Novo Nordisk Is Expected to See Strong Growth in Insulin Segment

Insulin sales volumes sold across the world have grown at a compounded average growth rate (or CAGR) of 4.1% from May 2011 to May 2016.

Sept. 30 2016, Updated 6:04 p.m. ET

Global insulin segment trends

According to IMS Health, insulin sales volumes around the world have grown at a compounded average growth rate (or CAGR) of 4.1% from May 2011 to May 2016. The largest volume growth was seen in emerging markets. The US, Europe, International Operations, China, and Pacific regions accounted for 28%, 34%, 21%, 9%, and 8%, of the total insulin volumes sold in May 2016, respectively. To know more about the global insulin market, please refer to Novo Nordisk Continues to Be a Leader in the Global Insulin Market.

The volume of human insulin sold across the world has remained more or less constant from May 2011 to May 2016. However, the volume of modern insulin sold globally has increased at CAGR of 4.8%, while the market value of the modern insulin segment has grown at CAGR of 20.3% from May 2011 to May 2016. The modern insulin segment also involves new-generation insulin drugs, which have been a key growth driver for the insulin market in 2016.

Modern insulin

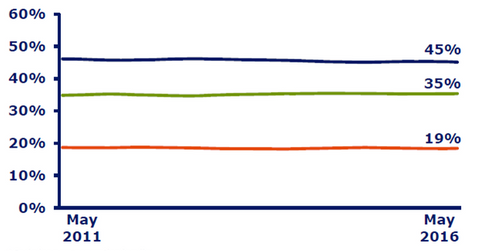

The above diagram shows that in May 2016, Novo Nordisk (NVO) accounted for 45% of the total modern insulin market volumes globally, ahead of peers such as Sanofi (SNY) and Eli Lilly (LLY). Being a leading player in the insulin segment, the company also presents strong competition to other diabetes players like Merck (MRK), AstraZeneca, and GlaxoSmithKline.

Novo Nordisk is well positioned in the modern insulin segment and is expected to benefit from the robust growth trends in the modern insulin market. If this projection proves correct, it may boost the company’s share prices as well as those of the International Dividend Achievers Portfolio (PID). Novo Nordisk makes up about 1.0% of PID’s total portfolio holdings. To know more about Novo Nordisk’s position in the modern insulin market, please refer to Can Novo Nordisk Continue to Maintain Market Share in Modern Insulin?