours. The prices found support due to China’s upbeat trade data. Considering that China is the largest copper consumer, the economic situation in China drives copper’s demand and price.

At 6:25 AM EST on March 8, the COMEX copper futures contract for May 2017 delivery was trading at $2.62 per pound—a gain of ~0.17%. The PowerShares DB Base Metals ETF (DBB) fell 0.93%, while the SPDR S&P Metals & Mining ETF (XME) fell 2.6% on March 7. Gold (GLD) and silver (SLW) are weaker in the early hours due to the firmer dollar and expectations of a US interest rate hike in the Fed’s March meeting. Platinum and palladium are weaker in the early hours.